Freelancing is working for oneself, as opposed to working for an employer. Freelancers are typically self–employed, and may work for a variety of clients at any given time. A freelancer works on a variety of projects at the same time but for different clients.

GST on Freelancers

India has emerged to be a hub for passionate freelancers and thereby, the freelance industry has been on a constant growing phase. However, it goes without saying that this particular industry is an unorganised sector and lacks clear and specific rules and regulations. The freelance industry in the country comprises of professional freelancers of various professions, bloggers and consultants. From a wide range of interests starting with travel and food to technology and fashion, freelancing has been a platform for people to display their talents and be their own boss. With the implementation of Goods and Services Tax (GST), there has been quite a confusion and the new rules and regulations of the tax concerning this market has been vague. This article is a GST Guide for Freelancers with the intent to simplify the complexity around the subject.

1. Registration Requirement Under GST

2. When you are providing services of up to Rs. 20 lakhs in a financial year –

3. When you are providing services of more than Rs. 20 lakhs/10 lakhs in a financial year

4. Calculating GST Turnover

5. Purpose of Aggregate Turnover

6. How to calculate Aggregate Turnover?

7. Which is not inclusive?

8. Voluntary Registration – Effect And Benefits

9. GST Rate On Freelancing

10.Export Of Services

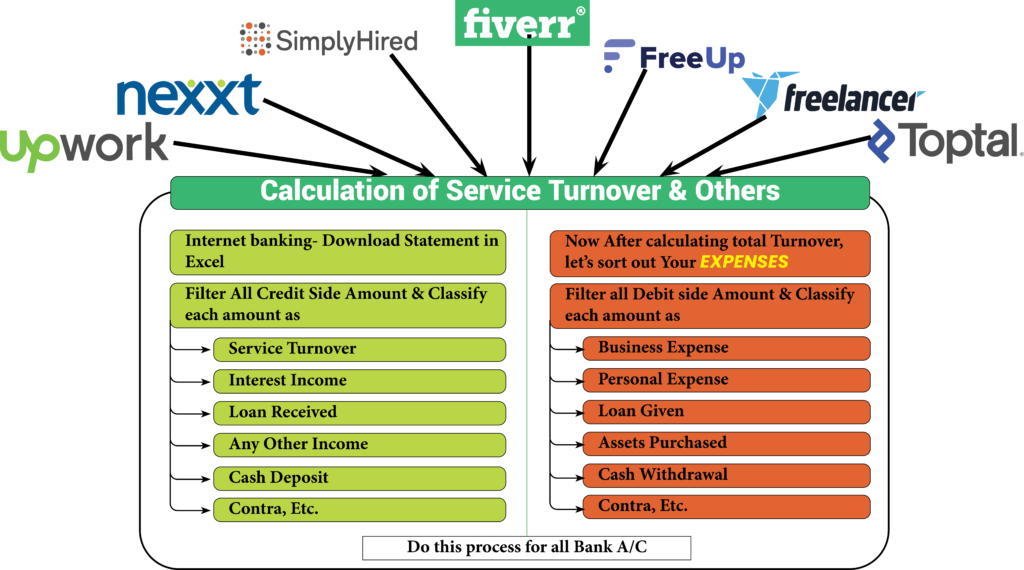

11. Providing Service Through Upwork, Fiverr, Freelancer, Guru Etc.

12. Foreign Inward Remittance Certificate (FIRC)

13. Taxability is as under

14. Composition Scheme

15. Invoicing

16. Foreign Currency Invoice For Services

17. Input Tax Credit

18. GST Refund

19. Tax Collected At Source (TCS) Under GST

20. Is Import Export Code (IEC) required for exporting of services?

21. To sum it up

Income Tax on Freelancers

As per Income Tax Laws in India, any income generated by an individual by implementing their manual or intellectual skills is considered as ‘’profit and gains from business and profession’’. As per the tax perspective, freelancing is treated as a business and profession.

Also includes Details Above

1. Calculation of Service Turnover

2. Claiming expenses

3. Depreciation Deductions

4. Include Income from All Other Sources

5. Exemptions or Deductions

6. Deductions/ Tax Exemptions Under the Section 80

7. Credit the TDS Deductions

8. Advance Tax

9. Presumptive Taxation

10. Claiming expenses under 44ADA

11. Maintaining Books of accounts for freelancers u/s 44ADA?

12. Books of accounts are required to be maintained?

13. What is audit u/s 44AB?

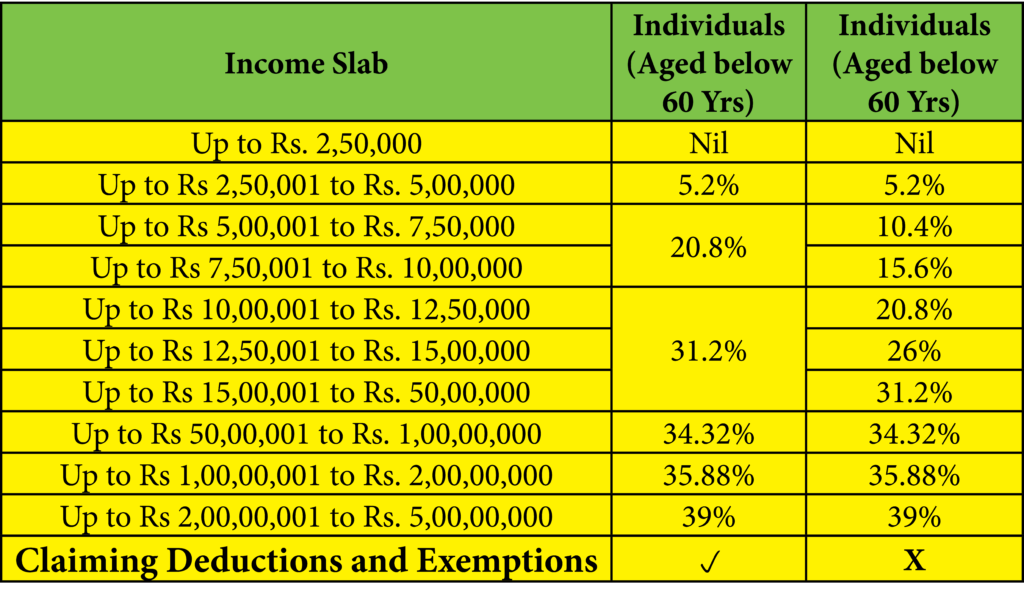

14. Old Vs New Tax Regime: Which One Should You Choose?

15. Features of the New Tax Regime

Free download complete e-book

1. Click Ada to Cart

2. Register

3. Continue to Cart

4. Order Now

You get this e-book in your Registered Mail Inbox