GST Filing Services for E-Commerce Sellers at Prokhata

GST Filing Services for E-Commerce Sellers at Prokhata

Services Covered

Services Covered

Who Should Buy

Who Should Buy

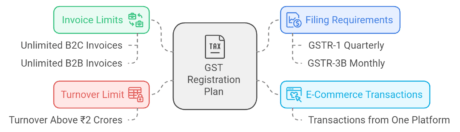

E-commerce sellers with a turnover below ₹2 Crores

Businesses looking for efficient GST filing services

How It’s Done

How It’s Done

Purchase of Plan

Expert Assigned

Upload Documents

Delivery of Services

Estimated Time: 365 days

Documents to be Submitted

Documents to be Submitted

Purchase and sales register

Payment challan for GST

Frequently Asked Questions (FAQs)

Frequently Asked Questions (FAQs)

What is a GST Return?

What is a GST Return?

A GST return is a document containing details of income that a taxpayer must file with tax authorities. It is used to calculate tax liability and includes:

- Purchases

- Sales

- Output GST (On sales)

- Input tax credit (GST paid on purchases)

Under this plan, our experts will file your GST Returns.

Is GST registration compulsory for selling online?

Is GST registration compulsory for selling online?

Yes, GST registration is compulsory for those selling online. Under Section 24 of the CGST Act, 2017, any person making supplies of goods or services through an electronic commerce operator (ECO) is required to obtain GST registration, regardless of their turnover.

This requirement applies even if their aggregate turnover is below the threshold limit (₹20 lakh for services and ₹40 lakh for goods in most states).

- GSTR-1 (Monthly or Quarterly): This return reports outward supplies (sales) and is due:

- Monthly: By the 11th of the following month.

- Quarterly (under QRMP Scheme): By the 13th of the month following the quarter.

- GSTR-3B (Monthly): A self-declaration summary of sales, input tax credits, and tax payable. It’s filed monthly by the 20th of the following month or quarterly under the QRMP scheme.

- GSTR-9 (Annual Return): This is the annual return that summarizes the year’s transactions and is due by 31st December of the following financial year.

- Audit Report (GSTR-9C): Required if the aggregate turnover exceeds ₹5 crore in a financial year. This includes a reconciliation statement audited by a certified professional.

The e-commerce seller may also need to maintain detailed records of sales, purchases, and other financial transactions for audit purposes. Note that e-commerce operators collecting tax at source (TCS) file GSTR-8, but this applies to the platform itself, not individual sellers.

Key Points of TCS:

- TCS Rate: The current TCS rate is 1% on the net value of taxable supplies made through the e-commerce platform (0.5% CGST + 0.5% SGST or 1% IGST for inter-state supplies).

- Example: If a seller on an e-commerce platform makes a sale of ₹1 lakh, the e-commerce operator will deduct ₹1,000 as TCS and remit ₹99,000 to the seller. The TCS amount is then deposited with the government.

- Filing by E-commerce Operators: E-commerce operators report TCS collected through GSTR-8 each month by the 10th of the following month.

- Credit for Sellers: Sellers can claim credit for the TCS deducted by the e-commerce operator in their electronic cash ledger, which can be adjusted against their GST liability.

This ensures that the tax liability is met at the source of transaction and improves tax compliance among e-commerce sellers.

- Claiming Credit: The TCS collected by the e-commerce operator is reflected in the seller’s electronic cash ledger on the GST portal. The seller can then use this credit to offset their GST liability.

- Timeline for Credit: E-commerce operators are required to file GSTR-8 by the 10th of the following month and upload TCS details. Once filed, the TCS amount appears in the seller’s cash ledger, allowing them to claim the credit in the same month of deduction.

- Utilization of Credit: The seller can use this credited amount to pay any tax liabilities, interest, penalties, or other dues under GST.

Regularly reconciling TCS entries with the cash ledger helps sellers ensure they’re utilizing available credits effectively.

Get Started Today!

Get Started Today!

Don’t let the complexities of GST filing hold you back. Join countless satisfied customers who have streamlined their tax processes with Prokhata.

Contact Us Now!

Visit Prokhata.com or call us at +91-8319130080 to schedule a consultation today! Let us help you take the first step towards a compliant and successful business journey.