Table of Contents

ToggleGST on Freelancers

India has emerged to be a hub for passionate freelancers and thereby, the freelance industry has been on a constant growing phase. However, it goes without saying that this particular industry is an unorganised sector and lacks clear and specific rules and regulations. The freelance industry in the country comprises of professional freelancers of various professions, bloggers and consultants. From a wide range of interests starting with travel and food to technology and fashion, freelancing has been a platform for people to display their talents and be their own boss. With the implementation of Goods and Services Tax (GST), there has been quite a confusion and the new rules and regulations of the tax concerning this market has been vague. This article is a GST Guide for Freelancers with the intent to simplify the complexity around the subject.

Registration Requirement Under GST

When you are providing services of up to Rs. 20 lakhs in a financial year –

In such a case you are not required to register under GST in any case and therefore not liable to collect GST.

You are not required to register whether you are providing services within the state, another state or even outside India. The rule that if sales is made in another state (inter-state) then it is required to register mandatorily is applicable only on sales of goods and NOT on sale of services. (Notification no. 10/2017 – IGST)

Some persons get confused whether the limit gets extended to Rs. 40 lakhs per year. But it is extended only for goods, for services it is still Rs. 20 lakhs.

This limit is Rs. 10 lakhs (which is generally Rs. 20 lakh) for persons who are registered in following north-eastern states: –

• Uttarakhand

• Arunachal Pradesh

• Assam

• Jammu & Kashmir

• Manipur

• Meghalaya

• Mizoram

• Nagaland

• Sikkim

• Tripura

• Himachal Pradesh

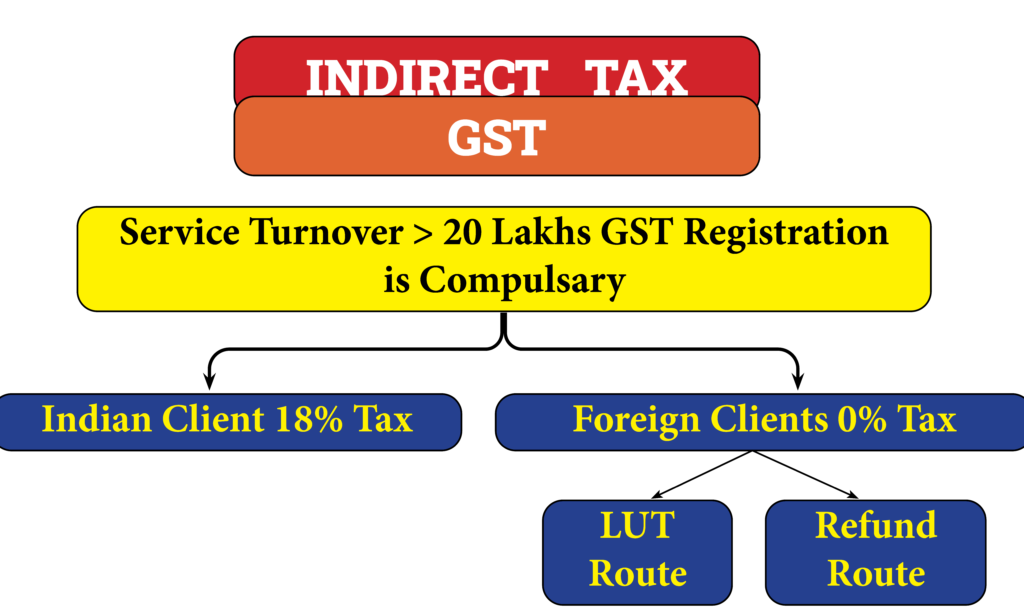

When you are providing services of more than Rs. 20 lakhs/10 lakhs in a financial year

In such a case, registration is mandatory. Even if you are providing all of your services outside India (100% Export of services) still registration is mandatory for you

Calculating GST Turnover

Aggregate turnover is an important term that determines GST registration requirement. Turnover, in common parlance, means value of a business over a period of time. Aggregate turnover in GST can be described as the taxable value of supplies of goods and services, exempt supplies of goods and services, export of goods and services and inter-state supplies. Hence, aggregate turnover for GST includes supplies of goods or services, supplies exempt from GST and exports.

