Discuss your Tax Issues with Experts in Accounts, Taxation & Finance.

Tax Rules in India for freelancers | Fiverr, Upwork, etc | GST | Income Tax | Accounting

Fiverr, Upwork, etc | GST

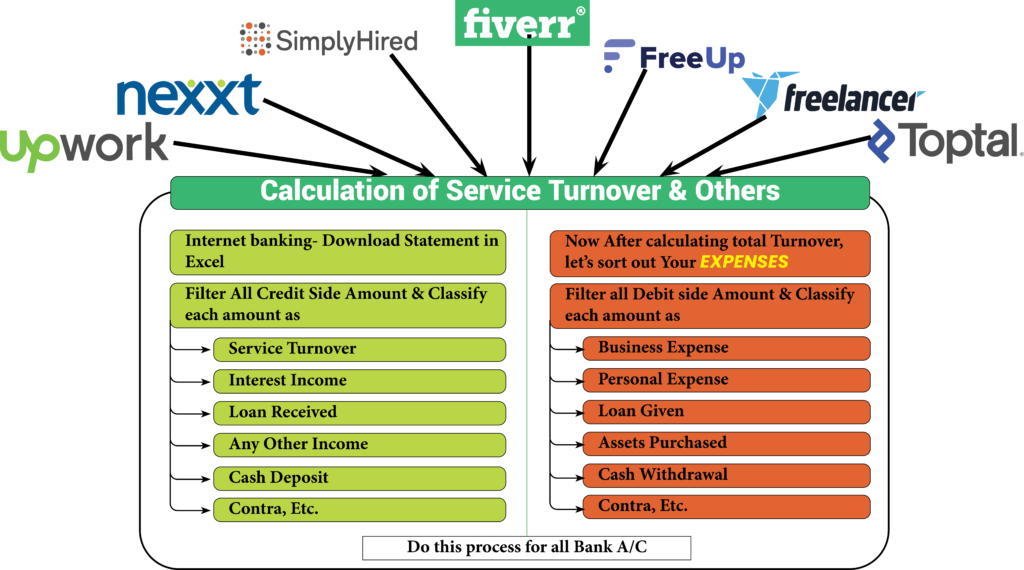

What Is Service Turnover Calculation ?

How To Calculate Service Turnover Of Freelancers?

How To Classify The Nature Of Transaction?

What Are The Indirect Tax (GST) Rules For Freelancers?

Is GST Registration Mandatory For Freelancers?

How Do Freelancers Charge GST For Work Done For Foreign Clients?

