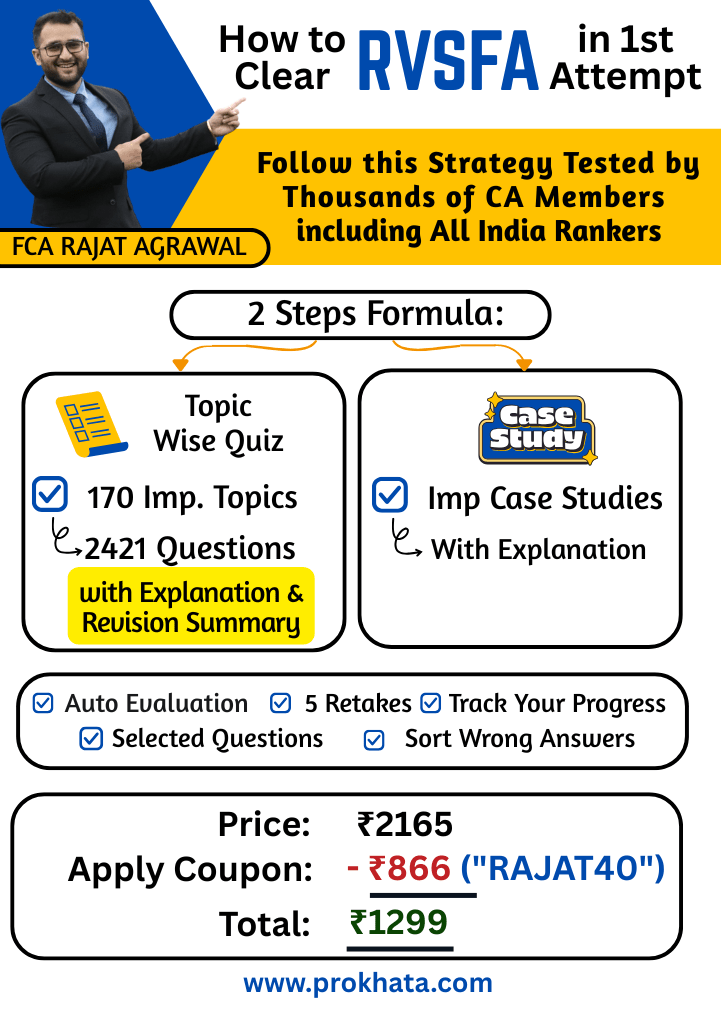

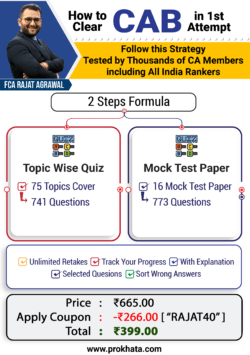

Registered Valuer (SFA Asset Class) – Comprehensive Practice & Case-Based Learning on Prokhata

Course Highlights:

Course Highlights:

Get exam-ready for the Registered Valuer – Securities or Financial Assets (SFA) Asset Class with our meticulously curated quiz-based course, hosted on the Prokhata LMS platform. Designed for aspiring registered valuers, this course provides deep conceptual clarity and practice through 2,421 carefully selected questions—bifurcated across 170+ critical topics and mapped to all ICAI/RVO-approved syllabus modules.

- Full Syllabus Coverage with Module-Wise Quizzes

Questions selected after thorough research from the following modules:Macro Economics – 107 Questions

Finance & Financial Statement Analysis – 124 Questions

Professional Ethics and Standards – 56 Questions

General Laws

Companies Act, 2013 – 192 Questions

Transfer of Property Act, 1882 – 52 Questions

Indian Stamps Act, 1899 – 11 Questions

Income Tax Act, 1961 – 38 Questions

Insolvency and Bankruptcy Code, 2016 – 291 Questions

SARFAESI Act, 2002 – 16 Questions

SEBI Regulations – 70 Questions

Financial Reporting under Ind AS – 65 Questions

Overview of Valuation – 473 Questions

Valuation Approaches – 130 Questions

Valuation Application – 77 Questions

Equity/Business Valuation – 151 Questions

Valuation Standards – 143 Questions

Fixed Income Securities – 166 Questions

Option Valuation – 25 Questions

Valuation of Other Financial Assets and Liabilities – 19 Questions

Intangible Assets – 72 Questions

Situation-Specific Valuation – 123 Questions

Judicial Pronouncements – 20 Questions

- Cloud-Based Quiz LMS System

Access anytime, anywhere from the Prokhata dashboard. Each question includes:Detailed explanations