Purpose of Aggregate Turnover

The basic pre-requisite for registration in GST is the aggregate turnover. The laws of GST states that any turnover up to 20 lakhs is completely exempted from GST, 10 lakhs for special category states except the state of “Jammu and Kashmir”, which is fully exempted from registration, while anything above these values are subject to registration. The aggregate turnover is calculated by taking together the value in respect of the activities carried by all the entities of the concerned person on a pan- India basis.

How to calculate Aggregate Turnover?

Aggregate turnover can be calculated as follows:

Value of all (taxable supplies+Exempt supplies+Exports+Inter-state supplies) – (Taxes+Value of inward supplies+Value of supplies taxable under reverse charge + Value of non-taxable supplies) of a person having the same PAN(Permanent Account Number) across all his business entities in India.

Which is not inclusive?

The below given charges must be excluded while calculating aggregate turnover:

• Taxes with respect to CGST, SGST or IGST Acts

• Value of taxes payable on reverse charge mechanism

• Value of inward supplies of goods and services

•Value of Non-taxable supplies of goods or services like Alcohol, Petrol etc.

Voluntary Registration – Effect And Benefits

A person can take registration in GST even if his turnover is less than Rs 20 Lakh / Rs 10 Lakh (in north-eastern states).

If a person takes voluntary registration, then also all provisions of GST will apply to him. In other words, he is required to collect and pay GST, file returns etc.

Taking voluntary registration is beneficial in cases when a person is incurring heavy expenses on which GST is payable. For example: A company gives ads on google for getting new clients, GST of 18% is payable in such cases. If such a company doesn’t get registered, then such GST cannot be claimed. However, if such a company takes registration, it can claim GST credit which can be used later for offsetting GST liability and may apply for GST refund (subject to certain conditions).

GST Rate On Freelancing

GST rate is applicable on the basis of the type of services provided. GST rate is 18% for following types of services:

• Accounting/Bookkeeping

• Software/App Development

• Technical services

• Call center or customer care

• Data entry

• Designing services

• Marketing Services

• Domain and hosting

• Voice over

• Language Translation

• Management/Consultancy Services

GST rate is 18% for almost all services provided via internet. You can also look for GST rate on government official website at https://cbic-gst.gov.in/gst-goods-services-rates.html

Export Of Services

For export of services, you are not required to charge GST if you have filed Letter of Undertaking (LUT). If you have not filed LUT then you have to charge GST, and thereafter you may apply for refund of such GST paid by filing GST Refund forms. LUT is a very simple form which doesn’t require many details, so it is advised to file LUT rather than going for the refund route.

Prerequisite condition for export of services: –

• Client is located outside India

• Payment must be received in convertible foreign currency.

• Person providing services is located in India

This doesn’t mean you must receive foreign currency in your bank account. Generally, payment is received in dollars by bank and they convert it to Indian rupees and transfer to your account. This will also be considered as an amount received in foreign currency but you must have Foreign Inward Remittance Certificate (FIRC) for the transaction. Read below for more details.

Providing Service Through Upwork, Fiverr, Freelancer, Guru Etc.

There is no difference in provisions of GST if services are provided via online marketplaces like Upwork, Fiverr or Freelancer.com etc. or provided directly to clients.

Taxability is as under

If services provided via any of the marketplace then liability to collect GST is on the freelancer only. The marketplace does not have any role in regards to GST.

• When the client is located outside India -> It will be considered as an export of services. Make sure you have FIRC for the remittance received via Upwork or Freelancer.com. Generally online platforms provide options for direct bank transfer to India for faster payout but they do not provide FIRC. We suggest you take payment via wire transfer or using PayPal as they provide you FIRC which is a very important document to prove export of services.

• When the client is located inside India -> It will not be considered as an export of services as the client is located inside India and GST is applicable on such transactions.

