GST Filing Services at Prokhata

GST Filing Services at Prokhata

Services Covered

Services Covered

GST Return Filing for 3 months (inclusive of Purchase & Sales) for ONE GSTIN

Filing for B2B and B2C invoices

Sales GST Returns (GSTR-1) within due dates

Book-Keeping and Accounting are not part of this package

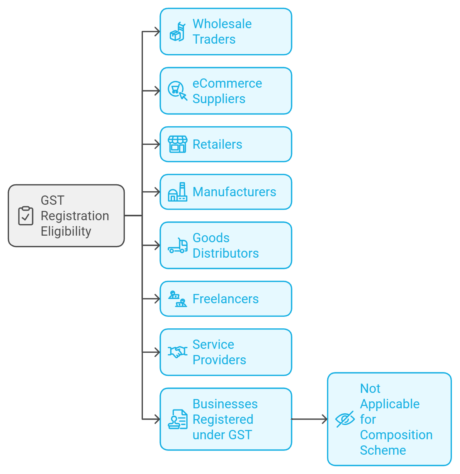

Who Should Buy

Who Should Buy

How It’s Done

How It’s Done

Purchase of Plan

Expert Assigned

Upload Documents

Monthly Delivery of Services

Estimated Time: 90 days

Documents to be Submitted

Documents to be Submitted

Purchase and sales register

Payment challan for GST

Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

What is a GST Return?

What is a GST Return?

A return is a document containing details of income that a taxpayer must file with tax authorities. It is used by tax authorities to calculate tax liability. Under GST, a registered dealer has to file returns that include:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

Under this plan, our experts will file your GST Returns.

Who has to file GST Returns?

Who has to file GST Returns?

In the GST regime, any regular business has to file three monthly returns and one annual return, totaling **37 returns** in a year. The beauty of the system is that one has to manually enter details of one monthly return – GSTR-1. The other two returns – GSTR-2B & GSTR-3B will auto-populate based on information derived from GSTR-1 filed by you and your vendors.

- GSTR-1: Monthly details of outward supplies due on the **10th** of the next month.

- GSTR-2B: Monthly details of inward supplies claiming input tax credit due on the **15th** of the next month.

- GSTR-3B: A monthly return based on finalization of details of outward and inward supplies due on the **20th** of the next month.

- GSTR-9: Annual return due on **31st December** of the following financial year.

How do I know if my tax invoice is GST compliant?A GST-compliant tax invoice must contain specific mandatory information, including:

How do I know if my tax invoice is GST compliant?A GST-compliant tax invoice must contain specific mandatory information, including:– Name, address, and GSTIN of the supplier

– Invoice number

– Date of issue

– Name, address, and GSTIN of the recipient (if registered)

– HSN code

– Description of goods/services

– Quantity of goods

– Value after discount

– Rate and amount of GSTUnder this plan, we expect you to provide a summary of invoices (purchase & sale) covering all this information to help us file your GST returns.

Get Started Today!

Get Started Today!

Don’t let the complexities of GST filing hold you back. Join countless satisfied customers who have streamlined their tax processes with Prokhata.

Contact Us Now!

Visit Prokhata.com or call us at +91-8319130080 to schedule a consultation today! Let us help you take the first step towards a compliant and successful business journey.