In the earlier #ForensicForesight article, we probed into the value of implementing a fraud risk assessment and its capacity to aid organizations in spotting and preventing fraudulent acts

Need a review? You can find it right here!

In this piece, we will further expand on that groundwork and explore the process of developing a thorough fraud risk assessment through practical, real-world illustrations. We commence by delving into the essential step of evaluating an organization’s vulnerability, a critical aspect in pinpointing potential risks.

Vulnerability Assessment

Before effectively safeguarding against fraud, it’s essential for any organization to pinpoint its vulnerabilities. These may encompass deficiencies like inadequate internal controls in financial reporting, insufficient oversight of third-party vendors, or the absence of whistleblower hotlines and reporting mechanisms, among others. Once these vulnerabilities are identified, the subsequent step involves evaluating the probability and potential impact of each fraud risk event. This process entails assigning a risk score to each risk based on historical data, industry norms, and expert judgment.

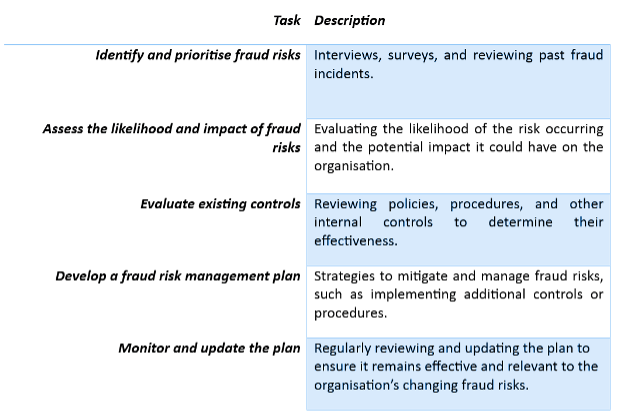

The likelihood and impact of a fraud risk event are gauged through a subjective assessment of the event’s probability and its potential repercussions on the organization. Here are the steps to consider when assessing likelihood and impact:

• Likelihood: Examine the likelihood of the fraud risk event transpiring, drawing insights from historical data, industry benchmarks, and expert assessments.

• Impact: Deliberate on the potential consequences that the fraud risk event could have on the organization, including financial ramifications, damage to reputation, and regulatory penalties.

• Rating Assignment: Employ a rating scale, such as high, medium, or low, to categorize the likelihood and impact of the fraud risk event.

• Risk Score Calculation: Determine the risk score by multiplying the likelihood rating with the impact rating. This computation yields a comprehensive evaluation of the risk associated with the fraud risk event.

Establishing Priorities: Utilize the risk scores as a basis for prioritizing fraud risks and identifying those that demand the highest degree of attention and allocation of resources.

It’s crucial to recognize that the likelihood and impact ratings are subjective and may fluctuate depending on the individual performing the assessment.

Consistency in approach and the inclusion of diverse stakeholders are imperative for maximizing the objectivity of the ratings

Template for Evaluating Fraud Risks

Within this article, we’ve presented both a basic template for gaining a foundational understanding of fraud risk assessment and an advanced template with pre-filled responses. It’s worth emphasizing that this template can be tailored and adjusted to align with the unique requirements of different organizations. While individuals can also devise their own matrices and templates, various organizations, including the Association of Certified Fraud Examiners (ACFE), offer a range of templates and guidelines that can be employed to ensure a comprehensive and efficient fraud risk assessment. By making use of these resources, organizations can proactively identify vulnerabilities and implement suitable measures to prevent fraud.

