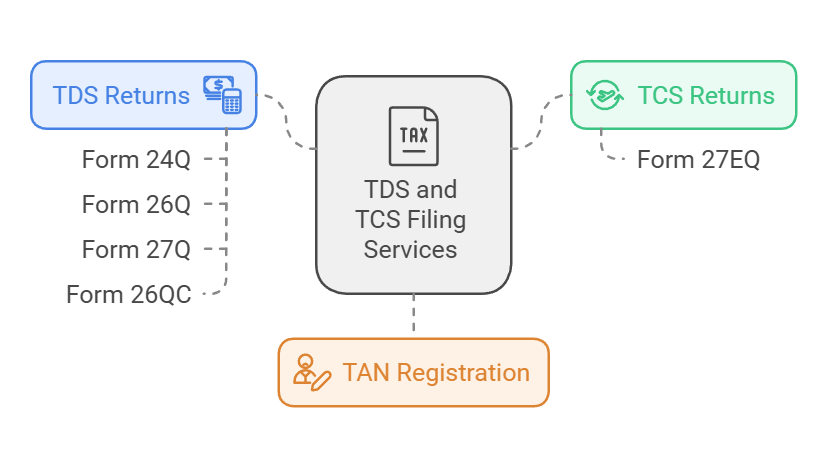

● TDS Return on Salary and other payments (Form 24Q and Form 26Q): This offering combines TDS return filing services for salaries (Form 24Q) and other types of payments (Form 26Q).

● TDS Returns – Payments outside India (Form 27Q): This covers TDS return filing for payments made to parties outside India.

● TDS Return on Salary Payment (Form 24Q): Specifically for filing TDS returns on salary payments.

● TDS Return on payment other than salary (Form 26Q): Covers TDS return filing for payments other than salaries.

● TDS on Rent – Form 26QC: A specialised service for filing TDS returns on rent payments.

● TAN Registration: Facilitates the process of obtaining a TAN (Tax Deduction and Collection Account Number), which is mandatory for businesses deducting TDS.

● TCS Returns – Form 27EQ: Covers the filing of TCS returns (Form 27EQ), applicable to businesses collecting tax at source.

Showing all 7 resultsSorted by popularity

-

Sale!

TDS Return on Salary and other payments (Form 24Q and Form 26Q)

Original price was: ₹3,200.00.₹2,500.00Current price is: ₹2,500.00. Add to cart -

Sale!

TDS Returns – Payments outside India (Form 27Q)

Original price was: ₹1,900.00.₹1,500.00Current price is: ₹1,500.00. Add to cart -

Sale!

TDS Return on Salary Payment (Form 24Q)

Original price was: ₹1,900.00.₹1,500.00Current price is: ₹1,500.00. Add to cart -

Sale!

TDS Return on payment other than salary (Form 26Q)

Original price was: ₹1,900.00.₹1,500.00Current price is: ₹1,500.00. Add to cart -

Sale!

TDS on Rent – Form 26QC

Original price was: ₹1,900.00.₹1,500.00Current price is: ₹1,500.00. Add to cart -

Sale!

TCS Returns – Form 27EQ

Original price was: ₹1,900.00.₹1,500.00Current price is: ₹1,500.00. Add to cart -

Sale!

TAN Registration

Original price was: ₹699.00.₹499.00Current price is: ₹499.00. Add to cart