Expert commentary and practical insights

Option to retake quizzes

Instant answer checking and performance tracking

Smart analytics to improve weak areas

- Topic-wise Breakdown for Targeted Preparation

Every question is tagged and categorized into 170+ micro-topics, allowing you to master one concept at a time.

- Valuation Case Studies

Realistic case studies included to strengthen your application-based understanding and prepare you for real-world valuation scenarios.

Who Should Join?

Who Should Join?

- Professionals preparing for the Registered Valuer – SFA exam under IBBI guidelines

- Chartered Accountants, MBAs, and Finance Professionals entering valuation practice

- Students enrolled in RVOs’ educational courses seeking structured practice

Unlock your valuation career with confidence. Get access now on www.Prokhata.com and prepare with India’s most detailed and practical quiz bank for RV SFA.

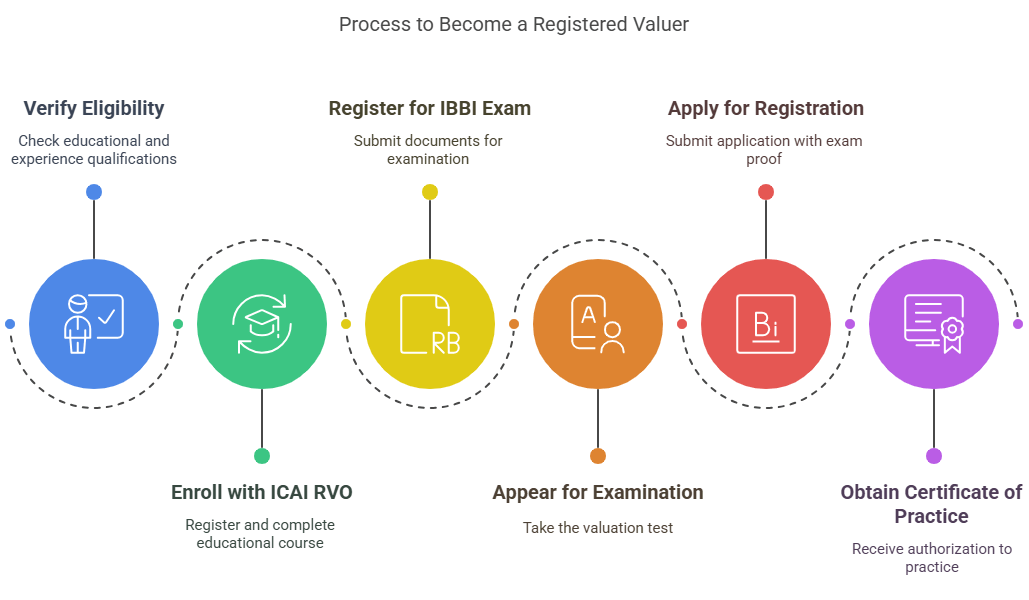

Step-by-Step Process to Become a Registered Valuer (SFA Asset Class)

Step-by-Step Process to Become a Registered Valuer (SFA Asset Class)

Step 1: Verify Eligibility

Step 1: Verify Eligibility

To be eligible, you must:

- Be a graduate in the relevant discipline.

- Possess the requisite experience as specified by the Companies (Registered Valuers and Valuation) Rules, 2017.

- Enroll as a valuer member with a Registered Valuers Organisation (RVO) recognized by IBBI.

Note: Chartered Accountants with three years of post-qualification experience are eligible to register.

Step 2: Enroll with ICAI RVO and Complete the 50-Hour Educational Course

Step 2: Enroll with ICAI RVO and Complete the 50-Hour Educational Course

- Register as a valuer member with ICAI Registered Valuers Organisation (ICAI RVO).

- Enroll in the 50-hour mandatory educational course specific to the SFA asset class.

