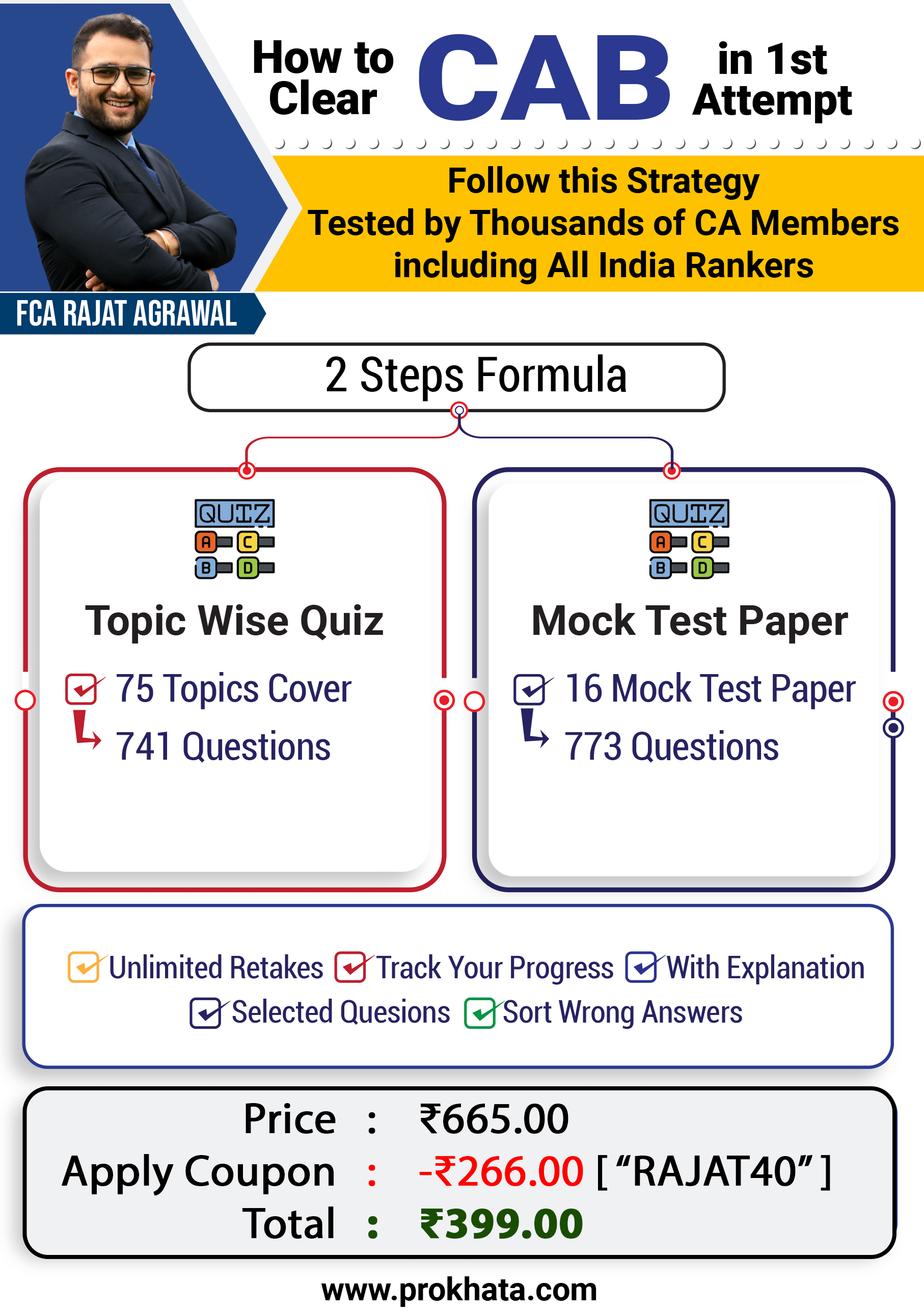

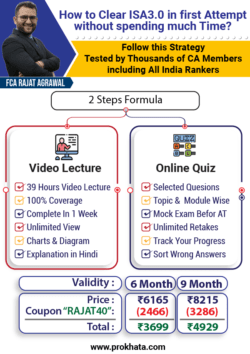

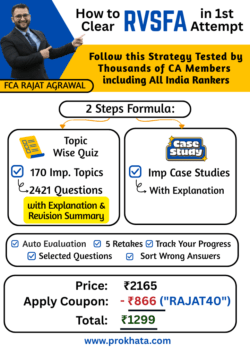

This Product Includes 2 Types of Online Question Bank

This Product Includes 2 Types of Online Question Bank

Full Mock Test Papers

Full Mock Test Papers

Complete MTPs with detailed explanations to enhance understanding and improve preparation.

Topic Wise Mock Test Papers

Topic Wise Mock Test Papers

Focused MTPs by topic, each with detailed explanations to deepen understanding and mastery.

Strategy to Clear CAB Exam on First Attempt

Strategy to Clear CAB Exam on First Attempt

Join Our Community

Steps for Pursuing CAB Certificate

1. Register

Register and make payment on https://learning.icai.org.

2. Professional Training

Course Requirements & Evaluation

Course Requirements & Evaluation

Evaluation Eligibility: 80% attendance required to appear in the evaluation.

Attempts: Unlimited attempts allowed, with a 6-month gap between each.

Course Duration: 6 days with 24 technical sessions, held on weekends or 3 consecutive days based on batch needs.

3. Assessment Test (AT)

Examination & CPE Credits

Examination & CPE Credits

Examination: Conducted quarterly. Date and time will be shared via email.

CPE Hours: 30 Structured CPE Hours awarded upon course completion. Partial credits given for lower attendance.

