Each year, Warren Buffett writes an open letter to Berkshire Hathaway shareholders. Over the last 40 years, these letters have become an annual required read across the investing world, providing insight into how Buffett and his team think about everything from investment strategy to stock ownership to company culture, and more.

At the age of 26, a Nebraska stockbroker and school teacher named Warren Buffett took his “retirement fund” of $174,000 and decided to start his own investment business.

Two decades later, he was a billionaire.

Today, the “Oracle of Omaha” has a net worth of around $85B — making him the fourth wealthiest person in the United States after Jeff Bezos (another CEO known for his shareholder letters, Bill Gates, and Mark Zuckerberg. Berkshire Hathaway, Buffett’s firm, has the most expensive share price of any company in history, with each Class A share costing upwards of $330,000.

Berkshire Hathaway’s fundamental strategy has been to identify valuable companies and then acquire increasingly large portions of them.

Among its most valuable holdings are its stakes in juggernauts of the American economy like Coca-Cola (9.3% stake) and Apple (5.4%) — its most valuable stake, with a market value of more than $120B.

Berkshire Hathaway also owns just under 19% of American Express, 11.9% of Bank of America, and 9.8% of US Bancorp. It has purchased controlling stakes in some 60 companies, including well-known brands like GEICO, Dairy Queen, and Fruit of the Loom.

Berkshire Hathaway’s portfolio is also full of more obscure successes too, like See’s Candy, which Buffett calls his “dream business.” Buffett bought See’s Candy for $25M in 1972, and by 2019, it had brought in “well over” $2B — a nearly 8,000x return.

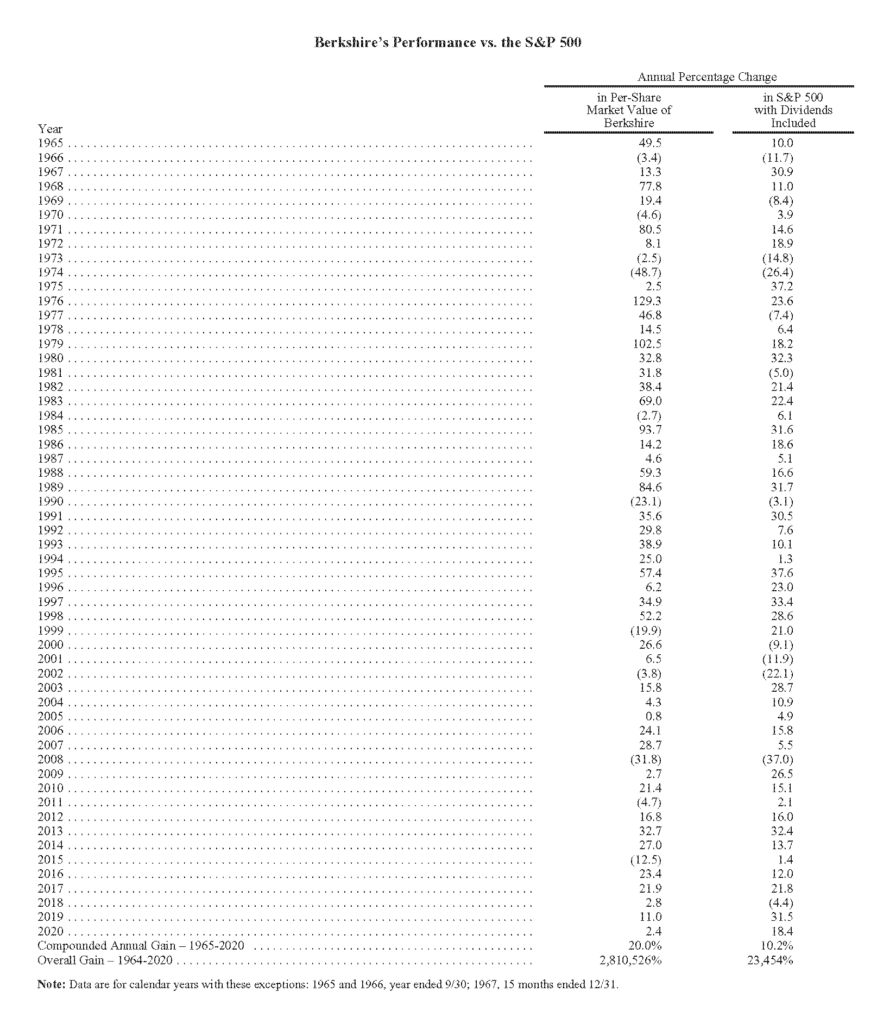

Investors in Berkshire Hathaway have done well too. Since 1965, the price of Berkshire’s Class A stock has increased by more than 2,800,000%. That’s compared to a roughly 23,000% increase in the overall gain of the S&P 500 over the same period.

It’s no wonder Buffett publishes an updated table of Berkshire’s per-share performance alongside the stock index at the beginning of each year’s shareholder letter, which has become an annual event in the world of business and finance.

Beyond some tremendous wins, Buffett himself is in some ways another quiet success. He preaches the importance of fiscal responsibility, and he still lives in the house he bought in Omaha for $31,500 in 1958. He eats at McDonald’s and drinks “at least five 12-ounce servings” of Coca-Cola every day.

This down-to-earth quality comes through in Buffett’s letters, too. In between accounts of Berkshire’s current holdings, he tells jokes, shares anecdotes, and relates quippy aphorisms to help illuminate his core points.

He mocks himself for making mistakes, and sings the praises of Berkshire’s army of CEO-managers. He offers an investment philosophy grounded not in complicated financial analysis, but often in common sense evaluations of what a particular company is worth.

The result is an eminently quotable collection of homespun investing wisdom:

- “Price is what you pay, value is what you get.” (2008)

- “For investors as a whole, returns decrease as motion increases.” (2005)

- “Be fearful when others are greedy and greedy only when others are fearful.” (2004)

- “You only find out who is swimming naked when the tide goes out.” (2001)

Below, we unpack 28 of the most important lessons from the last four decades of Berkshire Hathaway’s shareholder letters.

Together, they form a compendium of the beliefs and advice of the man widely regarded to be the greatest investor in history.

TABLE OF CONTENTS

- Executive compensation

- Executives should only eat what they kill

- Don’t give your executives stock options as compensation

- Stock ownership

- Buy stock as an owner, not a speculator

- Don’t ignore the value of intangible assets

- Conglomerates earned their terrible reputation

- Market volatility

- Ignore short-term movements in stock prices

- Be fearful when others are greedy, and greedy when others are fearful

- Save your money in peacetime so you can buy more during war

- Investment strategy

- Look for companies that reinvest their earnings into growth

- Don’t invest in businesses that are too complex to fully understand

- Invest in unsexy companies that build products people need

- Stock buybacks are often the best use of corporate cash

- Asset-heavy companies can be good investments

- Value investing

- Never invest because you think a company is a bargain

- Don’t invest only because you expect a company to grow

- Never use your own stock to make acquisitions

- Global economics

- America is not in decline — it’s becoming more and more efficient

- Current board of director incentives are broken and backwards

- Management

- Embrace the virtue of sloth

- Time is the friend of the wonderful business, the enemy of the mediocre

- Complex financial instruments are dangerous liabilities

- Investment banker incentives are usually not your incentives

- Company culture

- Leaders should live the way they want their employees to live

- Hire people who have no need to work again in their lives

- Compensation committees have sent CEO pay out of control

- Debt

- Never use borrowed money to buy stocks

- Borrow money when it’s cheap

- Raising debt is like playing Russian Roulette

- Links to every Berkshire Hathaway shareholder letter

Executive compensation

1. Executives should only eat what they kill

In 1991, Berkshire Hathaway acquired the H. H. Brown Shoe Company, at the time the leading manufacturer of work shoes in North America. In his shareholder letter that year, Buffett talked about a few of the reasons why.

While Buffett recognized that shoes were a tough industry, he liked that H. H. Brown was profitable. He liked that the company’s CEO, Frank Rooney, would be staying on. And he definitely liked the company’s “most unusual” executive compensation plan, which he wrote, “warms my heart.”

At H. H. Brown, instead of managers getting stock options or guaranteed bonuses, every manager got paid $7,800 a year (the equivalent of about $14,500 today), plus “a designated percentage of the profits of the company after these are reduced by a charge for capital employed.”

Each manager, in other words, received a portion of the company’s profits minusthe amount that they spent, in terms of capital, to generate those profits. The result was that each manager at H. H. Brown had to “stand in the shoes of owners” and truly weigh whether the cost of a project was worth the potential results.

Buffett is a strong believer in this kind of “eat what you kill” philosophy of executive compensation.

In 2014, Buffett successfully lobbied the leadership of Coca-Cola — the largest position in Buffett’s portfolio at the time, with his ownership share coming in at 6.2% — to cut back on “excessive” executive compensation plans. Image source: ValueWalk

For Buffett, executive bonuses can work to motivate people to go above and beyond, but only when they’re closely tied to personal success in places within an organization where an executive has responsibility.

