Company and LLP Income Tax Returns Filing

Services Covered:

Services Covered:

Income Tax Return Filing: Filing of income tax returns for companies and Limited Liability Partnerships (LLPs).

Individual Income Tax Return Filing: Filing for up to two directors/partners (salary income only).

Ask an Expert Session: Address any related queries with an expert.

ProKhata Product: Utilization of ProKhata’s tools for seamless tax filing.

Documented Follow-Up: Ensuring thorough follow-up.

Excludes Statutory Audit Fees: Audit fees are not covered.

Who Should Buy:

Who Should Buy:

Companies

Limited Liability Partnership firms (LLPs)

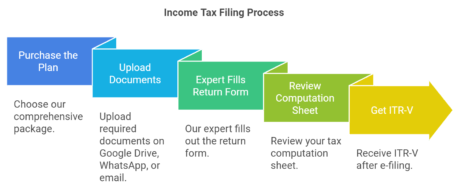

How it’s Done:

How it’s Done:

Purchase the Plan: Choose our comprehensive package.

Upload Documents: Upload required documents on Google Drive, WhatsApp, or email.

Expert Fills Return Form: Our expert fills out the return form.

Review Computation Sheet: Review your tax computation sheet.

Get ITR-V: Receive ITR-V after e-filing.

Documents to be Submitted:

Documents to be Submitted:

Tax Audit Report

Income Tax login credentials

Digital Signature

FAQs:

FAQs:

What is the due date to file a company income tax return?

What is the due date to file a company income tax return?

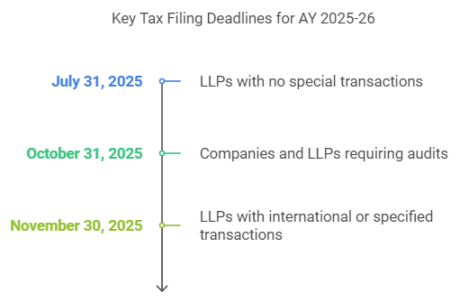

The due date for filing the income tax return for a company for AY 2025-26 is:

- October 31, 2025, if an audit is required.

- For LLPs, the due dates are:

- October 31, 2025 (if an audit is required).

- November 30, 2025 (if there are international transactions or specified domestic transactions requiring a transfer pricing report).

- July 31, 2025 (in other cases).

What are the ITR forms for companies and LLPs?

What are the ITR forms for companies and LLPs?

- Companies: All companies must file ITR 6, except those claiming exemption under Section 11, which pertains to income from property held for religious or charitable purposes.

- Companies claiming exemption under Section 11: Should file ITR 7.

- LLPs: Required to file ITR 5.

Can I file a revised return after the due date?

Can I file a revised return after the due date?

Yes, a revised return can be filed within three months before the end of the assessment year (i.e., December 31, 2025) or before the completion of the assessment, whichever is earlier. It is advisable to provide full and accurate details initially, as revising the return is not part of the plan.

Can I file a belated return?

Can I file a belated return?

Yes, a belated return can be filed until December 31, 2025 (three months before the end of the assessment year) or before the completion of the assessment, whichever is earlier. For income earned during FY 2024-25, a belated return can be filed by this deadline.

How long should I keep a copy of the filed return?

How long should I keep a copy of the filed return?

You should retain a copy of your filed return for at least 6 years from the end of the relevant assessment year. Legal proceedings under the Income Tax Act can be initiated for up to 4 to 6 years prior to the current financial year. In certain cases, proceedings may extend beyond 6 years if the income escaping assessment is substantial.

Do I need to attach documents with my ITR?

Do I need to attach documents with my ITR?

No, ITR forms are attachment-less. You do not need to attach documents such as TDS certificates or proof of investments when filing your return. However, it’s essential to retain these documents for your records in case they are required during assessments.

Are there any changes in the tax audit requirements for AY 2025-26?

Are there any changes in the tax audit requirements for AY 2025-26?

Yes, changes may apply to tax audit thresholds based on the latest budget announcements:

- The tax audit threshold for businesses is ₹10 crores, provided the cash receipts and payments do not exceed 5% of the total receipts and payments.

- For professionals, the tax audit limit remains at ₹50 lakhs.

- Always check the most current regulations or consult a tax professional for detailed guidance.

What are the consequences of not filing the return on time?

What are the consequences of not filing the return on time?

Failing to file a return by the due date may result in:

- Late filing fees under Section 234F.

- Interest on outstanding tax under Section 234A.

- Inability to carry forward losses (except for loss from house property).

- Possible scrutiny notices from the tax department.

It is recommended to file even a belated return to mitigate these consequences.

Is audit and financial statement preparation included in the plan?

Is audit and financial statement preparation included in the plan?

No, audit and preparation of financial statements are not part of the plan. You will need to buy additional products from our website to complete these services.