- Attend all sessions (attendance is compulsory).

- Obtain a Certificate of Completion upon successfully finishing the course.

Note: The 50-hour training is a prerequisite for appearing in the valuation examination.

Step 3: Register for the IBBI Valuation Examination via NISM

Step 3: Register for the IBBI Valuation Examination via NISM

- Visit the IBBI Valuation Examination page.

- Select the ‘Securities or Financial Assets’ asset class.

- Click on ‘Register/Enrol for Exam’ to be redirected to the NISM Certification Portal.

- Provide necessary documents:

- Scanned copy of PAN Card.

- Photograph.

- Proof of address.

- Educational qualifications.

- Employment details.

Note: This is a one-time registration process.

Step 4: Appear for the Valuation Examination

Step 4: Appear for the Valuation Examination

- Mode: Online examination at designated NISM centers.

- Duration: 2 hours.

- Format: 87 multiple-choice questions.

- Passing Criteria: Minimum 60% marks.

- Negative Marking: 0.25 marks deducted for each incorrect answer.

- Fee: ₹5,900 per attempt (inclusive of GST).

- Attempts: Unlimited, with a cooling-off period of 2 months between attempts.

Note: The examination syllabus, format, and qualifying marks are published on the IBBI website at least three months before the examination.

Step 5: Apply for Registration with IBBI

Step 5: Apply for Registration with IBBI

After passing the examination:

- Apply for registration as a valuer with IBBI using Form-A.

- Submit the application through your RVO (e.g., ICAI RVO).

- Provide necessary documents, including:

- Certificate of Completion of the 50-hour course.

- Proof of passing the valuation examination.

- Other documents as specified by IBBI.

Note: Registration and Certificate of Practice (COP) need to be applied through the same RVO where the 50-hour training was completed.

Step 6: Obtain Certificate of Practice (COP)

Step 6: Obtain Certificate of Practice (COP)

- Upon approval, IBBI will issue a Certificate of Registration.

- Your RVO will then issue a Certificate of Practice (COP).

- You are now authorized to practice as a Registered Valuer in the SFA asset class.

For more information and to start your journey:

- ICAI RVO Website: https://icairvo.in

- IBBI Valuation Examination: https://ibbi.gov.in/examination/valuation-examination

- NISM Certification Portal: https://certifications.nism.ac.in/nismaol/

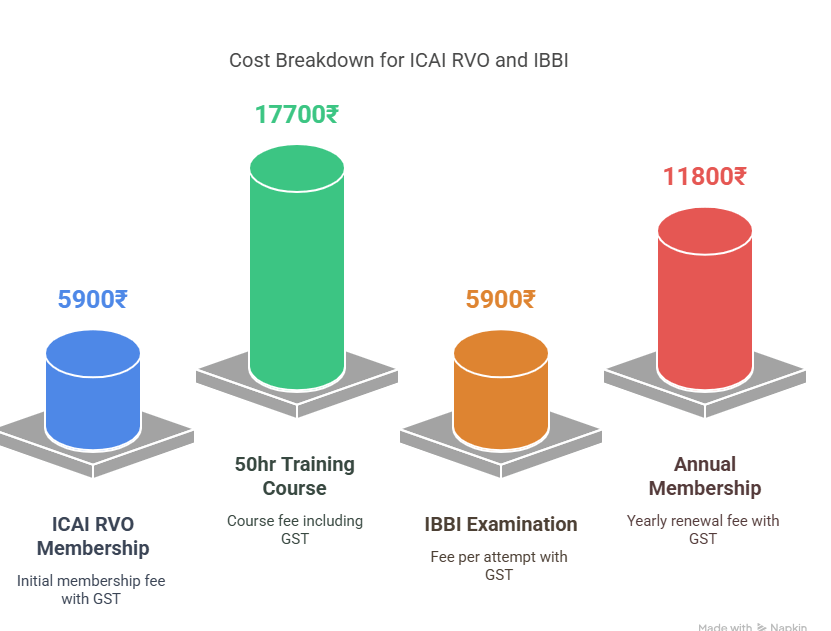

Step-by-Step Cost Breakdown

1. ICAI RVO Membership and Educational Course

- Primary Membership Fee: ₹5,000 + 18% GST = ₹5,900

- Educational Course Fee: ₹15,000 + 18% GST = ₹17,700

Total for ICAI RVO: ₹5,900 + ₹17,700 = ₹23,600

Note: Fees are to be paid during the registration process on the ICAI RVO portal.