Too often, for Buffett, executive compensation plans impotently reward managers for nothing more than their firm’s earnings increasing or a stock price rising — outcomes for which the conditions were often created by a previous manager.

“At Berkshire… we use an incentive-compensation system that rewards key managers for meeting targets in their own bailiwicks,” Buffett wrote in his 1985 letter. “We believe good unit performance should be rewarded whether Berkshire stock rises, falls, or stays even. Similarly, we think average performance should earn no special rewards even if our stock should soar.”

At Berkshire Hathaway, Buffett enforces an individualized system of compensation that rewards managers for their personal actions — even if that means, counterintuitively, rewarding managers of individual units when the wider business doesn’t do well.

2. Don’t give your executives stock options as compensation

In 2000, the dotcom bubble burst. Across the world, companies shuttered their doors and investors lost thousands or even millions on their holdings.

At the same time, many executives at companies that had failed or suffered huge losses (and whose shareholders had suffered in turn) received record levels of compensation.

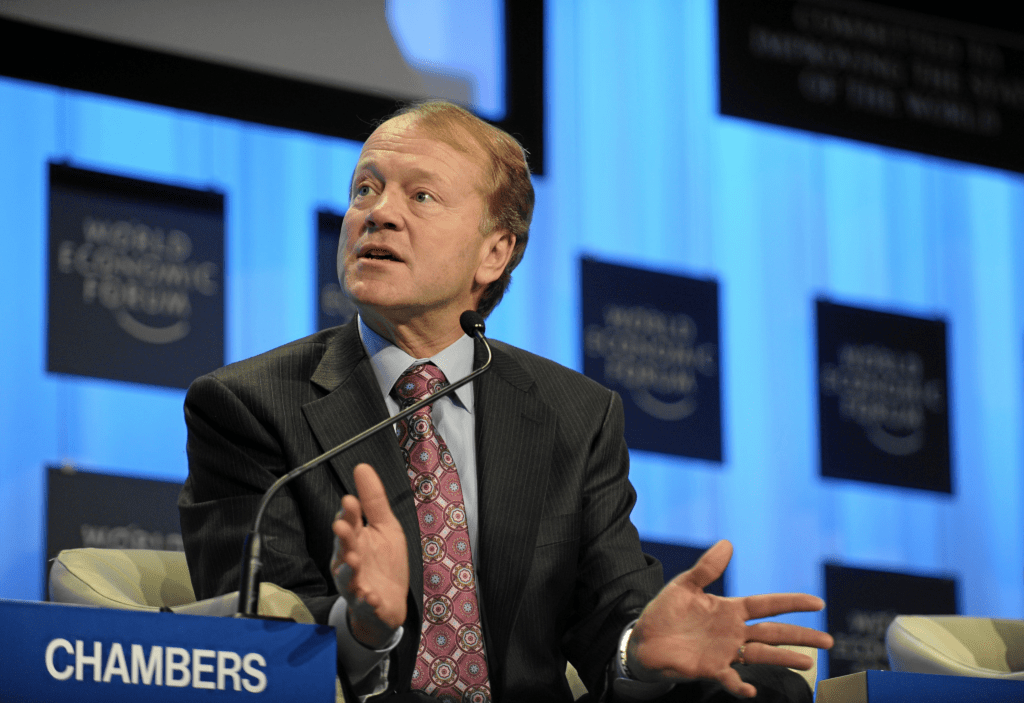

In spring 2001, Cisco’s shareholders had lost a total of 28.6% on their investment — yet CEO John Chambers took home $157M, mostly on his stock options (about $330,000 of that total consisted of direct, cash compensation).

At AOL, where shareholders had lost a total of 54.1%, CEO Steve Case came out with compensation totaling $164M. Again and again, at companies like Citigroup, Tyco, CMGI and others, CEOs made hundreds of millions while their shareholders faced heavy losses.

John Chambers, the former CEO of Cisco, at Davos in 2010. Image source: World Economic Forum

Buffett excoriated these leaders in his 2001 letter to shareholders.

“Charlie [Munger, Berkshire Hathaway vice chairman] and I are disgusted by the situation, so common in the last few years, in which shareholders have suffered billions in losses while the CEOs, promoters, and other higher-ups who fathered these disasters have walked away with extraordinary wealth.”

Buffett has several issues with the practice of CEOs granting themselves stock options as compensation.

First, there’s the problem of dilution. New options grants increase the number of shares of a company, diluting the existing pool of shareholders and reducing the value of shareholders’ current holdings. That means Buffett’s share of that company is worth less than it was before — contrary to Buffett’s beliefs that managers should work to increase the value of his share of the company, not decrease it.

Then there’s the corporate malfeasance possible when executives with a better understanding of their company’s value (or lack thereof) can leverage their own options into undeserved wealth.

Buffett writes, “Many of these [CEOs] were urging investors to buy shares while concurrently dumping their own, sometimes using methods that hid their actions. To their shame, these business leaders view shareholders as patsies, not partners.”

Lastly, options plans often allow firms to give their employees massive amounts of compensation without ever accounting for that compensation properly. Companies spending hundreds of millions giving unrestricted stock units to their employees can do deceptively, without reporting that cost to shareholders. In his 2018 letter, Buffett wrote,

“Managements sometimes assert that their company’s stock-based compensation shouldn’t be counted as an expense. What else could it be — a gift from shareholders?”

As far as his own company, Berkshire Hathaway, Buffett sticks to a ground rule he set down in 1956. As he wrote in 2001, his promise to his shareholders is that neither he nor his Vice Chairman Charlie Munger will take any “cash compensation, restricted stock or option grants that would make our results superior to yours.”

He adds: “Additionally, I will keep well over 99% of my net worth in Berkshire. My wife and I have never sold a share nor do we intend to.”

Stock ownership

3. Buy stock as an owner, not a speculator

When many investors buy stock, they become price-obsessed, constantly checking the ticker to see if they’re up or down money on any given day.

From Buffett’s perspective, buying a stock should follow the same kind of rigorous analysis as buying a business. “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes,” he wrote in his 1996 letter.

Rather than getting too caught up in the price or recent movement of a stock, Buffett says, buy from companies that make great products, that have strong competitive advantages, and that can provide you with consistent returns over the long term.

In short, buy stock in businesses that you would like to own yourself.

“Whenever Charlie and I buy common stocks for Berkshire’s insurance companies… we approach the transaction as if we were buying into a private business,” he wrote in his 1987 letter, “We look at the economic prospects of the business, the people in charge of running it, and the price we must pay. We do not have in mind any time or price for sale.”

Take his investment in (and later acquisition of) the auto insurer GEICO — an acquisition that has been called Buffett’s best ever.

GEICO represented everything Buffett was looking for as an investor. It had a great brand. It had a strong management team that he trusted. And when he first visited the company’s headquarters in 1951, he saw “the huge cost advantage the company enjoyed over the giants of the industry.” The combination of all these factors “set his heart afire.”

In 1951, Buffett made the decision to invest more half of his net worth in GEICO. He increased his holdings dramatically during the bear market of the mid-70s when GEICO was struggling. By 1995, he owned half of the company — and later that year, he arranged to buy the rest.

Warren Buffett admired Lou Simpson, the CIO of Geico from 1979 to 2010, so much that he once said that he would feel comfortable having Simpson replace him at Berkshire Hathaway. Image source: Wikipedia

“We agreed to pay $2.3 billion for the half of the company we didn’t own. That is a steep price. But it gives us full ownership of a growing enterprise whose business remains exceptional for precisely the same reasons that prevailed in 1951,” Buffett wrote in his 1995 letter.

Perhaps no other investment better represents Buffett’s ideal as this 50-year investment in GEICO.

Buffett concedes that those who invest in companies on the speculation that they may one day be worthwhile could reap returns — he just has no interest in that kind of investment. He prefers to invest in companies that are already successful (even if that success is undervalued by the market) and that have a strong chance of continuing success over the long term.

That conviction gives him the ability to buy even bigger portions of the companies in which he invests when the overall market goes into a downturn. With a speculator mentality, Buffett might have offloaded GEICO’s stock in the mid-70s. With a downturn in progress and healthy gains already realized, he would have come out ahead. With his owner mentality, however, Buffett used the downturn as an opportunity to amass an even greater share of the company.

In 2013, Buffett reported that GEICO had generated $73B for Berkshire Hathaway in one year — not a bad single-year return for a company that Buffett took over for $2.3B.

4. Don’t ignore the value of intangible assets

Companies have both tangible assets (factories, capital, inventory) and intangible assets, which include things like reputation and brand. For Buffett, those intangible things are of the utmost importance for value-driven investors.

But he didn’t always believe that.

Earlier in his investing career, he admits, he was a servant of tangible assets only.