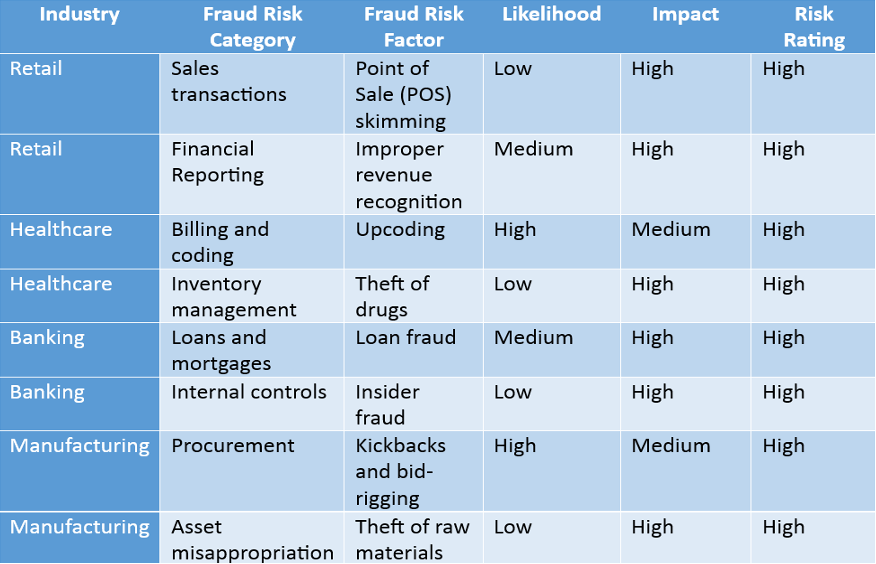

Following is a basic fraud risk assessment template applied to four different industries:

In this example, we have applied the template to four different industries: retail, healthcare, banking, and manufacturing. For each industry, we have identified two different fraud risk categories and assigned a fraud risk factor, likelihood, impact, and risk rating to each category.

For the retail industry, we have identified point of sale (POS) skimming and improper revenue recognition as two high-risk fraud categories. In the healthcare industry, we have identified upcoding and theft of drugs as high-risk fraud categories. In the banking industry, we have identified loan fraud and insider fraud as high-risk fraud categories. Finally, in the manufacturing industry, we have identified kickbacks and bid-rigging and theft of raw materials as high-risk fraud categories.

This table serves as a starting point for conducting a fraud risk assessment in each industry, allowing fraud examiners and forensic accountants to identify areas of high risk and develop strategies for mitigating those risks.

Guidance for Crafting a Fraud Risk Assessment

Utilizing the template provided earlier, let’s embark on a straightforward journey to grasp the various elements involved in developing a framework for a fraud risk assessment tailored to an organization’s needs.

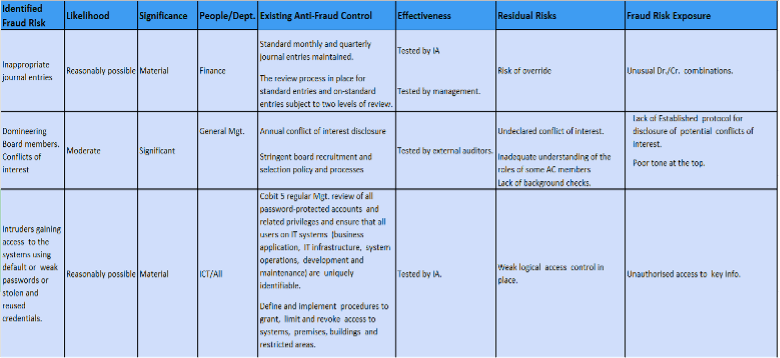

Comprehensive Template with Provided Answers

Now that we’ve gained insights from an industry standpoint, below is an advanced template that demonstrates the application of fraud risk identification, evaluation, and response components within a logical and structured framework for particular scenarios.

Both these templates can be modified using the above idea, or by using a standardised template like the one provided by the ACFE, organisations can ensure that they conduct a thorough and comprehensive fraud risk assessment.

