Capital Gain Income Tax Return

Services Covered:

Services Covered:

Tax filing: For individuals with capital gains, ESOP, or salary arrears.

E-filing of Form 10e: Complete the necessary form electronically.

Expert Assisted Tax Filing: Receive professional help with your tax filing.

Business Hours CA Support: Get support via email and phone.

Who Should Buy:

Who Should Buy:

Salaried employees with ESOP in domestic companies.

Salaried employees/non-salaried individuals with capital gains from property/stock.

PSU employees with salary arrears under OROP, 6th Pay Commission.

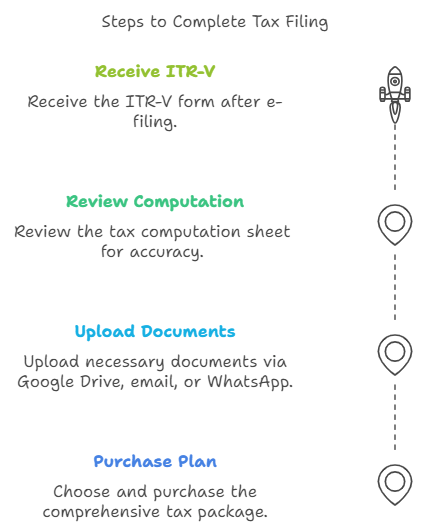

How it’s Done:

How it’s Done:

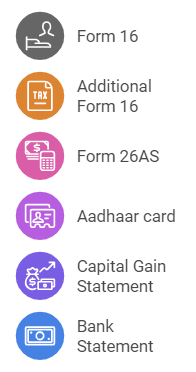

Documents to be Submitted:

Documents to be Submitted:

FAQs:

FAQs:

What is capital gain income?

What is capital gain income?

Capital gain income arises from the sale or transfer of a capital asset, such as real estate, stocks, mutual funds, bonds, or jewelry. It is classified as:

- Short-term capital gain (STCG): When the asset is held for a short period before being sold (less than 36 months for real estate, 12 months for listed securities and mutual funds, and 24 months for immovable property).

- Long-term capital gain (LTCG): When the asset is held for a longer period than specified above.

Which ITR form is applicable for capital gains?

Which ITR form is applicable for capital gains?

- Individuals and HUFs with capital gains income should file ITR 2.

- If there are capital gains in addition to business or professional income, then ITR 3 is applicable.

What is the due date for filing a capital gain income tax return for AY 2025-26?

What is the due date for filing a capital gain income tax return for AY 2025-26?

- The due date is July 31, 2025, if the tax audit is not required.

- If a tax audit is required due to business or professional income, the due date is October 31, 2025.

Can I claim an exemption on capital gains?

Can I claim an exemption on capital gains?

Yes, exemptions can be claimed on long-term capital gains if the proceeds are reinvested in specified assets under sections such as:

- Section 54: Exemption for capital gains from the sale of a residential property if invested in another residential property.

- Section 54EC: Exemption if the gains are invested in specified bonds (such as NHAI or REC bonds) within 6 months of the transfer.

- Section 54F: Applicable for the sale of assets other than a residential property if the proceeds are invested in a residential property.

What is the tax rate on capital gains?

What is the tax rate on capital gains?

- Short-term capital gains (STCG):

- Taxed at 15% for securities covered under Section 111A.

- Other assets are taxed as per the individual’s applicable income tax slab.

- Long-term capital gains (LTCG):

- Taxed at 10% on gains exceeding ₹1 lakh from the sale of equity shares or equity mutual funds.

- 20% with indexation benefits for other long-term capital assets.

How is indexation applied to capital gains?

How is indexation applied to capital gains?

Indexation allows taxpayers to adjust the purchase price of long-term assets to account for inflation, thereby reducing the taxable capital gains. The Cost Inflation Index (CII) issued by the government is used for this calculation.

What is a ‘Capital Gains Account Scheme’ (CGAS)?

What is a ‘Capital Gains Account Scheme’ (CGAS)?

If the capital gain amount is not utilized for purchasing or constructing a new property before the due date for filing the return, it can be deposited in a Capital Gains Account Scheme (CGAS) to claim the exemption. The amount must be used for the intended purpose within the stipulated period, failing which it becomes taxable.

Can I file a revised return for capital gain income?

Can I file a revised return for capital gain income?

Yes, a revised return can be filed until December 31, 2025 (three months before the end of the assessment year) or before the completion of the assessment, whichever is earlier.

What happens if I do not report capital gains in my return?

What happens if I do not report capital gains in my return?

Non-disclosure of capital gains may result in penalties, interest, and even scrutiny from the tax authorities. Inaccurate reporting can lead to the addition of income to the tax assessment with penalties.

Can I carry forward capital losses to future years?

Can I carry forward capital losses to future years?

Yes, capital losses can be carried forward:

- Short-term capital losses (STCL): Can be set off against both short-term and long-term capital gains and carried forward for 8 years.

- Long-term capital losses (LTCL): Can only be set off against long-term capital gains and also carried forward for 8 years.

Are there any exemptions for non-resident Indians (NRIs) on capital gains?

Are there any exemptions for non-resident Indians (NRIs) on capital gains?

NRIs are subject to special provisions:

- LTCG on listed securities and equity mutual funds: Taxed at 10% without indexation.

- LTCG on other assets: Taxed at 20% with indexation.

NRIs can claim exemptions under sections 54, 54EC, and 54F.

How should capital gains on inherited or gifted property be treated?

How should capital gains on inherited or gifted property be treated?

- The holding period of the previous owner is considered for determining whether the gain is short-term or long-term.

- The cost of acquisition is the original cost incurred by the previous owner, adjusted for indexation benefits.

Do I need to pay advance tax on capital gains?

Do I need to pay advance tax on capital gains?

Yes, if there is a significant capital gain during the year, advance tax must be paid to avoid interest under Sections 234B and 234C. The payment can be made in installments, based on the date of realization of the gain.

How can I claim a refund if excess TDS was deducted on capital gains?

How can I claim a refund if excess TDS was deducted on capital gains?

You can claim a refund of the excess TDS deducted by filing your income tax return and mentioning the correct details of the TDS deducted and the capital gain tax liability.