Just as the devil hides in the details, the reality of finances is often veiled behind the numbers.

In our previous article of the #ForensicForesight series, we explored the basics of forensic accounting practice and the preventive practices of forensic accounting, shedding light on proactive measures to mitigate the risk of fraud.

Get a recap here!

Now, let’s explore the intriguing realm of investigative practices, where forensic accountants and fraud examiners put on their detective hats and set out on a mission to reveal concealed facts.

In the upcoming series, we will thoroughly examine the components of investigative practice, which encompass evidence identification, post-fraud examinations, quantification, reporting, and the indispensable role played by seasoned experts in this time-sensitive and knowledge-intensive field!

The Perspective of a Detective

As you are aware, the detective practice within forensic accounting assignments is a responsive endeavor that takes place after fraud has transpired. It is more commonly recognized as Fraud Examination and falls under the purview of Fraud Examiners. In this sphere, forensic accountants and fraud examiners utilize their investigative acumen to unveil the intricacies of fraudulent schemes. This entails conducting thorough examinations of financial documents, scrutinizing transactions, and tracking the movement of funds. Employing advanced data analysis methods and drawing upon their proficiency in financial inquiries, forensic accountants can assemble the puzzle pieces and pinpoint the individuals responsible for the fraud.

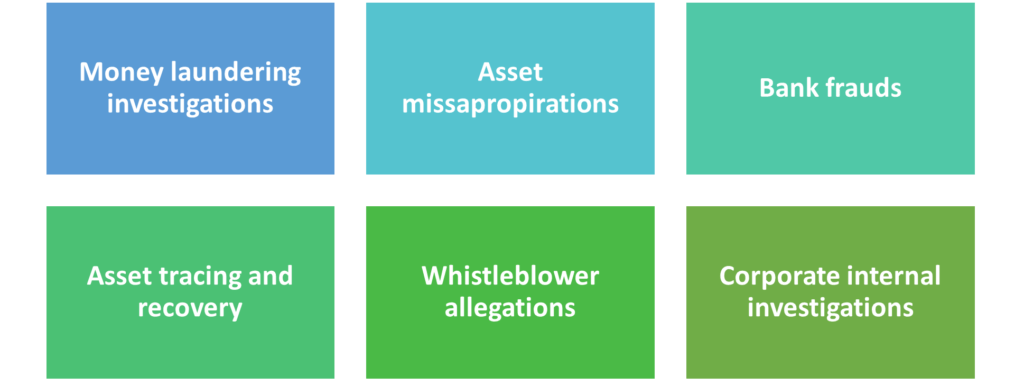

Reiterating some of the detective practice areas of forensic accountants and financial fraud examiners here:

It is apparent from the examples above that each of these assignments requires a distinct investigative skillset, making forensic accounting and fraud examination a unique domain. Successfully navigating these post-fraud activities demands the expertise and experience of a seasoned professional.

Let us see what common detective activities are involved in these assignments!

Essential Detective Tasks in Forensic Accounting

Detective practices within the realm of forensic accounting encompass a diverse array of investigative strategies and methodologies geared towards unearthing financial fraud and pinpointing those responsible.

Here are several standard detective activities commonly employed in the field of forensic accounting:

Scrutinizing financial statements – This entails a meticulous examination of financial statements to identify potential financial anomalies, discrepancies, or suspicious transactions that might suggest fraudulent conduct. This examination encompasses an analysis of income statements, balance sheets, cash flow statements, and various other financial documents.

Tracing transactions – The objective here is to follow the money trail and track transactions in order to uncover any fraudulent activities, such as embezzlement, money laundering, or asset misappropriation. This process involves a thorough analysis of bank statements, payment records, invoices, and associated documentation.

Data analysis and mining – Forensic accountants and Fraud Examiners employ advanced data analysis techniques to identify patterns, anomalies, or trends within extensive sets of financial data.

