Table of Contents

ToggleForensic Audit Report on Weakness in Internal Control FAFD Project 2

M/s PQW & Associates

Chartered Accountants

101, Ramashraye Chambers, Mahabali Road, Churchgate, Mumbai -400002

Background

- M/s XYZ Limited is a Garment Trading Company in India. The company purchases Garments (Jeans, Formal Pants, T-shirt, Shirts) of premium quality from its fixed vendors and sell it by repacking the same in its own brand name. It is a very well-known Brand of good quality garments in India.

- The company has been making continuous profits over the years since its inception. The company is a major competitor to other Brands in the market. Turnover for the year end 31st March 2018 as per signed financials amounted to Rs 750 Crores and a profit of Rs 47.75 Crores approximately 6.37% of Revenue.

- XYZ has 200 own outlets which are directly controlled by the management i.e. the sales made to the final customer who purchases garments from the store for personal use is considered as Revenue to the company. Also, company has also given 15 franchisees to people who wants to sell the branded garments after purchasing the same in bulk.

- XYZ’s profit started declining from the year 2016 and further declined by a great extent by the end of 31st March 2018. During the review of Financials for the year end 31st March 2018 in the Board Meeting, Directors have observed that in current year the Net Profit of the company has reduced drastically by 35% from Rs 75 Crore in 2016 to Rs 47.75 Crore in 2018. Directors have asked its Chief Executive Officer (CEO) & Chief Financial Officer (CFO) to provide detailed MIS report for reduction in Profits of the company in last 3 years.

- In the subsequent board meeting the MIS report was presented by CEO and CFO to the Directors stating that the major reason of reduction in profit was rise in Purchase Cost of Garments as the vendors have raised their rates. Also, even if the purchase cost was rising, there was no major difference with respect to Revenue as it was increasing at a constant rate over years.

- After the review of MIS Directors believed that there was something which has not been conveyed to them by CFO or CEO as the quality of garments provided by the vendors were still the same as per the report of quality review team as it was before 3 years. Also all the transactions relating to sales and purchase were seemed to have been done within the knowledge of the Board.

- Therefore, they appointed M/s PQW & Associates for Forensic Investigation of Purchases made in last 4 years to ascertain the exact reason for increase in Purchase Cost in last 3 years.

Scope of Forensic Audit

- To audit and investigate the reason of increase in Purchase Cost over last 3 years which led to reduction of profit.

- To find out the weakness in internal control related to purchase of Garments

- Period covered in forensic audit shall be last 4 years.

Methodology

- Data & Evidence Collection – The audit team collected digital image of Accounting records for last 4 years from accounting software Tally ERP maintained by the company in the presence of company’s CEO & CFO. The team ensured that the data is collected in duplicate form and not in original i.e. a backup of all the freezed financial data in tally of previous years was taken by the team which was only readable and the same was used for verification purpose later by the team. The HASH value of data was generated to ensure its reliability and accuracy.

The audit team took all the purchase data of individual years in MS Excel, based on which the team worked out the major purchases recorded during last 4 years and found that the purchases were made mainly from 15 different vendor which were almost fixed.

Audit team also took vendor wise purchase detail in MS Excel from the digital image and made Relative Size Factor (RSF) test on individual vendor ledger to ascertain any irregularity for all the year individually. It was found that RSF of 5 vendors were more than 10. Further, it was noted that major purchases were made at a single point in last 4 years from these 5 vendors.

Audit team obtained information about information about franchisees from the Interview of Purchase Department Head. Details of Interview given in point 2.1 below.

As per the information provided by Purchase Department Head, to get detail information about franchisee closure transactions Audit team collected detail of nature of transaction from the Director along with the Contracts entered with the parties. As per directors such transaction was entered as the company was not getting payment from some franchisees on time as they were unable to sell the product. As per Directors, the balance goods lying with the franchisee to be purchased at the price at which they were sold to them before.

Audit Team verified the contract and found that the rate at which the garments were taken back was MRP of goods minus 30% which was higher by approximately 20% of the price at which the goods were sold initially in previous years. The profit of 20% was passed on to the franchisee as commission. Even after clear instructions from directors the contract was made with conditions other than the agreed one to give gain to the franchisees.

To find out more evidence to ensure that the benefit of such closure is passed on to franchisee, Email and Laptop backup of CEO & CFO was taken along with the HASH values.

Audit Team recovered the deleted e-mails, photos and documents using data recovery tool. Audit team was able to find two photos of Letter written by CFO to 3 of the franchisees. The letter clearly mentioned that the remaining goods purchased back will be purchased at 20% higher price than the actual sale price to the franchisee as a commission and further 20% of the profit will be shared by CFO, CEO and franchisee out of the books in the ratio of 60:40.

Based on the recommended contract by BOD, actual contract with franchisee and photo of letters Audit team went to Directors for further actions. - Interview – The first person interviewed by audit team was Purchase Department Head for which written permission was taken from Directors. During interview the Purchase Department Head informed the audit team that the 5 major vendors were basically franchisees to whom company sells their product in bulk and subsequently they were closed one by one and the balance stock lying with them was purchased back and then those stores were made stores operated by the company as management operated stores.

