Form 20A – Filing of Declaration for Commencement of Business

Form 20A – Filing of Declaration for Commencement of Business

Services Covered:

Services Covered:

Drafting of Documents: Comprehensive document preparation.

Filing of Form 20A: Professional filing assistance.

Includes Govt. Fees: Covers fees up to Rs. 300.

Who Should Buy:

Who Should Buy:

- Individuals and businesses required to file Form 20A for commencement of business.

How it’s Done:

How it’s Done:

Purchase the Plan: Choose our comprehensive package.

Upload Documents: Upload required documents on the vault.

Drafting of Documents: Our experts will draft necessary documents.

Filing of Form 20A: We’ll handle the filing process.

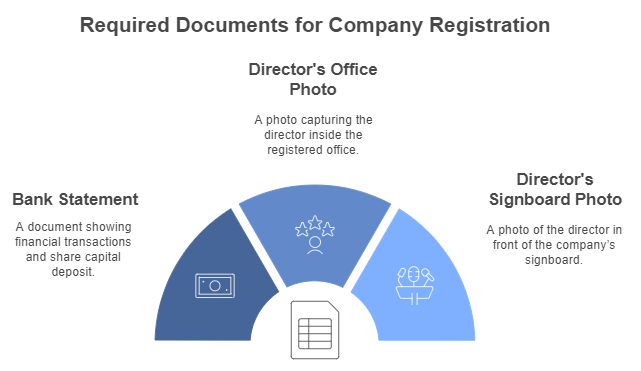

Documents to be Submitted:

Documents to be Submitted:

The following documents are required:

The following documents are required:

Bank Statement: Showing deposit of share capital by the director.

Photos of Director:

- One photo of the director inside the registered office.

- One photo of the director in front of the company’s signboard at the registered office.

Geo-tagging of Photos: Both photos must have geo-tagging to verify they were taken at the registered office.

Frequently Asked Questions

Frequently Asked Questions

What is Form 20A?

What is Form 20A?

Form 20A is a declaration of commencement of business required for all companies in India incorporated after November 2018 and having share capital.

Who is required to file Form 20A?

Who is required to file Form 20A?

Every company incorporated after November 2018 with share capital must file Form 20A with the Registrar of Companies (ROC).

By when should Form 20A be filed?

By when should Form 20A be filed?

Form 20A must be filed within 180 days from the date of incorporation.

What happens if Form 20A is not filed within the deadline?

What happens if Form 20A is not filed within the deadline?

The penalty for late filing of Form INC-20A, the Declaration for Commencement of Business, is as follows:

- Up to 30 days: Two times the normal fee

- More than 30 to 60 days: Four times the normal fee

- More than 60 to 90 days: Six times the normal fee

- More than 90 to 180 days: Ten times the normal fee

- More than 180 days: Twelve times the normal fee

In addition to the penalty for late filing, the company may also face the following consequences:

-

- The company’s name may be removed from the Registrar of Companies (RoC) register.

- In cases where a company fails to obtain the commencement of business certificate (COB) within 180 days of incorporation, the company will incur a penalty amounting to Rs. 50,000.

- Each director of the company who is in default may be required to pay a penalty of Rs 1,000 per day of default, up to a maximum of Rs 1,00,000.

What documents are required for filing Form 20A?

What documents are required for filing Form 20A?

The following documents are required:

- Bank Statement: Showing deposit of share capital by the director.

- Photos of Director:

- One photo of the director inside the registered office.

- One photo of the director in front of the company’s signboard at the registered office.

- Geo-tagging of Photos: Both photos must have geo-tagging to verify they were taken at the registered office.

Is Form 20A required even if the company hasn’t started business activities?

Is Form 20A required even if the company hasn’t started business activities?

Yes, it is mandatory regardless of whether the company has begun business operations.

Can Form 20A be filed online?

Can Form 20A be filed online?

Yes, Form 20A can be filed online through the Ministry of Corporate Affairs (MCA) portal.

Is a Digital Signature Certificate (DSC) required for filing Form 20A?

Is a Digital Signature Certificate (DSC) required for filing Form 20A?

Yes, the DSC of at least one director is required to submit Form 20A.

Who can certify Form 20A?

Who can certify Form 20A?

A practicing Chartered Accountant (CA), Company Secretary (CS), or Cost Accountant must certify the form.

What is the filing fee for Form 20A for Companies with Share Capital ?

What is the filing fee for Form 20A for Companies with Share Capital ?

| Sl.No | Nominal Share Capital (INR) | Fee Applicable (INR) |

|---|---|---|

| 1 | Less than 1,00,000 | 200 |

| 2 | 1,00,000 to 4,99,999 | 300 |

| 3 | 5,00,000 to 24,99,999 | 400 |

| 4 | 25,00,000 to 99,99,999 | 500 |

| 5 | 1,00,00,000 or more | 600 |

Estimated Time: 3 days

Estimated Time: 3 days