Consequences Of Not Providing Letter Of Credit

GST Applicability In Case Of Indian Clients

About Direct Tax For Freelancers

Turnover More Than 50 Lakhs Incase Of Freelance Business

Section 44Ada Applicability For Freelancers

Income Tax and GST Rules in India for Freelancers as per Budget 2023

Tax on Export Explained

Income Tax Rules For Freelancers

About Laws Governing Taxation In India For Freelancers

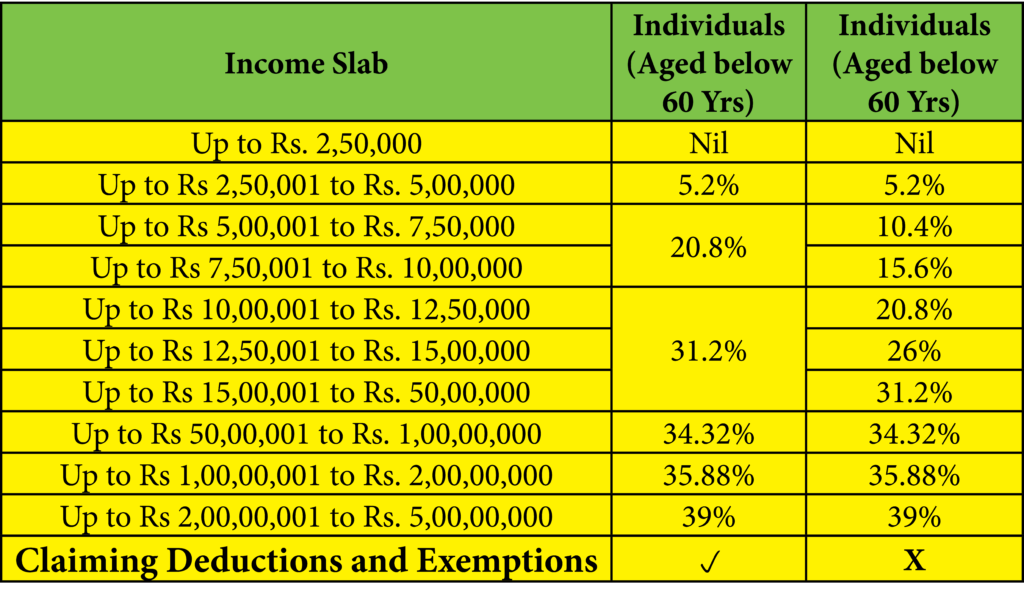

Change In Income Tax Slab Rate

Types Of Slab Rate [Old Regime And New Regime]

Whether The Assessee Can Change The Opted Regime Or Not?

Difference In Presumptive Scheme For Business And Profession

Change In Presumptive Scheme’S Threshold In Budget 2023 And Its Conditions

Whether Transactions In Shares And Securities Included In The Threshold For The Presumptive Scheme?

Gst Provisions For Freelancers

Threshold For Taking Gst Registration For Freelancers

Gst Rates For Providing Freelancer Services.

Better Channels For Receiving Payments And Arranging Firc

Does a single threshold for export services and within-India services prevail under GST Acts?

Applicability Of Igst And Cgst/Sgst/Utgst

When You Can And When You Should As A Freelancer, Take Gst Registration

Utilisation, Carry Forward, And Reversal Of Itc (Gst Credit)

Refund Of Itc (Gst Credit) For Service Exporters.

Capital And Revenue Expenditures And Depreciation For Freelancers.

Saving Or Current Account, Which Is Better For Freelancers?

Maximum Number Of Assets That Can Be Purchased As Per Gst Or Income Tax Laws?

Is An Income Tax Return Mandatory For Opening A Current Account In A Bank?

Do Different Banks Have Different Rules For Current Accounts?

Can We Charge Gst Without/Before Gst Registration And Process Time For Gst Registration

Liability For The Time Between Threshold Exceeds For Gst Registration And Registration Was Taken.

GST on Freelancers

India has emerged to be a hub for passionate freelancers and thereby, the freelance industry has been on a constant growing phase. However, it goes without saying that this particular industry is an unorganised sector and lacks clear and specific rules and regulations. The freelance industry in the country comprises of professional freelancers of various professions, bloggers and consultants. From a wide range of interests starting with travel and food to technology and fashion, freelancing has been a platform for people to display their talents and be their own boss. With the implementation of Goods and Services Tax (GST), there has been quite a confusion and the new rules and regulations of the tax concerning this market has been vague. This article is a GST Guide for Freelancers with the intent to simplify the complexity around the subject.

1. Registration Requirement Under GST

2. When you are providing services of up to Rs. 20 lakhs in a financial year –

3. When you are providing services of more than Rs. 20 lakhs/10 lakhs in a financial year

4. Calculating GST Turnover

5. Purpose of Aggregate Turnover

6. How to calculate Aggregate Turnover?

7. Which is not inclusive?

8. Voluntary Registration – Effect And Benefits

9. GST Rate On Freelancing

10.Export Of Services

11. Providing Service Through Upwork, Fiverr, Freelancer, Guru Etc.

12. Foreign Inward Remittance Certificate (FIRC)

13. Taxability is as under

14. Composition Scheme

15. Invoicing

16. Foreign Currency Invoice For Services

17. Input Tax Credit

18. GST Refund

19. Tax Collected At Source (TCS) Under GST

20. Is Import Export Code (IEC) required for exporting of services?

21. To sum it up

Income Tax on Freelancers

As per Income Tax Laws in India, any income generated by an individual by implementing their manual or intellectual skills is considered as ‘’profit and gains from business and profession’’. As per the tax perspective, freelancing is treated as a business and profession.

Also includes Details Above

1. Calculation of Service Turnover

2. Claiming expenses

3. Depreciation Deductions

4. Include Income from All Other Sources

5. Exemptions or Deductions

6. Deductions/ Tax Exemptions Under the Section 80

7. Credit the TDS Deductions

8. Advance Tax

9. Presumptive Taxation

10. Claiming expenses under 44ADA

11. Maintaining Books of accounts for freelancers u/s 44ADA?

12. Books of accounts are required to be maintained?

13. What is audit u/s 44AB?

14. Old Vs New Tax Regime: Which One Should You Choose?

15. Features of the New Tax Regime