The second person interviewed was CFO to find out detailed information about the adjustment. The Audit team took written permission from Directors for interviewing CFO. During the interview the evidence obtained by audit team was put in front of CFO. On confronting CFO with the evidence obtained by audit team, CFO informed that 3 of the franchisees were relatives of CFO and all of them was given franchisee through CFO himself. - All the franchisees were set up in 2015. The initial sale to all the franchisees in aggregate amounted to 180 crores in 2015. The franchisees paid initial amount of 40 crores to the company by the year end 2015 to prevent any doubt on transaction in that year.

- The balance amount was not paid by the franchisees giving the reason that they are unable to sell the goods of the balance value and hence by the end of 2016 one of the franchisees was converted to own store by entering into contract with them.

- Similar circumstances were found with other 2 franchisees also, out of which one was converted in 2017 and the other in 2018 into own store. The draft contract was approved by Directors. The draft contract’s a clause with respect to consideration stated that the goods shall be purchased back at the price at which it was initially sold, but this clause was changed, and the consideration was made at MRP less 30% discount by CFO with the help of CEO.

- Also, the amount over and above the Cost at which the garments were sold to franchisee was termed as commission to franchisee. Finally, CFO accepted that he made changes to the contract which was not communicated to Directors and rooted funds fraudulently to Franchisee. Further the extra money routed to franchisee was then distributed between CFO, CEO & Franchise.

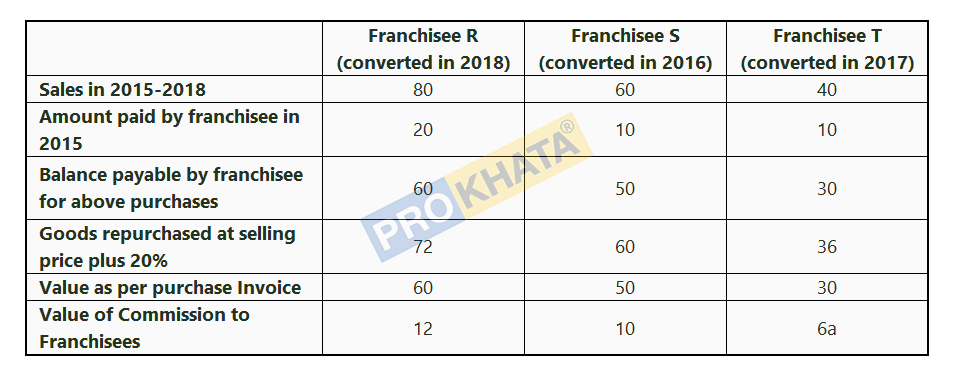

- The Table shows the comparison of Sales and Purchase back figures of each of the 3 franchisees

All the franchisees were set up in 2015. The initial sale to all the franchisees in aggregate amounted to 180 crores in 2015. The franchisees paid initial amount of 40 crores to the company by the year end 2015 to prevent any doubt on transaction in that year.

The balance amount was not paid by the franchisees giving the reason that they are unable to sell the goods of the balance value and hence by the end of 2016 one of the franchisees was converted to own store by entering into contract with them.

Similar circumstances were found with other 2 franchisees also, out of which one was converted in 2017 and the other in 2018 into own store. The draft contract was approved by Directors. The draft contract’s a clause with respect to consideration stated that the goods shall be purchased back at the price at which it was initially sold, but this clause was changed, and the consideration was made at MRP less 30% discount by CFO with the help of CEO.

Also, the amount over and above the Cost at which the garments were sold to franchisee was termed as commission to franchisee. Finally, CFO accepted that he made changes to the contract which was not communicated to Directors and rooted funds fraudulently to Franchisee. Further the extra money routed to franchisee was then distributed between CFO, CEO & Franchise.

The Table shows the comparison of Sales and Purchase back figures of each of the 3 franchisees

Executive Summary of Audit

- The purchase cost of the company has increased as the goods originally sold in bulk was purchased back from franchisees. This led to rise in purchase cost as the event was uncertain.

- The main reason of reduction in profit was extra commission paid to franchisees who were closed and converted into management stores. The commission was given in line with the agreement which was tampered by CFO, which was within the knowledge of CEO.

- The total value of commission paid as per the conditions of tampered contract was Rs 28 Crores which led to drastic reduction in profit.

- The persons involved in above transactions are the CEO, CFO of the company and the franchisees R, S & T relatives of CFO which can be clearly identified from the evidence obtained.

Conclusion and Recommendations

- Contract entered with franchisee R, S & T are void ab initio and hence company should ask the franchisees to return the excess commission paid to them.

- Company should conduct a complete background check of franchisee so as to ensure their capabilities to carry on the business. Special attention should be given to contracts with Related Parties of managerial staff.

- There is very possibility that the contracts entered by the company might have been tampered by managerial staff and hence directors should review all such important contracts entered by the company. Also, directors should review that the work executed are as per the terms mentioned in the contract.

- It is advisable to renew contracts with all the franchisees; the terms and conditions shall be made constant across all the contracts.

- It is advisable to carry out an Independent investigation on the work of CFO & CEO.

For M/s PQW & Associates

Chartered Accountants

CA Rajat Agrawal

(Partner)