GST Return Filing Made Easy: Comprehensive Package for Businesses

GST Return Filing Made Easy: Comprehensive Package for Businesses

Services Covered:

Services Covered:

Free GST Registration: Get your business registered under GST hassle-free.

Annual GST Filing: We’ll handle your GSTR-1 and GSTR-3B returns for a year.

B2B & B2C Invoice Filing: Our experts will accurately file your invoices.

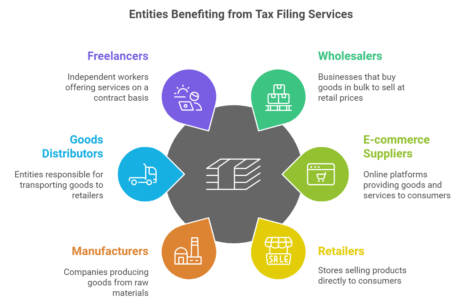

Who Should Buy:

Who Should Buy:

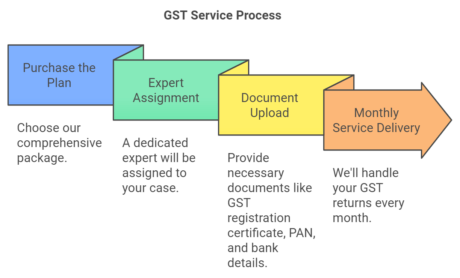

How it’s Done:

How it’s Done:

Documents Required:

Documents Required:

GST registration certificate

PAN card

Bank account details

Purchase and sales register

Payment challan for GST

FAQs:

FAQs:

What is a GST Return?

What is a GST Return?

A GST return is a document containing details of income that a taxpayer must file with tax authorities. It includes purchases, sales, output GST, and input tax credit.

Who has to file GST Returns?

Who has to file GST Returns?

All regular businesses registered under GST must file monthly and annual returns.

What are the types of GST Returns?

What are the types of GST Returns?

There are three monthly returns (GSTR-1, GSTR-2, GSTR-3) and an annual return (GSTR-9).

How do I claim Input Tax Credit?

How do I claim Input Tax Credit?

Input credit is the reduction in tax payable on output based on taxes paid on inputs. We’ll help you claim it.

How do I know if my tax invoice is GST compliant?

How do I know if my tax invoice is GST compliant?

A GST-compliant tax invoice includes specific details like supplier and recipient information, HSN code, description of goods/services, quantity, value, and GST amount.

What is GST 3B?

What is GST 3B?

GSTR 3B is a simplified return for the first two months of GST.

I have multiple GSTINs. How many returns do I need to file?

I have multiple GSTINs. How many returns do I need to file?

You need to file returns for each GSTIN. Our package covers one GSTIN.

How do I claim a refund under GST?

How do I claim a refund under GST?

Our experts will assist you with the refund process.

Is audit applicable under GST?

Is audit applicable under GST?

Audit may be applicable for businesses with turnover exceeding a certain limit. We can guide you on tax audit, but it’s not included in our package.

What penalties are applicable for non-compliance under GST?

What penalties are applicable for non-compliance under GST?

Non-compliance can lead to penalties, prosecution, and arrest.

Estimated Time: 365 days

Estimated Time: 365 days

Note: Our package does not include book-keeping or accounting services.