Download books for Concurrent Audit of Bank Exam

Why CAB Certification is Essential for Chartered Accountants in Banking

Why CAB Certification is Essential for Chartered Accountants in Banking

Gain insights into banking operations, compliance, and risk management, crucial for effective concurrent audits.

Master key banking audit skills, like transaction review, RBI compliance checks, and risk monitoring.

Become eligible for in-demand concurrent audit roles in banks, where regulatory compliance is essential.

Concurrent audits are recurring, offering a steady income through monthly, quarterly, or annual engagements.

CAB certification deepens your knowledge of banking regulations, making you a valuable advisor on compliance.

Build valuable connections with bank staff, opening doors to potential clients and collaborations.

Boosts your credibility with employers and clients, paving the way to roles in banks, NBFCs, and more.

Help banks identify risks, contributing to a stronger financial system and a rewarding career.

With CAB certification, you’re not just advancing your career—you’re becoming a vital part of the financial ecosystem.

Important topics covered in the Topic Wise Quizzes in this course

Important topics covered in the Topic Wise Quizzes in this course

This course provides a comprehensive overview of banking and finance, drawing from a wide range of topics relevant to the banking industry, with a focus on the concepts, regulations, and practices that are essential for banking professionals.

This course provides a comprehensive overview of banking and finance, drawing from a wide range of topics relevant to the banking industry, with a focus on the concepts, regulations, and practices that are essential for banking professionals.

Our Topic Wise Quizzes consist of all these Frequently asked topics in Exam

I. Core Banking Operations & Regulations:

This module delves into the foundational aspects of banking, covering the legislative framework that governs banking operations in India, including:

The Banking Regulation Act of 1949 which is the primary legislation that governs and controls banking companies in India.

The Reserve Bank of India Act of 1934 which outlines the functioning and powers of the Reserve Bank of India.

RBI circulars and guidelines that provide specific instructions for banks.

Key committees and their roles.

Core Banking Solutions (CBS), which are comprehensive software solutions that enable banks to manage their operations.

The regulatory framework for Cooperative Banks and Regional Rural Banks (RRBs).

The Basel Accords, which set international standards for banking regulation and supervision.

Income Recognition and Asset Classification (IRAC) norms which are used by banks to classify their assets based on quality.

Various sections of banking-related acts.

Centralized Credit Processing Units (CCPUs) and their role in processing loan applications.

Counterfeit currency and the procedures for handling and reporting it.

Stamp duty regulations and their application in various financial documents.

II. Legal and Regulatory Compliance:

This module focuses on the legal and compliance aspects that banks must adhere to, including:

The Income-tax Act of 1961.

Insolvency procedures and the Insolvency and Bankruptcy Code (IBC).

The Prevention of Money Laundering Act (PMLA) of 2002, and other Anti-Money Laundering (AML) laws.

III. Customer Accounts & Services:

This module covers the various types of accounts and services banks offer to customers, as well as the related regulations and guidelines including:

Joint accounts.

Savings Bank Accounts.

Small accounts designed for individuals with limited KYC documentation.

Non-resident ordinary (NRO) and Non-resident external (NRE) accounts.

Know Your Customer (KYC) guidelines for customer verification.

Nomination facilities for bank accounts and locker services.

Locker services, including deposit requirements and regulations.

IV. International Banking and Finance:

This module deals with international transactions and regulations, such as:

Foreign exchange markets and trading.

The Fixed Income Money Market and Derivatives Association of India (FIMMDA).

Interest Not Collected Account (INCA).

The Liberalized Remittance Scheme (LRS) for individuals to remit funds abroad.

V. Financial Transactions & Instruments:

This module focuses on the various financial instruments used in banking, as well as their specific use:

Automated Teller Machines (ATMs), their transactions and customer rights.

Call money market operations.

Certificates of deposit (CDs) and their regulatory guidelines.

Cheques and their handling as per banking norms.

Commercial paper.

Cash management and related transactions.

Cash flow analysis and budgeting.

Treasury bills and their issuance by the Government of India.

Short term finance options.

Factoring of accounts receivable.

Unrealized income in prior year (URIPY).

Nostro accounts and their functions.

Ledger and its use in banking.

VI. Lending, Credit & Security:

This section covers the different aspects of lending, credit risk, and the various forms of security:

Loans and their classification.

Term loans.

Working capital management and assessment.

Lines of credit and their utilization.

Micro, Small, and Medium Enterprises (MSME) lending and restructuring.

The Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) scheme.

Export finance and related mechanisms.

Guarantees, including bank guarantees and corporate guarantees.

Credit rating and its significance.

Non-Performing Assets (NPAs) and their management.

Special Mention Accounts (SMAs) and their classification.

Provisions for potential losses.

The Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act of 2002.

Mortgages and related concepts.

Immovable property and its valuation.

Movable goods and their use as collateral.

VII. Bank Lending and Operations:

This section includes topics related to the day-to-day operations of banks that were not covered elsewhere.

VIII. Financial Management & Risk:

This module encompasses crucial areas of financial planning and risk management within banks, including:

Budgeting principles and practices.

Capital budgeting techniques.

Cash budget.

Capital Adequacy and its importance in maintaining financial stability.

Risk management strategies and their importance.

Portfolio management and diversification.

Investment strategies and asset allocation.

Interest calculation methods.

IX. Audit & Compliance:

This module focuses on the various auditing and compliance functions within a bank, including:

Concurrent audit.

General audit procedures.

Legal audit requirements.

Statutory audit.

Due diligence procedures for loans.

This course provides a blend of theoretical knowledge and practical insights, enabling participants to gain a holistic understanding of the banking sector and its various facets. By covering these topics, the course aims to prepare individuals for a variety of roles within the banking industry, while ensuring they are knowledgeable about the regulatory and compliance aspects of banking operations.