Business and Profession Income Tax Return

Services Covered:

Services Covered:

Expert-Assisted Tax Filing: For business and professionals.

Tax Savings & Planning Advice: Get advice on saving and planning your taxes.

Documented Follow-Up: Ensuring thorough follow-up.

Excludes Tax Audit Fees: Tax audit fees are not covered.

Who Should Buy:

Who Should Buy:

Any business entity required to maintain books of accounts.

Small Businesses and Professionals requiring books of account.

Small businesses requiring Tax Audit.

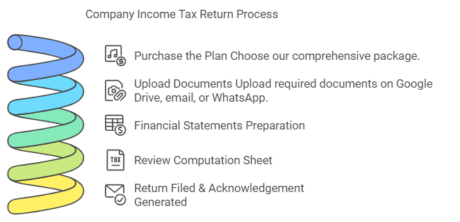

How it’s Done:

How it’s Done:

Documents to be Submitted:

Documents to be Submitted:

Digital Signature

Income tax login credentials

Auditor reports

Bank statement if interest received is above Rs. 10,000

FAQs:

FAQs:

What is the due date to file an income tax return for businesses and professionals?

What is the due date to file an income tax return for businesses and professionals?

For Assessment Year 2025-26, the due dates for income tax filing are:

- October 31, 2025: For businesses and professionals who require a tax audit.

- November 30, 2025: If the business or profession has international transactions or specified domestic transactions requiring a transfer pricing report.

- July 31, 2025: For businesses and professionals not subject to a tax audit.

Which ITR forms should be used for business or professional income?

Which ITR forms should be used for business or professional income?

- ITR 3: Applicable to individuals and Hindu Undivided Families (HUFs) carrying on a business or profession.

- ITR 4 (Sugam): For individuals, HUFs, and firms (other than LLPs) opting for the presumptive taxation scheme under Sections 44AD, 44ADA, or 44AE.

- ITR 5: For partnership firms, LLPs, Associations of Persons (AOPs), and Body of Individuals (BOIs).

Is tax audit mandatory for all businesses and professionals?

Is tax audit mandatory for all businesses and professionals?

A tax audit is required if the turnover or gross receipts exceed:

- ₹1 crore for businesses (unless eligible for the higher threshold below).

- ₹10 crores, provided that cash receipts and payments do not exceed 5% of the total receipts and payments.

- ₹50 lakhs for professionals.

Those opting for the presumptive taxation scheme are generally exempt from the audit requirement unless they declare income lower than the prescribed presumptive rate.

What is the presumptive taxation scheme?

What is the presumptive taxation scheme?

The presumptive taxation scheme allows eligible businesses and professionals to declare income at a prescribed rate without maintaining detailed books of accounts.

- Under Section 44AD, eligible businesses can declare 8% (6% for digital transactions) of gross turnover as income.

- Under Section 44ADA, professionals can declare 50% of gross receipts as income.

- Under Section 44AE, income from goods carriages is based on a fixed amount per vehicle.

Can I opt out of the presumptive taxation scheme?

Can I opt out of the presumptive taxation scheme?

Yes, you can opt out of the presumptive taxation scheme. However, once you opt out, you cannot re-enter the scheme for the next five assessment years.

Can I file a revised return if I made a mistake?

Can I file a revised return if I made a mistake?

Yes, a revised return can be filed until December 31, 2025 (three months before the end of the assessment year) or before the completion of the assessment, whichever is earlier.

What are the consequences of not filing the return on time?

What are the consequences of not filing the return on time?

If you fail to file the return by the due date, the following consequences may apply:

- Late filing fees under Section 234F (up to ₹5,000).

- Interest on outstanding tax under Section 234A.

- Losses (except house property loss) may not be carried forward.

- Higher chances of scrutiny notices from the tax department.

Do I need to keep books of accounts?

Do I need to keep books of accounts?

Yes, if your turnover exceeds ₹25 lakhs (for professionals) or ₹10 lakhs (for others). For presumptive taxation, detailed books may not be required, but basic records must be maintained to justify turnover.

Are there any exemptions for small businesses from filing requirements?

Are there any exemptions for small businesses from filing requirements?

Small businesses opting for the presumptive taxation scheme under Section 44AD are exempt from maintaining detailed books of accounts and tax audit requirements, provided the turnover is below ₹2 crores.

How long should I retain records and documents?

How long should I retain records and documents?

You should retain all records for at least 6 years from the end of the relevant assessment year. In some cases, records may need to be kept for a longer period if there are ongoing disputes or litigation.

What deductions can professionals claim?

What deductions can professionals claim?

Professionals can claim deductions on expenses directly related to their profession, such as:

- Office rent

- Employee salaries

- Travel expenses

- Depreciation on assets

- Professional development expenses

Is GST registration required for businesses and professionals filing ITR?

Is GST registration required for businesses and professionals filing ITR?

Yes, GST registration is required if your annual turnover exceeds ₹20 lakhs (₹10 lakhs for special category states) for services and ₹40 lakhs for goods.

Is audit and financial statement preparation included in tax filing plans?

Is audit and financial statement preparation included in tax filing plans?

No, audit and preparation of financial statements are not included in standard tax filing plans. You will need to buy other products from our website for these services.