Foreign Inward Remittance Certificate (FIRC)

You must have FIRC to prove that the payment has been received in foreign convertible currency, which is a necessary condition for treating it as an export of services.

FIRC is provided by your bank (in case of wire transfer). Generally the bank emails you FIRC at the time of crediting wire transfer into your account.

If the payment has been received by international payment gateways like Paypal or Payoneer or Stripe etc then you have to collect FIRC from these payments gateway. Payonner and Stripe provide you FIRC along with the payment. Beginning from February 2021, PayPal has also started to provide your FIRC freely for all of your payments.

Also, if you are applying for refund of GST, FIRC is a compulsory document without which you will not be able to get refund of GST paid at the time of export of service or refund of GST paid on input services used in export of service.

Composition Scheme

There is a composition scheme for service providers having turnover of less than Rs. 50 lakhs. In this scheme, you can pay GST at a rate of 6% in place of applicable GST rate on the service provided by you (i.e. commonly 18%) but you can not take the benefit of input tax credit.

Also, if you provide service to a person in another state or in another country, then you cannot register under the composition scheme.

Invoicing

General invoicing rules are applicable for freelancers. In other words, there are no special requirements for freelancers. The invoice should contain all the necessary information such as name, address, GSTIN of the service provider as well as the recipient, SAC of services, date, the value of service provided and so on.

If you are issuing invoice for services provided outside India under LUT and thus not charging GST, then you have to mention in invoice “Export of Services without payment of GST under LUT filed on 19th March 2021 having ARN AD080421001248J“

Beginning from 1st April 2021, If you are issuing invoice to another business having GST number then it is mandatory to write Service Accounting Codes (SAC) in such invoice.

Foreign Currency Invoice For Services

Generally, the invoice is raised in foreign currency when you provide services to a client outside India. However, at the time of filing GST returns, you are required to report your income in Indian Rupees. In such case, we suggest you to follow below procedure: –

Raise invoice for your client in foreign currency.

Convert the invoice in Indian Rupees using the applicable conversion rate as on date of invoice approved by RBI which is available on this website – https://www.fbil.org.in/#/home (you can find the exchange rate once you click on Foreign Exchage Tab).

Use the above converted value for reporting in GST return as well as for your bookkeeping purpose.

Once you receive the actual transfer, book the difference to Exchange Gain/ Exchange Loss account (direct expenses) in your books.

Note – No GST is payable on exchange gain or exchange loss.

Input Tax Credit

Input tax credit is the amount of GST which is paid on purchases and thus allowed as deduction from the GST payable to the government.

There are no special provisions for input tax credit for freelancers. They can take input tax credit of GST paid on all business purchases like rent, telephone bill, computer, laptop etc other than some purchases on which ITC is not allowed like purchase of motor vehicles, food bills etc.

GST Refund

If you are engaged in export of services then GST law allows you to get the GST refund into your bank account for the following: –

• On the input services/goods used to provide such export of service or

• GST charged and paid to the Government at the time of export of services.

The most important condition for claiming GST refunds are: –

• FIRC to prove export of services.

• The refund application has to be filed within 24 months from the end of the month in which such services are exported.

Tax Collected At Source (TCS) Under GST

Under Section 52 of CGST Act, e-commerce operators are required to collect TCS from the persons selling goods or services through them.

Freelancer.in is registered in India and thus liable to collect TCS at the rate of 1% on amount paid through them. Although, it is required to be collected only from persons who are registered in GST.

Upwork is also collecting 1% TCS from all the freelancers irrespective of registration under GST.

Is Import Export Code (IEC) required for exporting of services?

No, the IEC code is not mandatory for the export or import of services. It is only mandatory when you want to claim SEIS scheme benefit or you are providing services related to national security.

To sum it up

We have seen that GST registration for freelancers is a must in some instances. You cannot hide your income from the government. They will find it from the TDS deducted by your clients or from your bank payments. As all your accounts are linked with PAN and Aadhaar, the best option would be to go for GST registration. You can hire a CA to manage all your GST-related tasks.