GST Registration Services at Prokhata

GST Registration Services at Prokhata

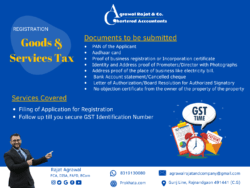

Services Covered

Services Covered

Complimentary Registration of GST for 1 GSTIN

GSTR Filing for 3 months for ONE GSTIN

Filing for B2B and B2C invoices

Book-Keeping and Accounting are not part of this package

Valid for businesses with turnover less than ₹1.5 crores

Who Should Buy

Who Should Buy

Wholesale Traders

ECommerce Suppliers

Retailers

Manufacturers

Goods Distributors

Freelancers

Service Providers

Business registered under GST (not applicable for business under composition scheme)

How It’s Done

How It’s Done

Purchase of Plan

Expert Assigned

Upload Documents

Monthly Delivery of Services

Estimated Time: 90 days

Documents to be Submitted

Documents to be Submitted

No objection certificate from the owner of the property

Purchase and sales register

Payment challan for GST

FAQs

FAQs

What is a GST Return?

What is a GST Return?

A return is a document containing details of income which a taxpayer is required to file with the tax administrative authorities. This is used by tax authorities to calculate tax liability. Under GST, a registered dealer has to file GST returns that includes:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

Under this plan, our experts will file your GST Returns.

Who has to file GST Returns?

Who has to file GST Returns?

All regular businesses registered under GST must file two monthly returns (GSTR-1, GSTR-3B) and one annual return (GSTR-9). This totals up to 25 returns in a year.

What are the types of GST Returns?There are three types of GST Returns to be filed every month and an annual return for registered businesses as below:

What are the types of GST Returns?There are three types of GST Returns to be filed every month and an annual return for registered businesses as below:

- The types of returns include:

- GSTR-1: Monthly details of outward supplies due on the 10th of the next month.

- GSTR-2B: Auto-populated details of inward supplies due on the 15th of the next month.

- GSTR-3B: Summary return due on the 20th of the next month.

- GSTR-9: Annual return due by December 31st of the following financial year.

How do I claim Input Tax Credit?Input credit allows businesses to reduce their output tax liability by claiming credits for taxes paid on inputs. To claim this credit, ensure that all invoices are from registered dealers and are reported in GSTR-1.

How do I claim Input Tax Credit?Input credit allows businesses to reduce their output tax liability by claiming credits for taxes paid on inputs. To claim this credit, ensure that all invoices are from registered dealers and are reported in GSTR-1.

How do I know if my tax invoice is GST compliant?A tax invoice is generally issued to charge the tax and pass on the input tax credit. A GST compliant tax invoice must contain specific mandatory information including:

How do I know if my tax invoice is GST compliant?A tax invoice is generally issued to charge the tax and pass on the input tax credit. A GST compliant tax invoice must contain specific mandatory information including:– Name, address and GSTIN of the supplier

– Invoice number

– Date of issue

– Name, address and GSTIN of the recipient (if registered)

– HSN code

– Description of the goods/services

– Quantity of goods

– Value after discount

– Rate and amount of GST

Under this plan, we expect you to provide a summary of invoices (purchase & sale) covering all this information to help us file your GST returns.

What is GSTR-3B?GSTR 3B is a simplified return that businesses need to file monthly. It summarizes sales and purchases along with tax liability.

What is GSTR-3B?GSTR 3B is a simplified return that businesses need to file monthly. It summarizes sales and purchases along with tax liability.

I am a wholesaler of sports goods. Do I need to file GST Returns?If you are registered under GST, then you need to file GST returns. By filing GST returns, you will be able to claim Input tax credit.

I am a wholesaler of sports goods. Do I need to file GST Returns?If you are registered under GST, then you need to file GST returns. By filing GST returns, you will be able to claim Input tax credit.

I am a clothing seller and sell through leading e-commerce portals. Which package do I need to apply for GST returns?Presently, the government is yet to define GST filing guidelines for e-commerce operators. Until such time, you will be required to file GST returns like others. We will cover this under this package.

I am a clothing seller and sell through leading e-commerce portals. Which package do I need to apply for GST returns?Presently, the government is yet to define GST filing guidelines for e-commerce operators. Until such time, you will be required to file GST returns like others. We will cover this under this package.

I have three GSTINs. How many returns do I need to file?You need to file GST returns for every GSTIN. So for one GSTIN, you need to file three returns every month and one annual return. Under this plan, we will file GST returns for one GSTIN only. You will need to purchase additional packages for multiple GSTINs.

I have three GSTINs. How many returns do I need to file?You need to file GST returns for every GSTIN. So for one GSTIN, you need to file three returns every month and one annual return. Under this plan, we will file GST returns for one GSTIN only. You will need to purchase additional packages for multiple GSTINs.

How do I claim a refund under GST?The processing time for a refund application has been kept as sixty days under GST model law but it could be as early as two weeks. Our experts will assist you with claiming the refund.

How do I claim a refund under GST?The processing time for a refund application has been kept as sixty days under GST model law but it could be as early as two weeks. Our experts will assist you with claiming the refund.

Is audit applicable under GST?Audit under GST is the examination of records maintained by the taxable person to verify the correctness of information declared, taxes paid, and compliance with the provisions of GST. Audit can be done by the taxpayer himself or by tax authorities.

Is audit applicable under GST?Audit under GST is the examination of records maintained by the taxable person to verify the correctness of information declared, taxes paid, and compliance with the provisions of GST. Audit can be done by the taxpayer himself or by tax authorities.

What penalties are applicable for non-compliance under GST?To prevent tax evasion and corruption, strict provisions have been introduced regarding penalties, prosecution, and arrest for offenders related to fraud and tax evasion among others. For more details, please read our article.

What penalties are applicable for non-compliance under GST?To prevent tax evasion and corruption, strict provisions have been introduced regarding penalties, prosecution, and arrest for offenders related to fraud and tax evasion among others. For more details, please read our article.

What are B2B invoices?B2B invoices are invoices for taxable supplies made to registered taxpayers considered as B2B.

What are B2B invoices?B2B invoices are invoices for taxable supplies made to registered taxpayers considered as B2B.

What are B2C Large invoices?B2C invoices are invoices for taxable outward supplies made to unregistered taxpayers where:

What are B2C Large invoices?B2C invoices are invoices for taxable outward supplies made to unregistered taxpayers where:– Supply is made interstate

– Total invoice value is more than ₹2,50,000

Get Started Today!

Get Started Today!

Don’t let the complexities of GST registration hold you back. Join countless satisfied customers who have streamlined their tax processes with Prokhata.

Contact Us Now!

Visit Prokhata.com or call us at +91-8319130080 to schedule a consultation today! Let us help you take the first step towards a compliant and successful business journey.