2. IBBI Valuation Examination via NISM

- Examination Fee: ₹5,000 + 18% GST = ₹5,900 per attempt

Note: This fee applies to each examination attempt. There should be 2 month gap between 2 exams.

3. Annual Membership Fee:

- Amount: ₹11,800 (₹10,000 + 18% GST)

- Details: This fee is payable every financial year to maintain active membership with ICAI RVO.

Post-COP CPE Compliance:

- 16 CPE hours/year

- 64 CPE hours over 4 years

- Maintain ICAI RVO membership (₹11,800 annually)

Note: If COP is not taken within 3 years of passing the IBBI exam, the candidate must retake the exam to become eligible again.

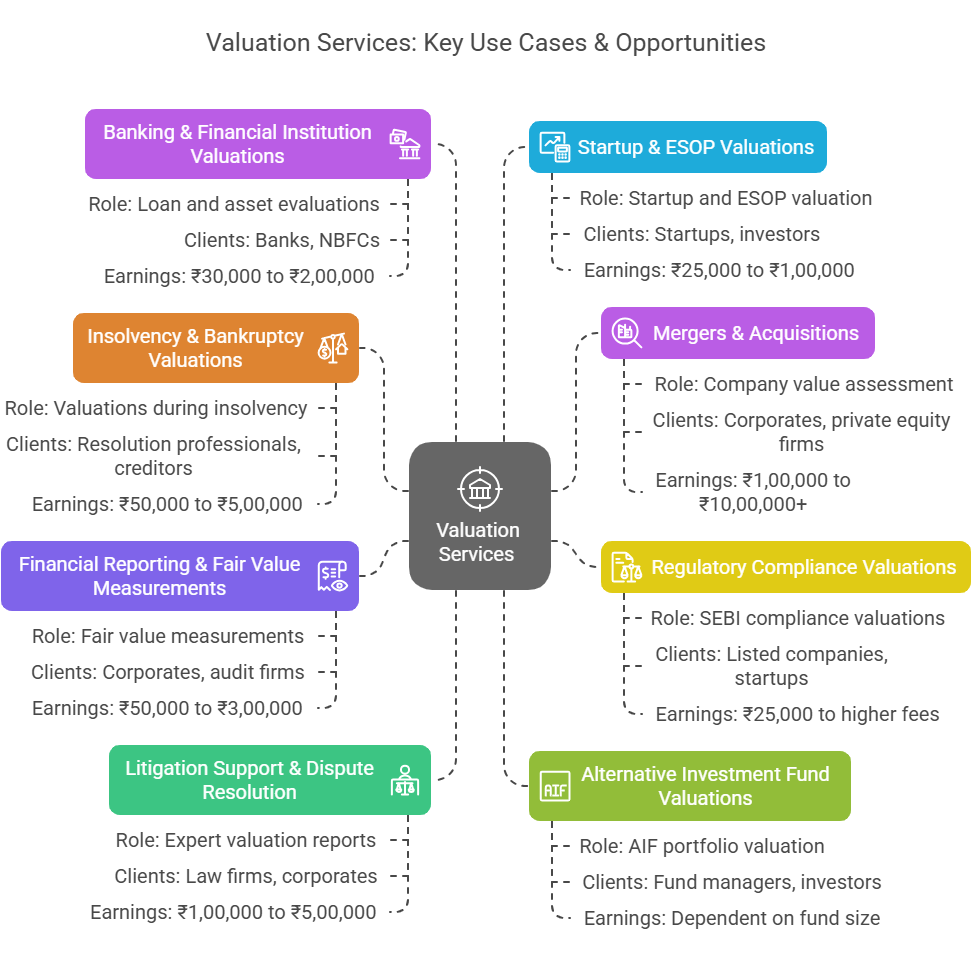

Key Use Cases & Earning Opportunities

Key Use Cases & Earning Opportunities