“I was taught to favor tangible assets and to shun businesses whose value depended largely upon economic Goodwill,” he wrote in 1983. “This bias caused me to make many important business mistakes of omission, although relatively few of commission.”

By 1983, however, Buffett’s attitude had changed — largely because of the success of one of his favorite businesses at the time, See’s Candy Stores.

In the early 70s, See’s was able to produce about $2M a year (after tax) on just $8M in net tangible assets (including all accounts receivable.) For a shop chain like See’s, that far exceeded expectations — and the reason for it, according to Buffett, was that the company enjoyed a subjective competitive advantage in the form of “a pervasive favorable reputation with consumers based upon countless pleasant experiences they have had with both product and personnel.”

Berkshire Hathaway bought See’s, and by 1982, it was up to producing $13M after taxes on just $20M in net tangible assets.

When Berkshire Hathaway or anyone else buys a company, they pay a premium for the company’s subjective assets. That premium is the company’s “economic goodwill.”

When Berkshire first acquired See’s, they paid a small multiple to account for the fact that See’s was able to earn 25% of net tangible assets after tax — an impressive rate of return for a candy business. A few years later, however, See’s was earning 65% of its net tangible assets after tax.

Berkshire had paid a small premium upon acquisition to account for the company’s subjective advantage over other candy stores, but just a couple years later, that advantage had increased and made See’s an even more robust and profitable business. And this was an advantage that Buffett was beginning to see was inflation-proof.

During inflation, the conventional wisdom has been that businesses with lots of tangible capital resources were the best bets. With their factories and machinery, the thinking went, they could better weather the market impact of widespread lower purchasing power and higher costs.

However, Buffett found that “asset-heavy businesses generally earn lower rates of return… that often barely provide enough capital to fund the inflationary needs of existing businesses.”

Because of the success of See’s, Buffett realized that companies with relatively few tangible assets and “combined intangibles of lasting value” ultimately do best in an inflationary environment, because they have less costs to cover and higher rates of return on their existing capital.

“During inflation, Goodwill is the gift that keeps giving,” he concludes.

5. Conglomerates earned their terrible reputation

Conglomerates are corporations made up of multiple different businesses. According to Buffett, the term — which carries a negative connotation — has often been applied to Berkshire.

However, he argues that defining Berkshire as a conglomerate is only partially correct. And in his 2020 letter, Buffett goes on to explain that “conglomerates earned their terrible reputation” and why owning stocks in these businesses may not be the best investment strategy.

For one, conglomerates tend to buy companies in their entirety. But this approach leads to two problems. One, great businesses have “no interest in having anyone take them over,” says Buffett. And conglomerates then have to focus on mediocre companies that often lack competitive strengths.

The second problem is that gaining a controlling ownership in a company often requires paying an above-the-market share price, known as a control premium. To solve this problem, conglomerates often manufactured the overvaluation of their stocks. They then used these stocks to fund acquisitions in a manner that Buffett explains as, “I’ll pay you $10,000 for your dog by giving you two of my $5,000 cats.” But techniques and accounting maneuvers conglomerates used to overvalue stocks were often deceptive and sometimes even fraudulent.

Eventually, the illusion of investment success fades away. Conglomerates, once hailed by analysts, journalists, and bankers as business miracles, fall apart, and investors lose their money.

To avoid this outcome, Berkshire deploys a different strategy. This investment powerhouse has stakes in both controlled and non-controlled companies. Buffett says that “owning a non-controlling portion of a wonderful business is more profitable, more enjoyable and far less work than struggling with 100% of a marginal enterprise.”

Market volatility

6. Ignore short-term movements in stock prices

For the layman stock investor, the price is everything — buy low, sell high. There’s even a Wall Street proverb to this effect: “you can’t go broke taking a profit.”

Buffett disagrees completely with this approach, and he ranks this maxim as perhaps the “most foolish” of all of Wall Street’s sayings. And with Berkshire’s portfolio, he is adamant that the price of a stock is one of the least important factors to consider when deciding whether to buy or sell shares in a particular company.

The company’s operations and underlying value are the only things that matters, to Buffett. That’s because the price of a stock, on any given day, is mostly dictated by the whims of “Mr. Market” (Buffett’s metaphor for the mercurial movements of the broader stock market).

“Without fail, Mr. Market appears daily and names a price at which he will either buy your interest or sell you his… Sad to say, the poor fellow has incurable emotional problems,” Buffett wrote in his 1987 letter.

For Buffett, investors succeed when they can ignore Mr. Market and his up-and-down emotional states. Instead, they look at whether the companies that they’re invested in are profitable, returning dividends to investors, maintaining high product quality, and so on.

Eventually, Buffett says, the market will catch up and reward those companies.

“In the short run, the market is a voting machine,” he writes, quoting Benjamin Graham, “But in the long run it is a weighing machine.”

7. Be fearful when others are greedy, and greedy when others are fearful

In the aftermath of the 2007-2008 financial crisis, few economic dogmas were hit harder than the efficient markets hypothesis, or the idea that the price of an asset reflects the market’s rational assessment of available information about it.

When it became clear that executives at some of the biggest banks on earth systematically underestimated the risks inherent to the assets they were trading in, it became difficult to defend the idea that prices were truly ever set rationally.

In the aftermath of the crisis, retail and institutional investors offloaded massive numbers of stocks in businesses weak and strong. Buffett, however, went on a personal buying spree, even penning an impassioned New York Times op-ed titled “Buy American” about the billions he had spent buying up marked-down stock.

Buffett is a moderate on the question of efficient markets and rational actors. Reflecting on the financial crisis, its consequences, and his profits from it, he wrote in 2017,

“Though markets are generally rational, they occasionally do crazy things. Seizing the opportunities then offered does not require great intelligence, a degree in economics or a familiarity with Wall Street jargon.”

Buffett believes that markets are generally efficient. That’s why he generally advises against bargain-hunting or “timing” your entry into a market: because trying to outsmart the wisdom of the crowd that sets prices is virtually impossible.

Buffett also believes that there are world-historical phases where all of that goes out the window — natural disasters, crashes, and other moments where emotions take over and rationalism flies out the window. He goes on,

“What investors then need instead is an ability to both disregard mob fears or enthusiasms and to focus on a few simple fundamentals. A willingness to look unimaginative for a sustained period – or even to look foolish – is also essential.”

In uncertain or chaotic times, Buffett believes that savvy investors should continue looking at the fundamental value of companies, seeking companies that able to sustain their competitive advantage for a long time, and investing with an owner’s mentality. If investors can do that, they’ll naturally tend to go in the opposite direction of the herd — to “be fearful when others are greedy and greedy only when others are fearful,” as he wrote in 2004.

His reasoning is simple: when others are fearful, prices go down, but prices are only likely to remain low in the short term. In the long term, Buffett is bullish on any business that creates great products, has great management, and offers great competitive advantages.

By piling cash into distressed American companies like General Electric, Goldman Sachs, and Bank of America during the 2008 financial crisis, Buffett reportedly made $10B by 2013.

8. Save your money in peacetime so you can buy more during war

In 1973, Buffett made one of his most successful investments ever in the Washington Post.

At the time, the Post was widely regarded to have a value somewhere between $400M and $500M — though its stock ticker put it at only $100M. That was, for Buffett, a signal to buy. For just $10M, he was able to acquire more than 1.7M shares.

The underlying philosophy here is simple: hold onto your money when money is cheap, and spend aggressively when money is expensive.

In 1973, the country was still in the grips of a stock market crash that had begun in January. That slow-motion crash created a two-year-long bear market — the Dow Jones began 1973 at 1020 and was at 616 by the end of 1974. Shares of Coca-Cola, one of Buffett’s major stocks, plummeted from $149.75 to $44.50. Across the board, companies whose fundamentals had not changed were dramatically, in Buffett’s estimation, underpriced.

1973 marked the beginning of one of the biggest stock market downturns in history, particularly in the UK. Image source: Paul Townsend

The Washington Post’s stock suffered too, even after Buffett’s acquisition. After the end of 1974, the Post had officially been a loser for Berkshire Hathaway, falling from a value of $10.6M to $8M. But Buffett had a conviction the company’s fortunes would turn, and he knew he had picked up the company at a great price, despite the fact that it had fallen even more.

By the time Jeff Bezos acquired the paper in 2013, Buffett’s 1.7M share stake was worth about $1B — a more than 9,000% return.

“Every decade or so, dark clouds will fill the economic skies, and they will briefly rain gold,” Buffett wrote in 2016. “When downpours of that sort occur, it’s imperative that we rush outdoors carrying washtubs, not teaspoons.”

Investment strategy

9. Look for companies that reinvest their earnings into growth

Warren Buffett is well known for his love of companies that pay dividends, and Berkshire Hathaway has profited greatly from companies making payouts to their shareholders. In his 2019 shareholder letter, Buffett reported that Berkshire Hathaway’s top 10 stock investments had generated almost $3.8B in dividends over the previous year.