Conducting interviews and interrogations – To acquire information, extract admissions, and reveal critical details pertaining to fraudulent activities, forensic experts and fraud examiners conduct interviews with relevant individuals, including employees, suspects, and witnesses.

Document scrutiny – In order to detect inconsistencies, forgeries, or alterations, these professionals scrutinize various documents such as contracts, invoices, receipts, and bank statements. This area of expertise is commonly referred to as questioned document examination.

Expert testimony – During legal proceedings, forensic accountants provide expert opinions, present their findings, and elucidate intricate financial concepts to offer their expert perspective on the financial aspects of a case.

While the detective practice in forensic accounting encompasses a broad spectrum of assignments with unique challenges and complexities, there are several common steps that serve as a foundational framework for conducting post-fraud forensic assignments. It’s important to note that each case possesses its own distinct characteristics and variables.

Note that no two cases are identical. Each assignment presents its own challenges, intricacies, and variables.

However, there are a few common steps that form the backbone of any assignment. These steps serve as a guide, providing a framework to navigate the complex terrain of financial fraud investigations.

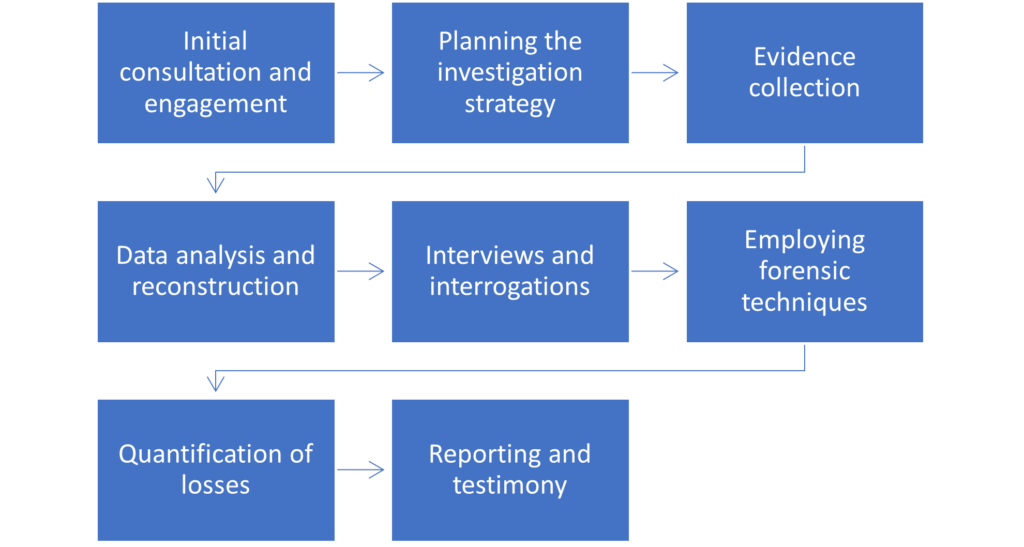

The 8 Typical Stages of a Post-Fraud Forensic Accounting Assignment

Stage 1 – Initial Consultation and Engagement: In this initial stage, the client consults with the forensic accountant to communicate the allegation, objectives, and scope of the assignment. This process entails collecting available information, assessing it, and establishing the assignment’s foundation and engagement terms.

Stage 2 – Devising the Investigation Strategy: The fraud examiner or forensic accountant devises a comprehensive plan that outlines the investigative strategy, methodologies, and techniques to be employed after the initial consultation. This plan encompasses the identification of key focus areas, determination of data sources, and establishment of the investigation’s timeline.

Stage 3 – Gathering Evidence: A pivotal stage in the process is the collection of evidence, as it serves as the foundation for the investigation. The professional collects and scrutinizes pertinent financial and non-financial data during this phase. This may encompass the review of financial statements, bank records, invoices, contracts, and other supporting documents. Additionally, digital evidence, including emails, electronic transactions, and computer files, may be gathered and analyzed using digital forensic tools.

