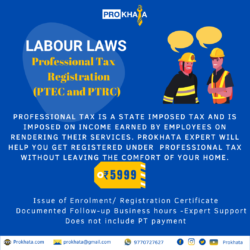

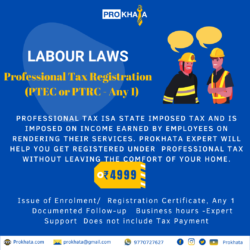

Professional Tax Registration

Services Covered:

Services Covered:

Issue of Enrolment/Registration Certificate: Choose any one.

Documented Follow-Up: Ensuring thorough follow-up.

Business Hours Expert Support: Get support during business hours.

Excludes Tax Payment: Tax payment is not included.

Who Should Buy:

Who Should Buy:

Every self-employed professional.

Any entity employing one or more employees.

How it’s Done:

How it’s Done:

Purchase the Plan: Choose our comprehensive package.

Upload Documents: Upload required documents on the vault.

Filing of Enrolment/Registration Application: We handle the application filing process.

Receipt of Enrolment Certificate: Receive your certificate.

Documents to be Submitted:

Documents to be Submitted:

Address proof of establishment

Address proof of partners, proprietor, or directors as applicable

PAN of partners, proprietors, and directors as applicable

Photo of partners, proprietors, and directors as applicable

Salary details of employees

Financial statement

FAQs:

FAQs:

What is professional tax and when is it levied?

What is professional tax and when is it levied?

Professional tax is a state-level tax imposed on income earned by way of profession, trade, calling, or employment. The tax is based on slabs depending on the income of the individual who may be self-employed or working as an employee of an entity. At present, the maximum tax that can be imposed is restricted to Rs. 2500.

What is enrolment certificate and what is registration certificate?

What is enrolment certificate and what is registration certificate?

Every employer in specific states is required to deduct taxes from salary when paid to one or more employees when the payment made exceeds Rs. 5000 (this limit is for Maharashtra) and deposit it with the state government. That entity is required to obtain a registration certificate. When a person is employed in a profession by two or more employers and is getting salary/wages exceeding Rs. 5000 but the employer is not deducting professional tax, then the individual needs to get an enrolment certificate from the authority.

Is Professional tax imposed in every state in India?

Is Professional tax imposed in every state in India?

Professional tax is imposed only in the following States: Karnataka, Bihar, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, and Sikkim.

Who is responsible for deducting the tax and depositing the same with the Government?

Who is responsible for deducting the tax and depositing the same with the Government?

- In the case of individuals who are self-employed, the tax has to be paid by the individual themselves.

- In the case of employed individuals, the liability is on the employer.

Can the professional tax liability amount be paid in a lump sum?

Can the professional tax liability amount be paid in a lump sum?

In certain states, there is a concept of the composition scheme. For example, in Maharashtra, the government announced a composition scheme under which any person liable to make a payment to the government at the rate of Rs. 2500 may make a lump sum payment in advance of Rs. 10,000 and their liability to pay for 5 years will be discharged.

What will be the other costs in the registration process?

What will be the other costs in the registration process?

The plan price covers all professional fees and convenience charges. Since Professional tax is a state-level tax, the applicable government charges vary from state to state. Government charges will be charged on an actual basis.

Is there any exemption from PT payment?

Is there any exemption from PT payment?

Every state has its own governing provisions and exemption criteria. For example, the Karnataka PT Act exempts certain persons from payment of PT, such as:

- All charitable and philanthropic hospitals or nursing homes situated in places below the Taluk level in all districts of the State except Bangalore and Bangalore Rural District.

- Directors of Companies registered in Karnataka and nominated by the financing agencies owned or controlled by the State Government or by other statutory bodies.

- Foreign technicians employed in the State provided their appointments are approved by the Government of India for the purpose of exemption from payment of income tax for the said period (exemption is for a period of 2 years from the date of their joining duty).

- Combatant and civilian non-combatant members of the Armed Forces who are governed by the Army Act, the Navy Act, and the Air Force Act.

- Salaried or wage-earning blind persons.

- Salaried or wage-earning deaf and dumb persons.

- Holders of permits of single taxi or single three-wheeler goods vehicle.

- Institutes teaching Kannada or English Shorthand or Typewriting.

- A physically handicapped person with not less than 40% of permanent disability (subject to production of a certificate from the HOD of Government Civil Hospital).

- An ex-serviceman not falling under Sl No.1 of the Schedule.

- A person having a single child and who has undergone sterilization operation, subject to production of a certificate from the District Surgeon, Government Civil Hospital, for having undergone such operation.

- Central Para Military Force (CPMF) Personnel. Persons running educational institutions in respect of their branches teaching classes up to twelfth standard or pre-University Education.

- No tax is payable by persons who have attained age of sixty five years.

- Also no tax is payable for holding any Profession for less than 120 days in the year.

Our experts will guide on on applicability of the provisions.

Which are the specific cities where the service will be delivered?

Which are the specific cities where the service will be delivered?

The service is state-specific in case you need a shop license and will be rendered only in specific cities, including Mumbai, Gurgaon, Hyderabad, Kolkata, Jaipur, Surat, Bangalore, Chandigarh, Pune, and Delhi.