However, perhaps even more than paying dividends, Buffett values the corporate practice of reinvesting profits into growth.

Among those top 10 Berkshire Hathaway companies, the amount of earnings that are retained and reinvested is more than double the size of the earnings being paid out as dividends.

Over 2019, the value of Berkshire Hathaway’s “share” of earnings from those companies — including Apple, Coca-Cola, and American Express — amounted to more than $8.3B.

As Buffett notes in his 2019 letter, the value of retained earnings wasn’t always accepted among American investors. It wasn’t until 1924 that John Maynard Keynes wrote about the power of companies not giving to shareholders “the whole of their earned profits,” but instead retaining a part to put back into the business, thus creating “an element of compound interest operating in favour of a sound industrial investment.”

John Maynard Keynes. Image source: Foundation for Economic Education (FEE)

Today, this idea has become core to how Berkshire Hathaway operates. “At Berkshire, Charlie and I have long focused on using retained earnings advantageously,” Buffett writes.

His conviction about the power of retained earnings comes from his related conviction that the companies Berkshire invests in must share three properties:

- They earn “good returns on the net tangible capital required in their operation”

- They are run by “able and honest managers”

- They are available “at a sensible price”

When companies are priced well, run well, and return capital well, it is Buffett’s belief that they should be encouraged to reinvest their profits, not just throw cash to shareholders in the form of dividends.

Sometimes that means investing into new factories and growth, but it can also mean buying back stock, which Buffett also likes, as it “enlarges Berkshire’s share of the company’s future earnings.” Even if that doesn’t work out in the short term, Buffett thinks that over the long term, investing back into the company is generally the right strategy:

“Sometimes, alas, retentions produce nothing… It is certain that Berkshire’s rewards from these 10 companies, as well as those from our many other equity holdings, will manifest themselves in a highly irregular manner… Overall, the retained earnings of our investees are certain to be of major importance in the growth of Berkshire’s value.”

10. Don’t invest in businesses that are too complex to fully understand

When Berkshire Hathaway announced that it was taking a $1B stake in Apple in 2016, it surprised many of the company’s long-time observers — not because of Apple’s business model or stock price, but because Buffett had long claimed to have “insufficient understanding” of technology to invest in tech companies.

They were right to be suspicious: a few weeks later, Buffett confirmed that it was one of his recent manager hires who had pulled the trigger on the deal.

In his 1986 letter to shareholders, Buffett laid out the different aspects he and Munger were looking for in new companies, including “simple businesses.” He even went so far as to say that “if there’s lots of technology, we won’t understand it.”

More specifically, Buffett’s model states that it’s inadvisable to invest in a business where you cannot predict whether the company will have a long-term (20+ years or more) competitive advantage.

In his 2007 letter, Buffett expands on his thinking about which kinds of businesses he prefers to invest in. “A truly great business must have an enduring ‘moat’ that protects excellent returns on invested capital,” he writes, “The dynamics of capitalism guarantee that competitors will repeatedly assault any business ‘castle’ that is earning high returns.”

When Buffett invests, he is not looking at the innovative potential of the company or, in a vacuum, its growth potential. He is looking for a competitive advantage.

“The key to investing is not assessing how much an industry is going to affect society, or how much it will grow,” he writes “But rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”

In 1999, when Wall Street analysts were extolling the virtues of virtually every dotcom stock on the market, Buffett was seeing a repeat of an earlier time: the invention of the automobile.

When the car was first invented, a naïve investor might have thought that virtually every automobile stock was guaranteed to succeed. At one point, there were 2,000 separate car brands just in the US. Of course, those didn’t all last.

“If you had foreseen, in the early days of cars, how this industry would develop, you would have said, ‘Here is the road to riches,’” Buffett writes. “So what did we progress to by the 1990s?” he asks. “After corporate carnage that never let up, we came down to three US car companies.”

He observes that the airplane industry suffered similarly. While the technological innovation was even more impressive than the car, the industry as a whole could be said to have failed most of its investors. By 1992, the collection of all airline companies produced in the US had produced a total of no profits whatsoever.

His conclusion about dotcom stocks at the time was simple: there will be a few winners, and an overwhelming majority of losers.

Correctly picking the winners requires understanding which companies are building a competitive advantage that will be defensible over the very long term. During the dotcom boom, that meant understanding how the infrastructure of the web would change over the next several decades — an impossible task for any observer at the time.

Buffett prefers to keep it simple, as he makes clear in his 1996 letter.

“Your goal as an investor should simply be to purchase, at a rational price, a part interest in an easily-understandable business whose earnings are virtually certain to be materially higher five, ten, and twenty years from now.”

As for his lieutenants: Buffett hired Todd Combs and Ted Weschler in 2016, and allowed them to take positions without consulting with him beforehand. While Buffett himself may not feel comfortable taking a position in a company like Apple, he concedes that others might have stronger convictions about the future potential of an investment like that.

11. Invest in unsexy companies that build products people need

In his 1996 letter to shareholders, Buffett recounts Coca-Cola’s 1896 shareholder report, admiring how the company had set — and closely followed — its 100-year growth plan, while the core product of the company had not changed at all.

Buffett uses the example of Coca-Cola to explain one of the biggest tenets of his and Charlie Munger’s investing philosophy: invest in boring companies that are likely to be around for a long time, and avoid investing in anything innovative or revolutionary, no matter the returns you think it might achieve.Coca-Cola’s product has not changed in any meaningful way in over 100 years — just the way that Buffett, as both an investor and as a consumer, likes it.“I should emphasize that, as citizens, Charlie and I welcome change: fresh ideas, new products, innovative processes and the like cause our country’s standard of living to rise, and that’s clearly good,” Buffett states in his 1996 letter.

“As investors, however, our reaction to a fermenting industry is much like our attitude toward space exploration. We applaud the endeavor but prefer to skip the ride.”

Buffett goes on to discuss the Berkshire portfolio, which he says features all companies where he and Munger do not expect the underlying industries to change in a major way.

Wells Fargo, American Express, Walt Disney, Dairy Queen, Duracell — Buffett’s portfolio looks to some investors like a safe and generic mix, but it is rooted in a philosophy of long-term success.

“We are searching for operations that we believe are virtually certain to possess enormous competitive strength ten or twenty years from now,” he writes, “A fast-changing industry environment may offer the chance for huge wins, but it precludes the certainty we seek.”

This isn’t just Buffett’s philosophy, either. It’s been the philosophy behind some of his favorite companies, including Coca-Cola.

When Coca-Cola first started, it was turning something relatively cheap to produce — syrup — into a branded product. Over 100+ years, that brand has grown to encompass a broad range of human emotions and aspirations.

“‘Buy commodities, sell brands has long been a formula for business success. It has produced enormous and sustained profits for Coca-Cola since 1886,” he wrote in his 2011 letter.

Just as Coca-Cola built an empire buying syrup and selling a lifestyle, Buffett has made Berkshire Hathaway an empire by buying boring companies and selling their ever-returning dividends.

12. Stock buybacks are often the best use of corporate cash

Since Apple first began buying back its own stock in 2012, it has become one of most prolific stock repurchasers in history.

In H1’18, Apple set a record with $43.5B of stock buybacks. In May, it announced an additional $100B would be spent buying back Apple stock.

Some claimed the company lacked imagination and simply couldn’t figure out a more productive way to spend those billions.

One might expect a figure like Buffett — simple, no nonsense, and focused on intrinsic value — to balk at the energetic spending of capital on stock repurchases. Instead, he was delighted, especially by the idea that his 5% stake in the company might be able to grow to 6% or 7% simply because the company chose to buy back some of its stock.

Buffett is a bigger advocate of buybacks than many other investors and neutral observers of the stock market. At Berkshire Hathaway’s 2004 meeting, he claimed that “when stock can be bought below a business’s value, it is probably the best use of cash” for a company.

Apple headquarters in Cupertino. Apple’s $100B buyback plan, announced in spring 2018, made it the most prolific stock repurchaser in history. Image source: Wikipedia

The classic criticism of buybacks is that firms are spending money that should be spend on R&D and product improvement to buy back their own stock and boost the stock’s price — an artificial improvement to the ticker that doesn’t reflect an intrinsic increase in the value of the business.

While Buffett does disagree with executives who buy back their company’s shares simply because they have the cash to do it or to inflate earnings, he also believes in buying stocks when they’re underpriced.

When a company buys back its own stock because it sees that it is underpriced (according to the company’s estimation of its intrinsic value), it increases the ownership share of every shareholder in a way that Buffett likes:

“If Charlie and I think an investee’s stock is underpriced, we rejoice when management employs some of its earnings to increase Berkshire’s ownership percentage,” he wrote in his 2018 letter.

