Welcome to Prokhata.com – Your One-Stop Solution for GST Registration!

Welcome to Prokhata.com – Your One-Stop Solution for GST Registration!

Why Choose Prokhata for Your GST Registration?

Why Choose Prokhata for Your GST Registration?

Expert Guidance: Our experienced professionals provide personalized assistance tailored to your specific business needs.

Fast Processing: We streamline the registration process, typically completing it within 2-6 working days.

No Hidden Fees: Enjoy transparent pricing with no hidden charges. We believe in clear communication and integrity.

Comprehensive Support: From document preparation to application submission, we handle everything for you.

Understanding GST Registration

Understanding GST Registration

If your business falls under these thresholds, registering for GST is essential to avoid penalties and ensure compliance with tax regulations.

Benefits of GST Registration:

Benefits of GST Registration:

Input Tax Credit: Claim credits on taxes paid for goods and services used in your business.

Legitimacy: A registered business gains credibility and trust among customers and suppliers.

Seamless Transactions: Conduct business across state borders without worrying about complex tax regulations.

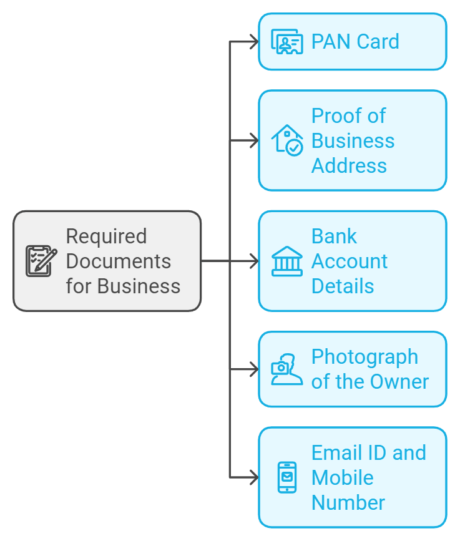

Required Documents for GST Registration

Required Documents for GST Registration

Our team at Prokhata will help you gather and prepare these documents efficiently.

The GST Registration Process Simplified

The GST Registration Process Simplified

Initial Consultation: Contact us to discuss your business needs and eligibility.

Document Submission: Provide the necessary documents; we’ll guide you through this step.

Application Filing: We will complete and file your application on your behalf.

Receive GSTIN: Once approved, you will receive your unique GST Identification Number (GSTIN) via email.

Ongoing Support: Our services don’t stop at registration; we offer ongoing support for compliance and filing requirements.

Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

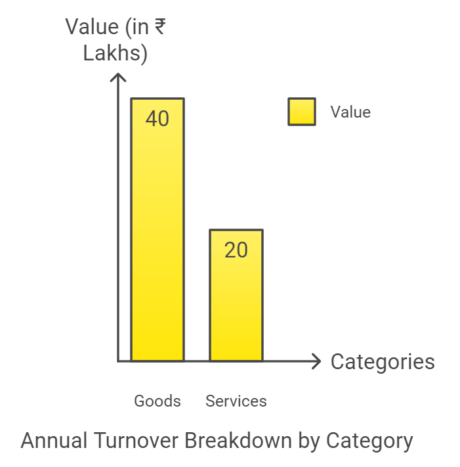

Is GST registration mandatory?

Is GST registration mandatory?

Yes, If your annual turnover exceeds ₹20 lakhs for services or ₹40 lakhs for goods, or if you do interstate sales, you’re required to register.

If your turnover is below the prescribed limit, registration isn’t mandatory. But voluntarily registering can be a smart move—you get to claim input tax credits and enhance your business’s credibility.

Extra Insights:

- Composition Scheme: The Composition Scheme simplifies GST compliance for small businesses with turnover up to ₹1.5 crores. Under this, you pay a fixed percentage of your turnover as tax—1% for traders, 2% for manufacturers, and 5% for restaurants. It reduces paperwork, but you can’t issue taxable invoices or claim ITC.

- E-commerce Sellers: Selling online? GST registration is mandatory, regardless of turnover. Platforms like Amazon and Flipkart require a GSTIN to onboard you as a seller.

What happens if I don’t register?

What happens if I don’t register?

Non-compliance can lead to penalties up to 100% of the tax amount due.

Can I apply for multiple registrations?

Can I apply for multiple registrations?

Yes, businesses can have multiple GST registrations within a single state based on different business activities.

Get Started Today!

Get Started Today!

Don’t let the complexities of GST registration hold you back. Join countless satisfied customers who have streamlined their tax processes with Prokhata.

Contact Us Now!

Visit Prokhata.com or call us at +91 8319130080 to schedule a consultation today! Let us help you take the first step towards a compliant and successful business journey.