Advance Tax Calculation

Services Covered:

Services Covered:

Calculation of Advance Taxes: For one quarter.

Who Should Buy:

Who Should Buy:

Any taxable person whose tax payable, after considering TDS, is more than Rs. 10,000.

How it’s Done:

How it’s Done:

Purchase Plan: Choose our comprehensive package.

Provide Details: Give us details about your taxable income and any available deductions.

Receive Calculation: ProKhata experts will give you the amount of tax that is to be deposited as Advance tax before the due date.

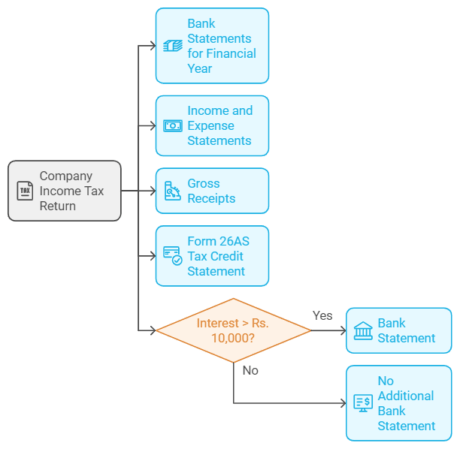

Documents to be Submitted:

Documents to be Submitted:

The documents needed will depend on the service required. Our experts will communicate these based on your requirements.

FAQs:

FAQs:

What is advance tax and when do I need to pay it?

What is advance tax and when do I need to pay it?

Advance tax is the prepayment of your tax liability in the year it is earned. If the tax liability is more than Rs. 10,000 in a financial year, then advance tax needs to be paid by the assessee. The due dates are:

- 15th June (15%)

- 15th September (45%)

- 15th December (75%)

- 15th March (100%)

Who is Advance Tax applicable for?

Who is Advance Tax applicable for?

If in a financial year your total tax liability exceeds Rs. 10,000, you will be required to pay Advance Tax. Do remember to include all heads of income while calculating Advance Tax. Senior citizens, those who are 60 years or older and do not run a business, are exempt from paying advance tax.

Additionally, Tax Deducted at Source (TDS) is a concept where, when you receive any income (your salary, interest income), the person paying you will often deduct TDS before paying you. If the TDS deducted is more than your tax due, then you may not have to pay advance tax.