But when a company buys back its own stock while it is priced at or above the stock’s intrinsic value, the company is by definition overpaying. And a company that is in the habit of overpaying for anything — be it stock buybacks or new acquisitions — is not a good hold for a careful shareholder.

“Buying dollar bills for $1.10 is not good business for those who stick around,” Buffett wrote in 1999.

The most common culprits, for Buffett, are the kinds of executives who determine that they’re going to buy a certain amount of stock over a certain period of time.

For Buffett, there’s no difference between a CEO announcing this kind of stock repurchasing plan and a retail investor saying, “No matter the price, I will buy ‘X’ shares of Berkshire Hathaway over the next ‘Y’ months”— an investment strategy even he would deem incredibly foolish.

For Buffett, it is always “buy when it’s cheap” — never “buy just because.”

Buffett followed up on his buybacks strategy in 2020 as well. Berkshire spent $24.7B to buy back its own stock, the equivalent of 80,998 “A” shares.

That action “increased your ownership in all of Berkshire’s businesses by 5.2% without requiring you to so much as touch your wallet,” wrote Buffett to shareholders in his 2020 letter. And as Berkshire keeps repurchasing more of its shares, its shareholders will indirectly increase their ownership in Apple, BNSF, BHE, and other Berkshire-owned businesses.

13. Asset-heavy companies can be good investments

Buffett’s long-standing belief is that companies that run high-margin operations, require minimal assets, and can expand sales volume with little-to-no extra capital yield the best results.

But there are only so many companies that fit these three criteria.

No surprise, then, that Berkshire, as Buffett revealed in his 2020 letter, owns $154B worth of US-based property, equipment, and plants — more than any other American company.

He argues that asset-heavy companies “can be good investments,” with the Burlington Northern Santa Fe Railway (BNSF) and Berkshire Hathaway Energy (BHE) as prime examples. These two Berkshire-owned companies had combined earnings of $8.3B in 2020.

Buffett explains why investments in BNSF and BHE make sense. From 2010 to 2020, BNSF paid $41.8B in dividends to Berkshire, despite investing $41B in fixed assets. But the railroad company pays only what remains after it covers its needs and maintains a $2B cash balance. “This conservative policy allows BNSF to borrow at low rates, independent of any guarantee of its debt by Berkshire,” says Buffett.

Nevada Energy (a subsidiary of BHE) completed the 231-mile One Nevada Transmission Line in 2013, enabling the development of renewable energy projects in remote areas of the state. Image source: Las Vegas Review-Journal

BHE, however, has been paying no dividends on its common stock for the past 21 years. This electric-utility company is channeling all of its earnings into modernizing and expanding the outdated grid. These years-long investments are vital to ensure that electricity, produced by wind and solar sources in remote areas, can reach densely populated areas in the western US. Once completed, the modernized infrastructure will enable BHE to increase revenue and even start paying dividends.

Investing in asset-heavy companies is a long-term game. But Buffett welcomes it and says, “Though it will be many years before our western transmission project is completed, we are today searching for other projects of similar size to take on.”

Value investing

14. Never invest because you think a company is a bargain

Buffett’s distrust of bargains comes mostly from a series of poor acquisitions and investments he made early on in the life of Berkshire Hathaway.

One striking example that he discusses at length in his 1979 letter to shareholders is that of Waumbec Mills in Manchester, New Hampshire.

Buffett decided to purchase Waumbec Mills a few years prior because the business was priced so low — in fact, the price was below the working capital of the business itself, meaning Buffett acquired “very substantial amounts of machinery and real estate for less than nothing,” as he wrote in 1979.

It was, by all accounts, an incredible deal. But despite the appealing nature of the deal, the acquisition still turned out to be a mistake for Berkshire Hathaway. No matter how hard the company worked to turn the struggling business around, it could not get any traction.

The textile industry had simply gone into a downturn.

“In the end,” Buffett wrote in 1985, “Nothing worked and I should be faulted for not quitting sooner. A recent Business Week article stated that 250 textile mills have closed since 1980. Their owners were not privy to any information that was unknown to me; they simply processed it more objectively.”

Ultimately, Buffett’s distaste for cheap companies and their problems means that while some investors argue the merits of taking large positions in companies, Buffett and Berkshire Hathaway are comfortable taking relatively small positions in more expensive firms.

“At Berkshire, we much prefer owning a non-controlling but substantial portion of a wonderful company to owning 100% of a so-so business. It’s better to have a partial interest in the Hope Diamond than to own all of a rhinestone,” he wrote in 2014.

15. Don’t invest only because you expect a company to grow

Buffett is known for his advocacy of the value investing paradigm — buying shares of companies that are underpriced relative to their value according to some kind of analysis of company fundamentals, meaning its dividend yield, price-to-earnings multiple, price-to-book ratio, and so on.

Buffett’s personal formulation of the strategy is simply “finding an outstanding company at a sensible price” as opposed to finding mediocre companies for cheap prices.

But his embrace of “value investing” does not mean Buffett is skeptical of growth — it just means he avoids investing in companies solely because he thinks they have the potential to grow much larger than they are.

For a long time, however, Buffett notes in his 1992 letter, investors interested in “value” and investors interested in “growth” have been considered to be at odds.

Growth investors, the thinking goes, primarily look for companies that show they can grow at an above average rate. Companies that growth investors like might look expensive today, but are worth it if they are going to grow at or above the expected rate.

Value investors, on the other hand, purportedly ignore potential growth as a function in their fundamental analysis.

Buffett rejects this contrast, proudly proclaiming that “growth and value investing are joined at the hip.”

“Most analysts feel they must choose between two approaches customarily thought to be in opposition: ‘value’ and ‘growth,’” he wrote in his 1992 letter.

“We view that as fuzzy thinking (in which, it must be confessed, I myself engaged some years ago)… Growth is always a component in the calculation of value, constituting a variable whose importance can range from negligible to enormous and whose impact can be negative as well as positive,” he adds.

Value investing, for Buffett, means “seeking value at least sufficient to justify the amount paid.” Valuing a company higher because you expect it to exhibit healthy long-term growth is not the same as investing in a company solely because you believe it will grow and then justifying your valuation — a practice which Buffett is not fond of.

16. Never use your own stock to make acquisitions

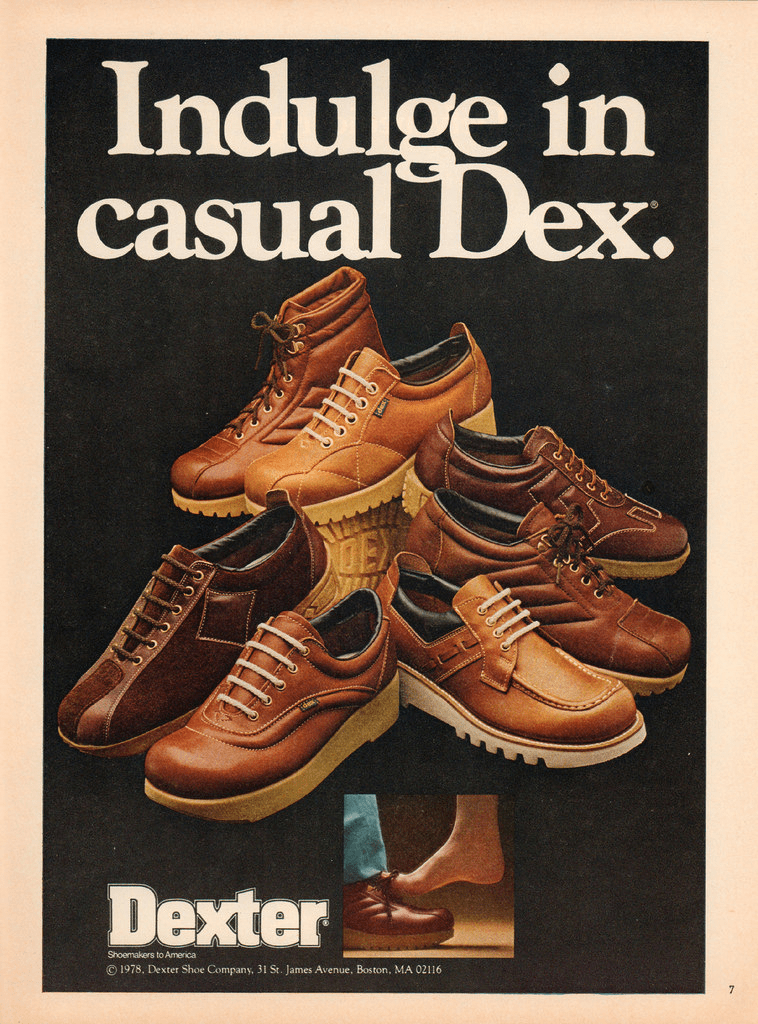

One of Buffett’s self-proclaimed worst mistakes as an investor came with his all-stock acquisition of Dexter Shoe Company in 1993.