Addressing Challenges Along the Way

As we’ve acquired a pragmatic comprehension of implementing a framework for fraud risk assessment, it’s apparent that various challenges can hinder its effectiveness, including:

1. Neglecting the utilization of subject matter experts for analyzing fraud risk.

2. Perceiving fraud risk assessment as a one-time, non-value-adding event.

3. Encountering difficulty in comprehending and utilizing information and data.

4. Failing to take action based on the results of the fraud risk assessment.

5. Delegating the responsibility for managing fraud risk solely to the Risk Management and Compliance Unit.

6. Excessive control measures for mitigating fraud risk.

7. Conducting an excessive number of disparate risk assessments throughout the organization.

Nonetheless, professionals can follow several strategies to ensure the success and value of their fraud risk assessments within their organizations. These include simplifying communication of data, evaluating the feasibility of implementing suggested actions for addressing residual fraud exposure, holding accountable staff or process owners with established action plans and deadlines, cultivating heightened interest from all stakeholders, and crucially, adopting a consistent approach to prevent an excess of assessments.

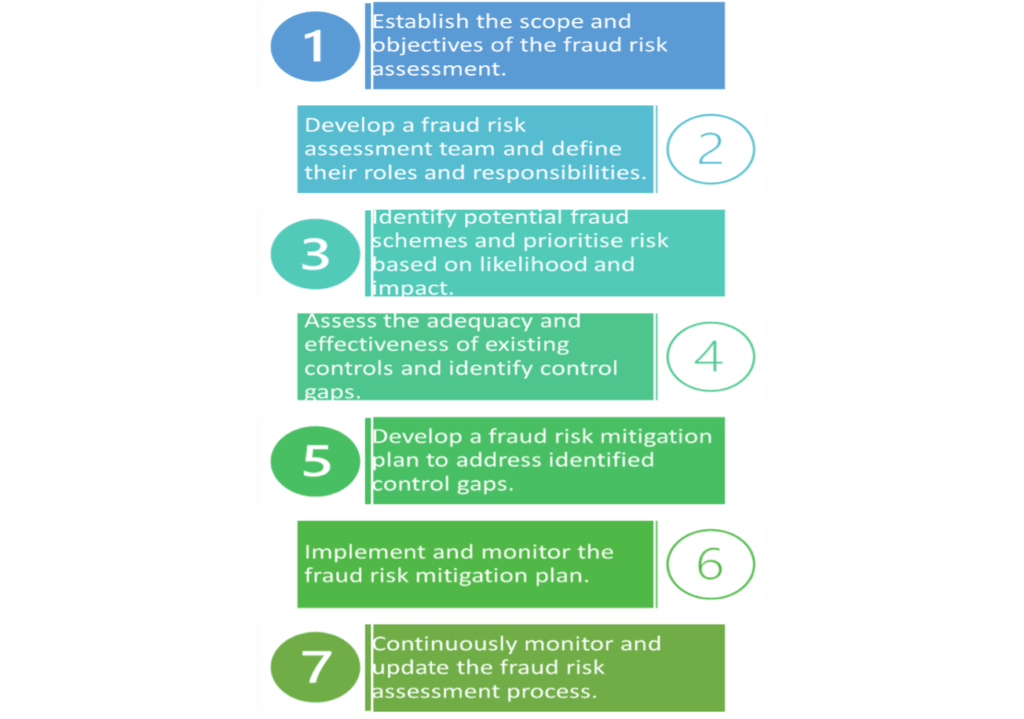

Presenting a Brief 7-Step Guide for Establishing a Strong Fraud Risk Assessment in an Organization:

It is evident that the incorporation of a fraud risk assessment framework is a pivotal element within any successful fraud prevention program.

A fraud risk assessment helps organisations identify their vulnerabilities and proactively take measures to prevent fraud. This preventive measure can be a beneficial practice for individuals starting their careers in forensic accounting and fraud examination.

By conducting regular fraud risk assessments, individuals can gain valuable experience and skills while helping organisations safeguard against fraud. A strong understanding of the fraud risk assessment process can help individuals identify red flags and risks and take appropriate actions to mitigate them. By following the steps outlined in this article, forensic professionals can develop and implement a robust fraud risk assessment framework that can help protect organisations and individuals against fraud.

Remember, fraud prevention is not a one-time effort but a continuous process. Regular fraud risk assessments are essential to identify new threats and protect against potential losses.

0 responses on "Constructing an Effective Framework for Assessing Fraud Risk: Best Practices and Insights"