Tax Filing for Securities Traders

Services Covered:

Services Covered:

Income Tax Return for Individuals: Trading in derivatives.

Income Tax Return for Individuals: Engaged in intraday trading.

Consolidation of Trading Statements: Across multiple platforms.

Prepare Account Summary: P&L and Balance Sheet (up to 100 entries per year).

Tax Return Preparation & Filing by Experts: Ensuring compliance and accuracy.

Business Hours Expert Support: Available via Email and Phone.

Excludes Tax Audit Fees: Tax audit fees are not covered.

Who Should Buy:

Who Should Buy:

Salaried Individuals having income or loss from F&O Trading or intraday equity trading.

Self-Employed traders who have income or loss from F&O Trading or intraday equity trading.

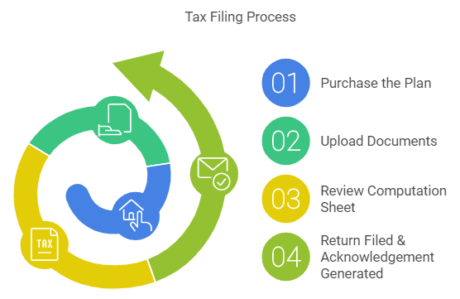

How it’s Done:

How it’s Done:

Documents to be Submitted:

Documents to be Submitted:

Form 16 from your company

Form 26AS Tax Credit Statement

Trading account statement from your broker

Bank statement if interest received is above Rs. 10,000

FAQs:

FAQs:

Who are the experts who’ll be filing my return?

Who are the experts who’ll be filing my return?

ProKhata taps into its expert network and connects you with a qualified CA. These experts bring a combined experience of 40 years in foreign taxation.

How to calculate Trading Turnover?

How to calculate Trading Turnover?

Turnover for Future and Options is the absolute value of each profit and loss trade during the year. For example, if you have a profit of Rs.1000 and a loss of 500 from F&O, the turnover is 1,500.

What are other requirements if I am under a tax audit?

What are other requirements if I am under a tax audit?

Apart from regular documents and the tax audit report, you would require a Class 2 Digital Signature for submitting your tax return.

What are the types of transactions under share trading and where are they reflected in the tax return?

What are the types of transactions under share trading and where are they reflected in the tax return?

Short Term and Long Term Capital Gains form part of Income under the Head Capital Gains, while trading in intra-day markets, F&O, Commodity, etc., falls under Income from Business and Profession.

What happens to the loss incurred in the Share Market?

What happens to the loss incurred in the Share Market?

Losses from shares in speculation business can be carried forward for 4 years, while all other losses can be carried forward for 8 years, provided the tax return is filed within the due date of the original tax return.

Do I have to provide login credentials to upload the audit report?

Do I have to provide login credentials to upload the audit report?

Yes, you will need to provide login credentials so that the expert can upload the audit report.