This was one of Berkshire Hathaway’s first major acquisitions in its transition to earning most of its revenue by acquiring other companies. Before this, Berkshire Hathaway had mostly made money from investing in stocks.

With Dexter Shoe, Buffett picked possibly the worst company to help in this transition.

Within a few years, the relatively high priced Dexter shoes were driven out of the market by a flood of cheap, imported versions. The price of the company went to virtually zero within just a few years. “What I had assessed as durable competitive advantage vanished within a few years,” he would write in his 2007 letter. He called it the worst deal of his entire career.

After Dexter Shoe fully shut down production in 2001, the town of Dexter went into a depression. According to Bloomberg, as of 2017, it has still not recovered. Image source: Wikipedia

What made this deal even worse for Buffett was the fact that he had conducted the deal not in cash — as he would virtually every other acquisition made through Berkshire Hathaway — but in Berkshire stock.

“By using Berkshire stock, I compounded this error hugely. That move made the cost to Berkshire shareholders not $400 million, but rather $3.5 billion. In essence, I gave away 1.6% of a wonderful business – one now valued at $220 billion – to buy a worthless business.”

Buying Dexter Shoe would have been a mistake either way, but using Berkshire stock to buy the company made the problem even worse. Instead of spending cash, Buffett spent a percentage of a business that proceeded to dramatically outperform the S&P 500 for the next decade. Each year that followed, his acquisition of Dexter Shoe became more and more expensive in retrospect, rubbing salt in the wound.

“My error caused Berkshire shareholders to give far more than they received (a practice that – despite the Biblical endorsement – is far from blessed when you are buying businesses).”

“Today, I would rather prep for a colonoscopy than issue Berkshire shares,” he later wrote.

Global economics

17. America is not in decline — it’s becoming more and more efficient

In 2009, while America was still gripped by the effects of the Great Recession, Berkshire Hathaway made one of its largest purchases ever: BNSF Railway Company.

He called it an “all-in wager on the economic future of the United States.”

While Buffett believes that other countries, particularly China, have very strong economic growth ahead of them, he is still bullish, above all, for his home turf of the United States.

Buffett, who was born in Omaha in 1930 and got his start in business working in his grandfather’s grocery store, is fond of making historical references in his annual shareholder letters. “Think back to December 6, 1941, October 18, 1987, and September 10, 2001″, he writes in his 2010 letter, “No matter how serene today may be, tomorrow is always uncertain.”

But, he adds, one should not take from any calamity the idea that America is in decline or at risk — life in America has improved dramatically just since his own birth, and is improving further everyday.

“Throughout my lifetime, politicians and pundits have constantly moaned about terrifying problems facing America. Yet our citizens now live an astonishing six times better than when I was born. The prophets of doom have overlooked the all-important factor that is certain: Human potential is far from exhausted, and the American system for unleashing that potential – a system that has worked wonders for over two centuries despite frequent interruptions for recessions and even a Civil War – remains alive and effective.”

The core of that success, for Buffett, is America’s particular blend of free markets and capitalism.

“The dynamism embedded in our market economy will continue to work its magic,” he wrote in 2014, “Gains won’t come in a smooth or uninterrupted manner; they never have. And we will regularly grumble about our government. But, most assuredly, America’s best days lie ahead… Americans have combined human ingenuity, a market system, a tide of talented and ambitious immigrants, and the rule of law to deliver abundance beyond any dreams of our forefathers.”

For Buffett, it is this mixture of system, mentality, and circumstance that has allowed “America’s economic magic” to remain “alive and well.”

Buffett’s belief in the American dream is so strong that he is willing to make huge, capital-intensive investments in companies like BNSF and BHE — companies that require large amounts of debt (of which Buffett is not fond) but which, so far, have generated high returns for the Berkshire Hathaway portfolio.

By 2016, BNSF and BHE combined made up 33% of all of Berkshire Hathaway’s yearly operating earnings.

“Each company has earning power that even under terrible economic conditions would far exceed its interest requirements,” he wrote that year, “Our confidence is justified both by our past experience and by the knowledge that society will forever need huge investments in both transportation and energy.”

Today, Buffett remains optimistic, despite the Covid-19 pandemic wreaking havoc across the world and parts of his business.

Berkshire reported an $11B write-down of its investment in the metal fabrication company Precision Castparts (PCC), as the pandemic brought aerospace manufacturing to a near halt, hurting some of PCC’s largest customers and pushing its shares down.

But Buffett is undeterred and boldly declares in his 2020 letter: “Never bet against America.”

18. Current board of director incentives are broken and backwards

Warren Buffett has a complicated relationship with boards. On the one hand, he has a long history of serving on them: according to his 2019 shareholder letter, he has served as a director on the board of a total of 21 publicly owned companies over 62 years.

On the other hand, he is deeply suspicious of what he sees as the modern-day trend of corporate boards incentivizing directors to be passive accomplices to whatever a CEO wants to do.

Boards aren’t all bad for Buffett. He identifies several recent promising changes in the culture around boards of directors, including the profusion of women on boards and the mandating of “CEO-free” sessions where executives can speak frankly.

But there is one big problem: the majority of CEOs aren’t actively looking for directors to challenge their decision-making.

Despite the fact that boards nominally seek directors with “independence,” the actual behavior of executives and other directors betrays this idea.

At the bottom of the problem is director compensation, which Buffett argues has “soared to a level that inevitably makes pay a subconscious factor affecting the behavior of many non-wealthy members.”

From 2013 to 2017, total director pay rose about 12%. Image source: Directors & Boards

Board directors are regularly paid more than $250,000 a year for the work of attending “six or so” annual meetings. They’re seldom fired, according to Buffett, and can generally serve well into their 70s. All of this adds up to a strong set of incentives to do whatever it takes to stay on the board. In most cases, that means never challenging their CEO.

Companies are eager to find these kinds of directors, Buffett says, but counterintuitively short-change those who have a large amount of their net worth tied up in the companies they serve. These directors, despite “possessing fortunes very substantially linked to the welfare of the corporation,” are ignored and deemed “lacking in independence.” Instead of being valued for the amount of skin they have in the game, they’re pushed aside. And the result is a set of incentives that isn’t good for companies, Buffett argues.

When directors have skin in the game, they’re more likely to look out for the company’s best interests. When you have directors who are in it for the money, you’re likely to get an absentee board, and worse outcomes.

“Not long ago, I looked at the proxy material of a large American company and found that eight directors had never purchased a share of the company’s stock using their own money. (They, of course, had received grants of stock as a supplement to their generous cash compensation.) This particular company had long been a laggard… But the directors were doing wonderfully,” Buffett writes.

Buffett is careful to not make a blanket statement here. “Paid-with-my-own-money ownership, of course, does not create wisdom or ensure business smarts,” he writes. Even directors who get salaries, he says, also tend to get grants of company shares. But Buffett argues that there is a fundamental difference between directors who put up their own money to intertwine their fate with that of the company they’re serving and directors who have simply “been the recipients of grants.”

Setting the question of incentives aside entirely, Buffett offers one final observation about directors to explain why he has complex feelings about boards and their current value.

While he’s confident that he admires many of the people he has served alongside on corporate boards, he says, there is one thing he feels less confident about: that he wants those people responsible for his money.

“Almost all of the directors I have met over the years have been decent, likable and intelligent,” he writes, “Nevertheless, many of these good souls are people whom I would never have chosen to handle money or business matters. It simply was not their game.”

Management

19. Embrace the virtue of sloth

Asked to imagine a “successful investor,” many would imagine someone who is hyperactive — constantly on the phone, completing deals, and networking.

Warren Buffett could not be farther from that image of the hustling networker. In fact, he is an advocate of a much more passive, 99% sloth-like approach to investing. For him, it is CEOs and shareholders’ constant action — buying and selling of stocks, hiring and firing of financial advisers — that creates losses.

“Long ago,” he wrote in his 2005 letter, “Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir Isaac’s talents didn’t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, ‘I can calculate the movement of the stars, but not the madness of men.’”

“If he had not been traumatized by this loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole, returns decrease as motion increases,” he adds.

Buffett is a big advocate of inaction. In his 1996 letter, he explains why: almost every investor in the markets is better served by buying a few reliable stocks and holding on to them long-term rather than trying to time their buying and selling with market cycles.

“The art of investing in public companies successfully is little different from the art of successfully acquiring subsidiaries,” he writes, “In each case you simply want to acquire, at a sensible price, a business with excellent economics and able, honest management. Thereafter, you need only monitor whether these qualities are being preserved.”

“When carried out capably, an investment strategy of that type will often result in its practitioner owning a few securities that will come to represent a very large portion of his portfolio… To suggest that this investor should sell off portions of his most successful investments simply because they have come to dominate his portfolio is akin to suggesting that the Bulls trade Michael Jordan because he has become so important to the team,” he adds.

