Presumptive Income Tax Return

Services Covered:

Services Covered:

Expert-Assisted Tax Returns Filing: Professional help with filing your tax returns.

Business Hours Expert Support: Get support during business hours.

Documented Follow-Up: Ensuring thorough follow-up.

Who Should Buy:

Who Should Buy:

Businesses having annual turnover under Rs. 2cr and declaring income above 8% (no audit).

Professionals & Freelancers having annual gross receipts under Rs. 50 lakh and declaring income at 50% or above (no audit).

Any other person having casual income.

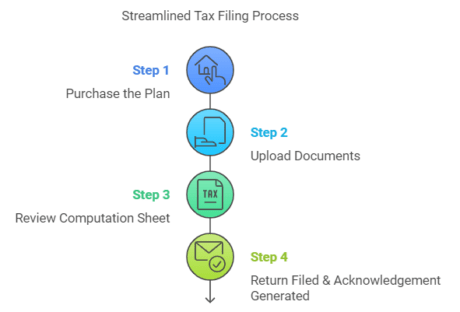

How it’s Done:

How it’s Done:

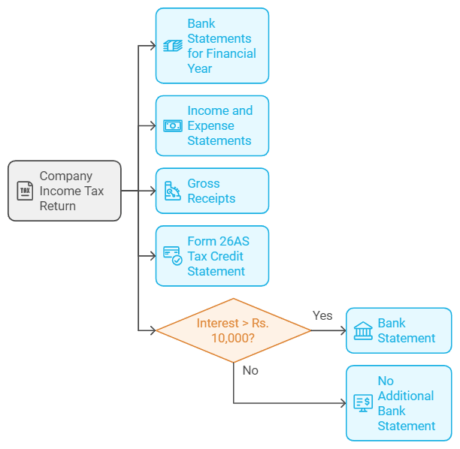

Documents to be Submitted:

Documents to be Submitted:

FAQs:

FAQs:

Who can opt for the presumptive taxation scheme?

Who can opt for the presumptive taxation scheme?

Only proprietors, Hindu Undivided Families (HUFs), and general partnership firms can opt for the scheme.

What are the benefits under the Presumptive Taxation Scheme?

What are the benefits under the Presumptive Taxation Scheme?

The benefits include:

- No requirement to maintain books of accounts

- No requirement to get accounts audited

- No need to assess advance tax, advance tax is paid by 15th March of the previous year

Note: Any amount paid by way of advance tax on or before 31st March is also treated as advance tax paid during the financial year ending on that day. The scheme applies only to resident assessees who are individuals, HUFs, or partnerships but not limited liability partnerships.

I am a shopkeeper and wish to declare income less than 8% of my gross turnover. How can I do that?

I am a shopkeeper and wish to declare income less than 8% of my gross turnover. How can I do that?

If you declare income less than 8% of turnover and your income exceeds Rs. 2,50,000 (Individual Tax Slab), then you are required to maintain the books of account as per the provisions of section 44AA and get accounts audited as per section 44AB. If your case falls under this category, you should opt for our Business ITR (Regular) plan.

I am an insurance agent and my gross receipts are Rs. 40 lakh. Am I eligible under the presumptive taxation scheme?

I am an insurance agent and my gross receipts are Rs. 40 lakh. Am I eligible under the presumptive taxation scheme?

There are certain businesses explicitly not allowed to claim the benefits under the scheme. They include:

- Any business involved in the renting, hire, or plying of goods carriages

- Any business related to agencies

- Individuals who receive commission or income related to brokerage

- Any individual involved in any profession mentioned under section 44AA(1)

- Insurance agents, since any income they receive is via commission

Can I file a revised return to correct a mistake in the original return filed?

Can I file a revised return to correct a mistake in the original return filed?

Yes, a return can be revised within a period of one year from the end of the relevant assessment year or before the completion of the assessment, whichever is earlier. Filing of a revised return is not part of the plan. The plan buyer is required to provide full and accurate details to avoid the need for any rectification in the originally filed return.

Am I required to keep a copy of the return filed as proof and for how long?

Am I required to keep a copy of the return filed as proof and for how long?

Yes, under the Income-tax Act, legal proceedings can be initiated up to 4 to 6 years (depending on the case) prior to the current financial year. However, in certain cases, the proceedings can be initiated even after 6 years, hence it is advised to preserve the copy of the return for at least 6 years or as long as possible.