Do you have a passion for numbers and a determination to uncover financial fraud?

Forensic accounting is now an indispensable tool in the battle against the growing menace of financial fraud. If you’re looking for a challenging and rewarding career, starting a career in forensic accounting could be the perfect path for you.

Fraud and Forensic Accounting

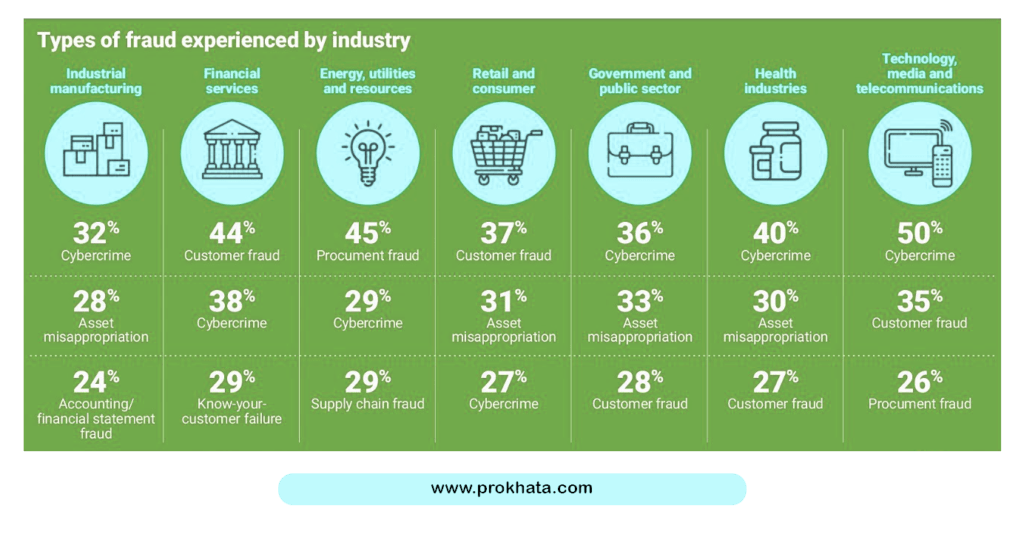

Fraud poses a challenge affecting both individuals and businesses alike. According to a report from the Association of Certified Fraud Examiners, organizations suffer losses equivalent to approximately 5% of their annual revenues due to fraud. Forensic accounting, a specialized field, plays a critical role in helping organizations investigate and prevent fraud. In cases involving fraud and embezzlement, forensic accounting is often employed to establish the foundation for legal proceedings. This process entails the meticulous tracking of financial transactions, conducting due diligence checks, and identifying assets. Forensic accounting encompasses a comprehensive review of financial records and operational aspects to uncover fraudulent activities. For example, a forensic accounting assignment may include tasks such as detecting discrepancies in inventory to uncover broader financial fraud or performing quantitative, cost, revenue analyses, and other investigative procedures.

It’s worth mentioning that forensic accounting and forensic audit are occasionally used interchangeably. Nevertheless, the globally recognized term is ‘forensic accounting.’ Additionally, forensic accounting sets itself apart from traditional auditing, fraud examination, and financial forensics in both scope and methodology. Throughout this article, we will consistently refer to experts in this field as forensic accountants.

Embarking on a career in forensic accounting offers a mix of challenges and rewards. In the upcoming sections, we will delve into the measures you can undertake to initiate your journey and thrive in this profession.

Academic Foundation and Credentials

Forensic accounting goes beyond just scrutinizing financial data; it involves a thorough examination of the inner workings of an organization. To uncover instances of fraud and embezzlement, forensic accountants receive training in auditing and analyzing financial records. If you’re interested in pursuing a career in forensic accounting, you should be aware of various academic prerequisites and certifications. Specialization in fields such as accounting, information systems, and legal aspects can prove particularly beneficial. Moreover, certifications offered by reputable institutions like the Institute of Chartered Accountants of India (ICAI), the American Institute of Certified Public Accountants (AICPA), and the Association of Certified Fraud Examiners (ACFE) in forensic accounting can enhance your professional profile and credibility. Certifications like Forensic Accounting and Fraud Detection (FAFD) from ICAI, Certified in Financial Forensics (CFF) from CPA-US, and Certified Fraud Examiner (CFE) from ACFE are some examples to consider. However, it’s important to note that these certifications don’t guarantee employment but serve as a means to showcase your expertise in the field, bolster your reputation, and distinguish yourself.

Mastering the Skillset: Achieving Excellence in Forensic Accounting

While effective communication and attention to detail are important attributes for professionals, the field of forensic accounting demands a distinctive skill set. Among these skills, one stands out: the ability to think creatively. Unlike conventional accounting, forensic accounting entails the examination and analysis of financial data to detect fraud, embezzlement, and other financial crimes. To excel in this arena, forensic accountants must exhibit creativity by employing techniques like lateral thinking, mind mapping, and brainstorming to uncover concealed evidence.