Buffett’s warning was a prescient one for retail investors who decided to take it. From 1997 to 2016, the average active stock investor only made about 4% returns annually, compared to 10% returns for the S&P 500 index as a whole. In other words, constantly buying and selling stock, and thinking that you can get an advantage from your instincts or analysis, has been proven to lead, in most cases, to smaller gains. And not just for your average retail investor.

“Lethargy bordering on sloth remains the cornerstone of our investment style,” Buffett wrote in his 1990 letter, and the difficulty of making any kind of money from buying and selling stocks is the very reason why. “Inactivity,” he adds, “strikes us an intelligent behavior.”

20. Time is the friend of the wonderful business, the enemy of the mediocre

By 1989, Warren Buffett was convinced that buying Berkshire Hathaway had been his first big mistake as an investor.

(By 2010, Buffett would say it was his biggest mistake ever — according to him, buying the company rather than insurance companies directly denied him returns of approximately $200B over the next 45 years.)

He bought Berkshire Hathaway because it was cheap. He knew that any temporary “hiccup” in the fortunes of the company would give him a good opportunity to offload the business for a profit.

The problem with that method, he reflects, is that mediocre companies (the kind that get offloaded for cheap in the first place) cost money in the time between you acquiring it and you selling it for a profit.

The approach of the more mature Buffett is to never invest in a company that can be a success if held for a short period of time. It is to only invest in companies that can succeed over an extremely long period of time, like 100 years or more.

“Time is the friend of the wonderful business, the enemy of the mediocre.”

No business that is not generating value over the long term is worth holding on to, and holding on to a bad business is never going to be a good investing strategy. This observation is important for Buffett, and for his overall conservative strategy in the market.

“The finding may seem unfair, but in both business and investments it is usually far more profitable to simply stick with the easy and obvious than it is to resolve the difficult,” he writes.

This philosophy extends to how Buffett thinks about finding managers.

“Our goal is to attract long-term owners who, at the time of purchase, have no timetable or price target for sale but plan instead to stay with us indefinitely,” he wrote in his 1988 letter, “We don’t understand the CEO who wants lots of stock activity, for that can be achieved only if many of his owners are constantly exiting. At what other organization — school, club, church, etc. — do leaders cheer when members leave?”

21. Complex financial instruments are dangerous liabilities

In 1998, Berkshire Hathaway purchased “General Re,” or the General Reinsurance Corporation.

In his 2008 letter, Buffett relates how he and Charlie Munger realized immediately that the business was going to be a problem.

General Re had been operating as a dealer in the swap and derivatives market, making money on futures, options on various foreign currencies and stock exchanges, credit default swaps, and other financial products.

While Buffett himself has professed to using derivatives at times to put certain investment and de-risking strategies into action, what he saw at General Re concerned him greatly.

General Re had 23,218 derivatives contracts with 884 separate counter-parties — a massive number of different contracts, most of which were with companies that neither Buffett nor Munger had ever heard of, and that they would never be able to untangle.

“I could have hired 15 of the smartest people, you know, math majors, PhD’s. I could have given them carte blanche to devise any reporting system that would enable me to get my mind around what exposure that I had, and it wouldn’t have worked,” he would later say.

It took Buffett and Munger 5 years and more than $400M in order to wind down General Re’s derivatives business, but they incurred those costs happily because they simply “could not get their minds around” a derivatives book of that size and complexity, and had no interest in owning a risky business they did not understand.

“Upon leaving,” he wrote, “Our feelings about the business mirrored a line in a country song: ‘I liked you better before I got to know you so well.’”

Warren Buffett with Barack Obama, whose administration pursued action to curb the use of complex financial derivatives in the aftermath of the 2008 financial crisis.

Buffett’s problem is less with the financial products themselves and more with the motivations behind using them to make a company’s quarterly numbers look better.

The reason that many CEOs use derivatives, Buffett says, is to hedge risks inherent to their business — like Burlington Northern (a railroad company) using fuel derivatives to protect its business model against an increase in the price of fuel.

A railroad like Burlington Northern might buy a futures contract, for example, that entitles them to buy fuel at a certain fixed price at a certain fixed point in the future. If the price of fuel stays the same or decreases, they still have to buy at the elevated price. However, if the price of fuel rises, they will be insulated from that increase and lower the damage to their business.

For Buffett, the problem with using derivatives to make money, rather than hedge bets, is twofold:

- Eventually, you’re going to lose just as much money on them as you win in the short term.

- Derivatives inevitably open up your business to incalculable amounts of risk.

Putting derivatives on your balance sheets always puts a volatile, unpredictable element into play. And it’s not one that can be fixed with regulation.

“Improved ‘transparency’ — a favorite remedy of politicians, commentators and financial regulators for averting future train wrecks — won’t cure the problems that derivatives pose. I know of no reporting mechanism that would come close to describing and measuring the risks in a huge and complex portfolio of derivatives,” he wrote.

“Auditors can’t audit these contracts, and regulators can’t regulate them,” he added.

22. Investment banker incentives are usually not your incentives

While Buffett and Berkshire Hathaway conduct plenty of business with investment banks and have invested in a few, he has issued some pointed criticisms at the industry over the years.

His main problem with investment bankers is that their financial incentive is always to encourage action (sales, acquisitions, and mergers) whether or not doing so is in the interest of the company initiating the action.

“Investment bankers, being paid as they are for action, constantly urge acquirers to pay 20% to 50% premiums over market price for publicly-held businesses. The bankers tell the buyer that the premium is justified for ‘control value’ and for the wonderful things that are going to happen once the acquirer’s CEO takes charge. (What acquisition-hungry manager will challenge that assertion?) A few years later, bankers — bearing straight faces — again appear and just as earnestly urge spinning off the earlier acquisition in order to ‘unlock shareholder value,’” he writes.

Sometimes this thirst for action even leads them to use fuzzy accounting to value the companies they’re selling.

His frustration with investment banker math reached its boiling point in his 1986 letter to shareholders, in which he dissected the value of Berkshire’s latest acquisition, the Scott Fetzer Company.

Buffett does not believe that standard GAAP accounting figures always give an accurate idea of what a company is worth, so he walks through a valuation of Scott Fetzer Company to explain why Berkshire purchased the company.

He wanted to show that typically, when one looks at a company through the lens of the earnings it will produce for its owners, the result is sobering relative to the company’s GAAP numbers — and that investment bankers and others use faulty numbers to push the companies they’re selling.

“All of this points up the absurdity of the ‘cash flow’ numbers that are often set forth in Wall Street reports. These numbers routinely include [earnings] plus [depreciation, amortization, etc.] — but do not subtract [capital expenditure and the cost of maintaining its competitive position].”

“Most sales brochures of investment bankers also feature deceptive presentations of this kind,” he adds. “These imply that the business being offered is the commercial counterpart of the Pyramids — forever state-of-the-art, never needing to be replaced, improved or refurbished. Indeed, if all U.S. corporations were to be offered simultaneously for sale through our leading investment bankers — and if the sales brochures describing them were to be believed — governmental projections of national plant and equipment spending would have to be slashed by 90%.”

For Buffett, investment bankers are too often simply using whatever math is most preferable for their preferred outcome, whether or not it is deceptive to the buyers and sellers involved in the transaction.

Culture

23. Leaders should live the way they want their employees to live

In his 2010 shareholder letter, Buffett provided a breakdown of all the money that is spent outfitting Berkshire’s “World Headquarters” in Omaha, Nebraska:

- Rent (annual): $270,212

- Equipment/supplies/food/etc: $301,363

By 2017, Berkshire Hathaway had hit about $1M in total annual overhead, according to the Omaha World-Herald — a paltry sum for a company with $223B in annual revenues.

The point of this breakdown is not to show off Berkshire’s decentralized structure, which offsets most operational costs to the businesses under the Berkshire umbrella, but to explain Berkshire’s culture of cost-consciousness. For Buffett, this culture must begin at the top.

Warren Buffett bought this house for $31,500 in 1958. It’s now worth an estimated $650,000. He still lives in it today. Image source: Smallbones

“Cultures self-propagate,” he writes, “Winston Churchill once said, ‘You shape your houses and then they shape you.’ That wisdom applies to businesses as well. Bureaucratic procedures beget more bureaucracy, and imperial corporate palaces induce imperious behavior… As long as Charlie and I treat your money as if it were our own, Berkshire’s managers are likely to be careful with it as well.”

For Buffett, there’s no reason for the CEOs of Berkshire’s companies to be careful with money if Charlie, him, and the inhabitants of Berkshire Hathaway’s HQ cannot be equally careful with it — so he insists on setting this culture from the top.

24. Hire people who have no need to work

In shareholder letter after shareholder letter, Buffett reminds his readers that the true stars of Berkshire Hathaway are not him or Charlie Munger — they are the managers that run the various companies under the Berkshire Hathaway umbrella.

