GST Advisory Services at Prokhata

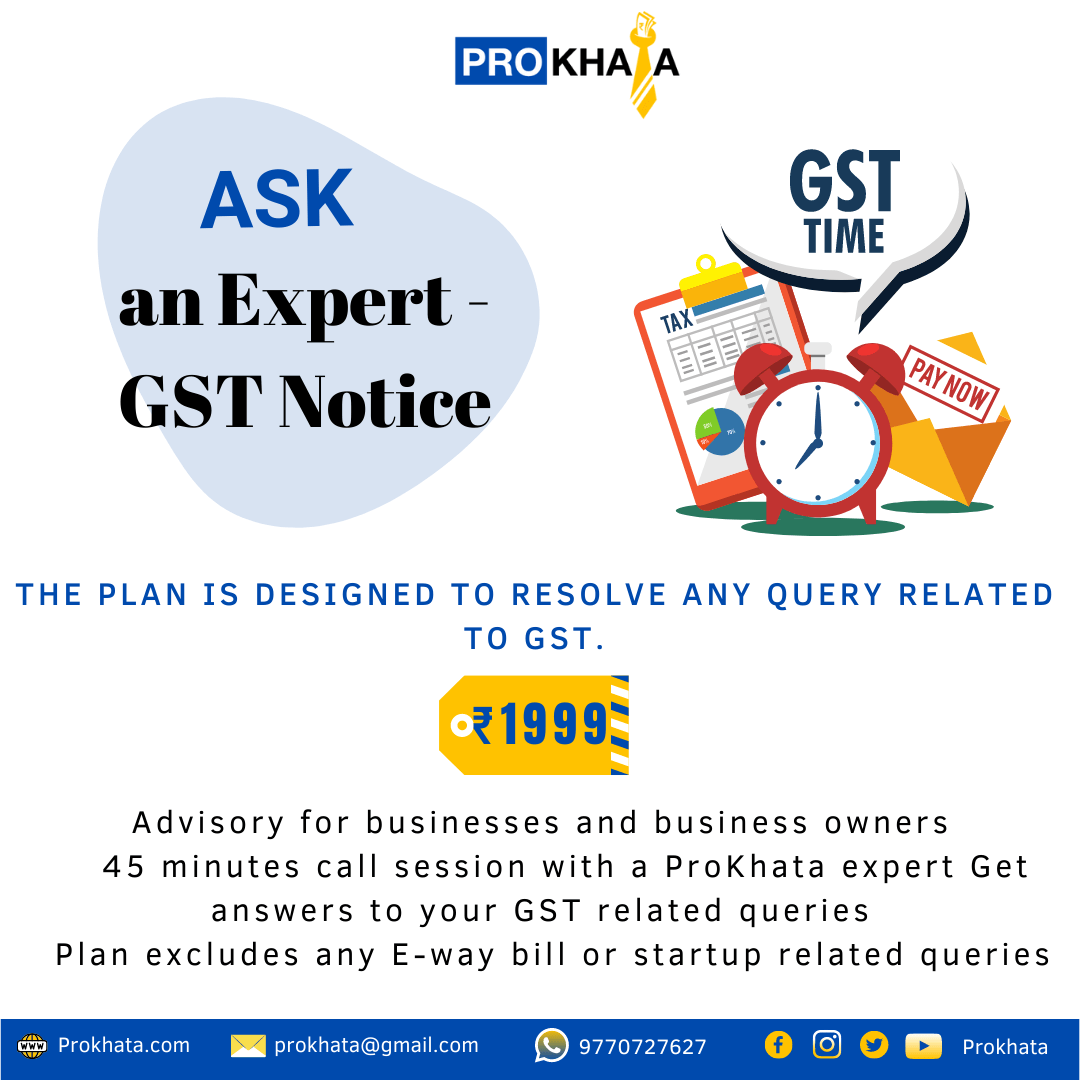

GST Advisory Services at Prokhata

Services Covered

Services Covered

Advisory for businesses and business owners

45 minutes call session with a ProKhata expert

Get answers to your GST-related queries

Plan excludes any E-way bill or startup-related queries

Who Should Buy

Who Should Buy

Businesses/Business owners

Freelancers

How It’s Done

How It’s Done

Purchase of Plan

Share your Requirements

Session with ProKhata Expert

Resolution of Query

Estimated Time: 2 days

Documents to be Submitted

Documents to be Submitted

The documents required will be communicated after analyzing your queries.

Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

What types of queries can I ask during the advisory session?

What types of queries can I ask during the advisory session?

You can ask any GST-related questions, including compliance requirements, filing processes, and general GST concepts. However, E-way bill and startup-related queries are not covered under this plan.

How do I prepare for my advisory session?

How do I prepare for my advisory session?

To make the most of your session, prepare a list of specific questions or topics you would like to discuss. This will help our expert provide you with tailored advice.

How do I schedule my advisory session?After purchasing the plan, you will receive instructions on how to schedule your session with a ProKhata expert at a time that is convenient for you.

How do I schedule my advisory session?After purchasing the plan, you will receive instructions on how to schedule your session with a ProKhata expert at a time that is convenient for you.

Get Started Today!

Get Started Today!

Don’t let GST complexities overwhelm you. Join countless satisfied customers who have benefited from our expert advisory services at Prokhata.

Contact Us Now!

Visit Prokhata.com or call us at +91-8319130080 to schedule your advisory session today! Let us help you navigate your GST queries with ease.