Lateral thinking plays a pivotal role in the toolkit of forensic accountants, enabling them to approach issues from various perspectives and devise innovative solutions. By breaking free from conventional thought patterns, forensic accountants can pinpoint the underlying causes of problems and devise more effective remedies. Mind mapping and brainstorming are also valuable methods that assist forensic accountants in organizing their thoughts, exploring fresh investigative avenues, and generating new ideas.

Additionally, forensic accountants can employ the reverse solution technique, which involves reverse-engineering the desired outcome to identify the necessary steps for achievement. Cross-fertilization is another method, merging seemingly unrelated ideas to produce innovative solutions. Problem switching entails examining a problem from a different angle to uncover novel solutions.

Armed with the right mindset and tools, forensic accountants can tackle challenges with creativity, revealing evidence that traditional approaches may overlook.

Preventative vs. Investigative Approaches in Forensic Accounting

Forensic accounting is a specialized field that leverages accounting, auditing, and investigative expertise to uncover and deter financial fraud. As discussed previously, forensic accountants must possess a distinct skill set, including analytical prowess, problem-solving abilities, and meticulous attention to detail, to excel in this discipline. Notably, the realm of forensic accounting can be classified into two primary categories: preventative and investigative.

1. Preventative Practice in Forensic Accounting

Preventative practices involve proactive measures taken before any instance of fraud occurs. Typically, these measures revolve around identifying and assessing potential fraud risks, as well as implementing safeguards to mitigate those risks. A common preventative practice is conducting a ‘fraud risk assessment,’ which entails scrutinizing the potential for fraud within a company’s operations, systems, and procedures. This goes beyond standard internal control assessments and contributes to the development of a comprehensive fraud prevention strategy.

Another crucial preventative practice entails establishing a framework that cultivates a culture of integrity and compliance within the organization. Additional services such as due diligence and background checks for borrowers or investors, bolstering cybersecurity measures, and enhancing system security fall under the preventative umbrella. These practices are accessible for newcomers in the field and can be proposed to existing clients.

For instance, consider this preventive action conducted by a forensic accountant:

A manufacturing company engaged a forensic accounting firm to evaluate its vulnerability to fraud. The firm conducted a thorough fraud risk assessment, which encompassed a review of the company’s internal controls, policies, and procedures. This assessment identified several weaknesses in the company’s systems, prompting recommendations for risk mitigation. The firm also provided employee training to heighten awareness of fraud risks and prevention. Subsequently, the company implemented the recommended changes, fortifying its defenses against potential fraud.

2. Detective Practice of Forensic Accounting

Conversely, investigative practices are reactive measures taken after a fraud incident has transpired. These activities encompass probing the fraud, identifying culprits, amassing evidence for legal proceedings, and subsequent actions like post-fraud investigations, evidence discovery, quantification, reporting, and court testimony. Expertise is paramount in these detective practices, and clients often prefer experienced professionals due to the time-sensitive nature of the work and the need for extensive knowledge. Hence, larger firms tend to be favored over individual practitioners.

An Illustrative Detective Task for a Forensic Accountant

In a specific case, a bank grew suspicious of one of its employees and their alleged involvement in a fraudulent scheme. To delve into the matter, the bank enlisted the services of a forensic accounting firm. The firm initiated a comprehensive investigation, comprising a meticulous examination of the employee’s financial transactions and interviews with the employee and relevant stakeholders. As a result of this investigation, it came to light that the employee had indeed been embezzling funds from the bank. The forensic accounting firm quantified the extent of the financial loss and presented compelling evidence in support of the bank’s case. Consequently, the employee faced termination, and the bank successfully recouped a portion of the misappropriated funds.

Other forensic accounting services that a professional can offer are:

· Fraud risk assessment for an organisation

· Incidence reporting

· Developing whistleblowing policies

· Bankruptcy forensics

· Bank loan forensics

· Market research forensics

· Pre-placement due diligence

· Actual income profiling, etc.

It is always better to build a team for a full-fledged practice as it provides the necessary support and expertise required to handle complex cases. Starting a forensic accounting practice requires a combination of skills, experience, and an understanding of the different areas of practice. By focusing on preventive practices initially and building a strong team of experienced professionals, one can succeed in the field of forensic accounting. Finally, it is important to understand where you stand as a professional and grow further.

Here are 7 Strategies to Build a Strong Reputation as a Forensic Accountant

Find your niche.

Build your network.

Develop your skillset.

Be tech-savvy.

Develop your service offerings.

Identify your target market.

Establish your brand.

Every great accomplishment begins with a single step. Starting your own forensic practice may seem daunting but remember that even the most successful professionals started as amateurs. Above all, integrity should be your strong suit as a forensic accountant. It is the foundation of trust, credibility, and professionalism that clients expect from you in this field.

1 responses on "Start Your Forensic Accounting Practice: Pathways to Excellence"