“We possess a cadre of truly skilled managers who have an unusual commitment to their own operations and to Berkshire. Many of our CEOs are independently wealthy and work only because they love what they do… Because no one can offer them a job they would enjoy more, they can’t be lured away.”

Warren Buffett’s hiring strategy, as he explains it, is relatively simple: find people who love what they do and have no need for money, and then give them the most enjoyable job they could possibly have. Never force them into a meeting, or a phone call, or even a conversation — just let them work. It is to this strategy that Buffett credits much of the success of both Berkshire and its many companies.

“There are managers to whom I have not talked in the last year, while there is one with whom I talk almost daily,” he adds.

Berkshire Hathaway’s annual meeting, which no Berkshire CEO is required to attend. Image source: Stefan Krasowski

There’s very little that defines the kind of person that Buffett hires beyond these qualifications. “Some have MBAs; others never finished college,” he writes, “Some use budgets and are by-the-book types; others operate by the seat of their pants. Our team resembles a baseball squad composed of all-stars having vastly different batting styles… [changes] are seldom required.”

Whatever the mentality of the manager, the key is to give them the freedom in how to work and ensure that they get the most fulfillment out of it as possible, an ideal that Buffett sees as less of a science and more an art.

“Managers of this stripe cannot be ‘hired’ in the normal sense of the word. What we must do is provide a concert hall in which business artists of this class will wish to perform,” he writes.

25. Compensation committees have sent CEO pay out of control

In 2017, word got out that Yahoo CEO Marissa Mayer had been making a staggering $900K a week during her 5 years at the beleaguered company. This was a massive sum even by Silicon Valley standards, and many were shocked that someone with such a poor record made out so well.

Yahoo wasn’t doing well when she arrived, but many said her management style and decisions made it worse. She resigned in 2017 after the company was sold to Verizon.

Despite poor performance as CEO, Marissa Mayer made millions during her time at Yahoo, and walked away with a massive severance package after she resigned. Image source: World Economic Forum

CEOs didn’t use to command such enormous sums. Prior to World War I, the average annual salary of an executive at a large corporation was $9,958, or $220,000 in today’s dollars. Between 1936 and the mid-1970s the average CEO was paid about $1M a year in today’s money. By 2017, that average pay had ballooned to $18.9M, according to the Economic Policy Institute.

What happened?

Well, many things. But Buffett believes part of the answer lies with the compensation committees that determine the CEO’s pay package.

There’s often a cozy relationship between members and the CEO. Board members are well compensated, and if you want to be invited to serve on other boards, then making waves isn’t going to help. Buffett notes in his 2005 letter: “Though I have served as a director of twenty public companies, only one CEO has put me on his comp committee. Hmmmm . . .”

Buffett identifies the problem in the comparative data the committees use to determine a CEO’s compensation package. This has led to a rapid inflation in which the offers get bigger and more loaded with perks and payments. There’s little tied to performance.

“The drill is simple,” he wrote in 2005, “Three or so directors – not chosen by chance – are bombarded for a few hours before a board meeting with pay statistics that perpetually ratchet upwards. Additionally, the committee is told about new perks that other managers are receiving. In this manner, outlandish ‘goodies’ are showered upon CEOs simply because of a corporate version of the argument we all used when children: ‘But, Mom, all the other kids have one.’”

Debt

26. Never use borrowed money to buy stocks

If there’s a practice that infuriates Warren Buffett more than poorly structured executive compensation plans, it is going into debt to buy stocks or excessively finance acquisitions.

Much of Berkshire’s early success came down to the intelligent use of leverage on relatively cheap stocks, as a 2013 study from AQR Capital Management and Copenhagen Business School showed. But Buffett’s main problem is not with the concept of debt — it is with the type of high-interest, variable-rate debt that consumer investors must take on if they want to use it to buy stocks.

When ordinary people borrow money to buy stocks, they’re putting their livelihoods in the hands of a market whose swings can be random and violent, even when it comes to a reliable stock like Berkshire’s. In doing so, they risk potentially losing much more than their initial investment.

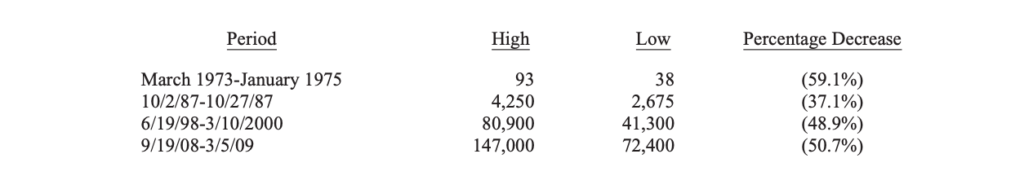

“For the last 53 years, [Berkshire] has built value by reinvesting its earnings and letting compound interest work its magic. Year by year, we have moved forward. Yet Berkshire shares have suffered four truly major dips.”

On four separate occasions, Berkshire’s stock fell by 37% or more within the span of just a few weeks.

“This table,” he writes, “Offers the strongest argument I can muster against ever using borrowed money to own stocks. There is simply no telling how far stocks can fall in a short period. Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions.”

When a stock falls by more than 37%, a highly leveraged investor stands a fair chance of incurring a margin call, where their broker calls and asks them to deposit more money in their account or risk having the rest of their securities portfolio liquidated to cover the losses.

“We believe it is insane to risk what you have and need in order to obtain what you don’t need,” Buffett writes. That’s why Buffett is a fan of some kinds of debt, just not the kind that can leave consumers broke when the market swings down.

27. Borrow money when it’s cheap

The Oracle of Omaha’s famous cost-consciousness does not mean that Berkshire Hathaway never borrowed money or went into debt — on the contrary, Buffett makes clear in his letters that he is enthusiastic about borrowing money in one type of circumstance.

Buffett is an advocate of borrowing money at a modest rate when he believes it is both “properly structured” and “of significant benefit to shareholders.” In reality, that usually means when economic conditions are tight and liabilities are expensive.

“We borrow… because we think that, over a period far shorter than the life of the loan, we will have many opportunities to put that money to good use,” Buffett writes, “The most attractive opportunities may present themselves at a time when credit is extremely expensive — or even unavailable. At such a time, we want to have plenty of financial firepower.”

When money is expensive, having more of it (in the form of debt) is a way of setting yourself up to take full advantage of opportunities. This fits nicely into Buffett’s general investment worldview that the best time to buy is when everyone is selling.

“Tight money conditions, which translate into high costs for liabilities, will create the best opportunities for acquisitions, and cheap money will cause assets to be bid to the sky. Our conclusion: Action on the liability side should sometimes be taken independent of any action on the asset side.”

28. Raising debt is like playing Russian roulette

All across the business world, from big, corporate boardrooms to the offices of venture capitalists, managers employ the use of debt to juice returns. Whether it’s a company like Uber taking on $1.5B to re-energize its slowing growth or a startup like Cedar taking on $25M to find that initial growth curve, debt offers companies a way to acquire capital without giving up room on their cap table or diluting existing shares.

Debt also forces shareholders into a Russian roulette equation, according to Buffett in his 2018 letter. And “a Russian roulette equation — usually win, occasionally die — may make financial sense for someone who gets a piece of a company’s upside but does not share in its downside. But that strategy would be madness for Berkshire,” he writes.

Because of the incentive structure involved, the venture capital model where one great success of an investment can cover the losses of a hundred failures is especially prone to recommending the use of debt.

In his 2018 letter, Buffett announced that prices for companies were too high at the moment, and that Berkshire would continue to invest in securities while awaiting another “elephant-sized” opportunity. Image source: USA International Trade Association

A stock speculator is equally likely to promote the use of debt to increase returns because they can build out portfolios where they don’t have to worry about the downside risk. For them, it can make good sense to do so, since as Buffett points out, they’re usually not going to get a “bullet” when they pull the “trigger.”

For Buffett, however, who owns so many companies outright and intends to continue holding them for the long term, an outcome of “usually win, occasionally die” doesn’t make sense.

The risk of a company failing and a significant amount of debt getting called back is too great a risk, and Buffett and Berkshire Hathaway share in that risk equally with their shareholders.

Berkshire utilizes debt, but primarily through its railroad and utility subsidiaries. For these extremely asset-laden businesses that have constant equipment and capital needs, debt makes more sense, and they will generate plentiful amounts of cash for Berkshire Hathaway even in an economic downturn.

LINKS TO EVERY BERKSHIRE HATHAWAY SHAREHOLDER LETTER

- 1977: http://www.berkshirehathaway.com/letters/1977.html

- 1978: http://www.berkshirehathaway.com/letters/1978.html

- 1979: http://www.berkshirehathaway.com/letters/1979.html

- 1980: http://www.berkshirehathaway.com/letters/1980.html

- 1981: http://www.berkshirehathaway.com/letters/1981.html

- 1982: http://www.berkshirehathaway.com/letters/1982.html