Stage 4 – Data Analysis and Reconstruction: The gathered evidence undergoes analysis through various forensic accounting techniques, such as financial statement analysis, transaction tracing, and data mining. Subsequently, financial transactions are reconstructed to identify irregularities, patterns, or anomalies that may indicate fraudulent activities.

Stage 5 – Interviews and Interrogations: The forensic accountant or fraud examiner conducts interviews with pertinent individuals to acquire information regarding the allegations. For instance, in the context of an internal investigation, employees may be interviewed to procure vital information about the accusations. The interviewing process is a skill unto itself and necessitates proficiency in several areas, including behavior analysis, communication skills, and recognition of verbal cues, among others.

Stage 6 – Application of Forensic Techniques: Forensic techniques such as document examination and other specialized methodologies like lifestyle analysis, net worth analysis, source and application of fund analysis, fund tracing, application of Benford’s law, financial modeling, and simulations may be employed based on the case’s specific requirements.

Stage 7 – Quantification of Losses: Subsequently, the fraud examiner quantifies the financial losses resulting from the fraudulent activities by evaluating the financial statement’s impact, determining the extent of misappropriation or financial manipulation, and calculating the damages incurred by the client.

Stage 8 – Reporting and Expert Testimony: In the final stage, the professional compiles a comprehensive report that presents the investigation’s findings, analyses, and conclusions, often used in legal proceedings. In some instances, the forensic accountant may be called upon to deliver expert opinions in court or other legal forums.

Reflecting on the detective practice areas discussed earlier in this article, the outlined procedure may have been followed to unravel the fraud, complemented by a few additional steps.

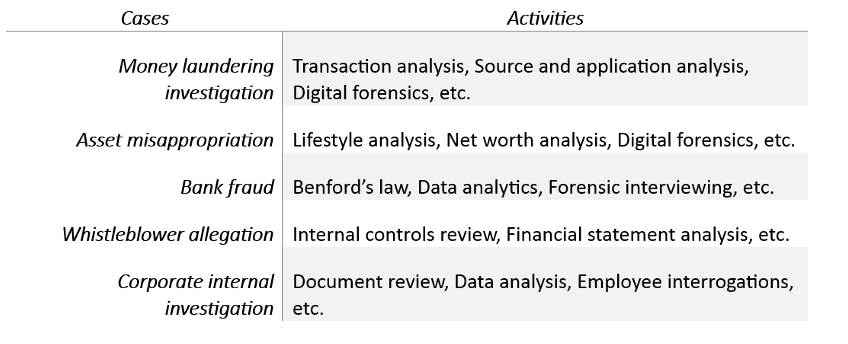

Now, let us try to map the type of activity/technique that a forensic accountant might have done for the cases mentioned at the beginning of this article.

While the table above presents several instances of prevalent forensic techniques employed in various case types, it’s crucial to acknowledge that a professional may have employed other techniques or a blend of techniques contingent upon the specific circumstances. For instance, uncovering a bank fraud case could involve transaction analysis and an internal control review, or an internal investigation could utilize lifestyle analysis when examining employees. Therefore, the practice of forensic accounting or fraud examination, particularly in the realm of detection, demands the expertise of an experienced professional.

As we conclude this article, we’ve acquired an overview of the detective practices within forensic accounting, the usual scenarios encountered in reactive post-fraud situations, and the activities integral to detective practice. We’ve wrapped up by offering an insight into what might typically transpire during a forensic accounting case.

Though each investigation possesses its unique facets, there are common steps undertaken in post-fraud forensic investigations, which we’ve explored as the 8 common steps. In the following weeks, we will delve deeper into each of these steps and delve into real-world instances of forensic accounting investigations.

Let us better equip ourselves to prevent, detect, and investigate financial fraud and misconduct.

1 responses on "Exposing Fraud: The Rising Function of Detective Forensic Accounting"