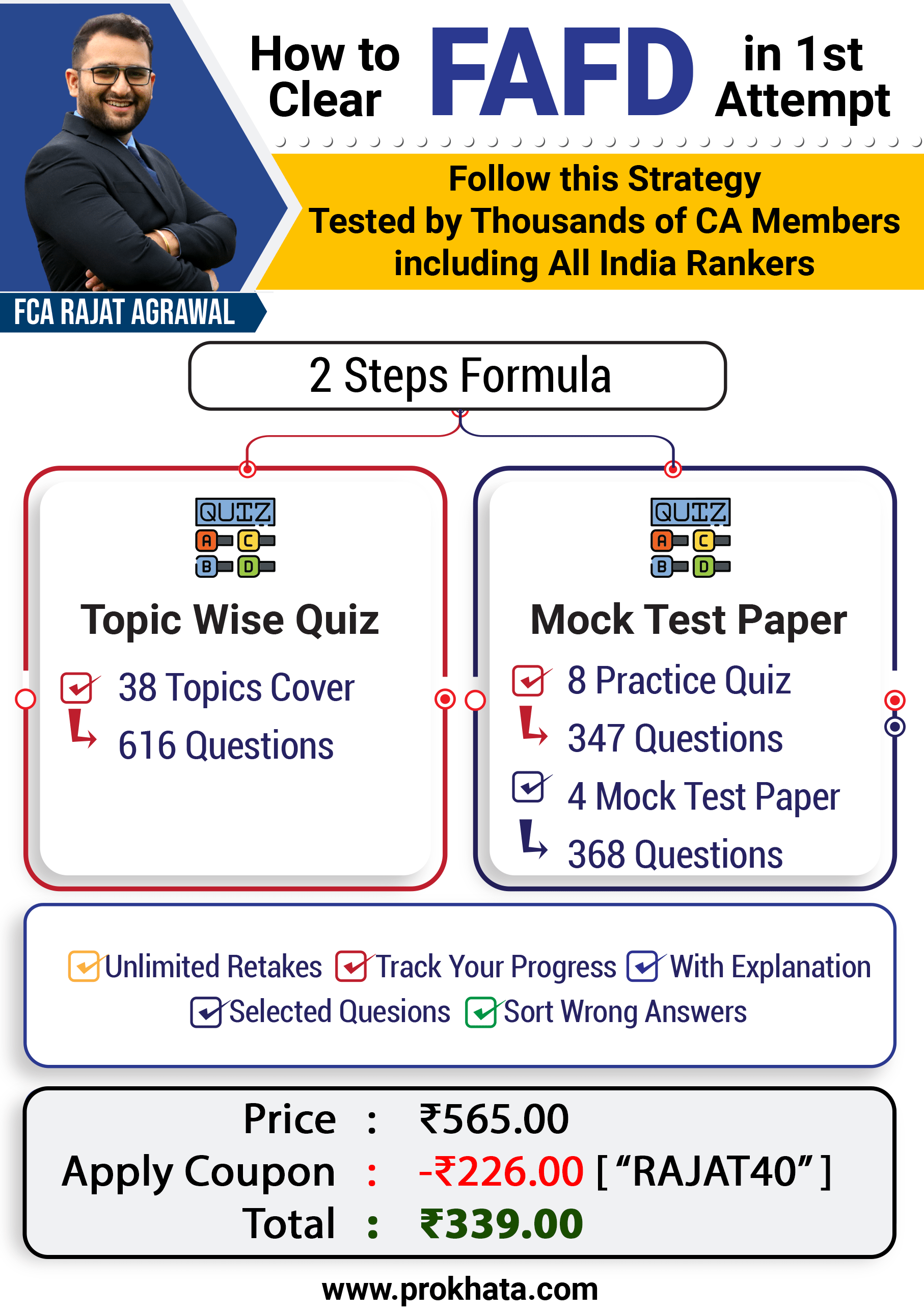

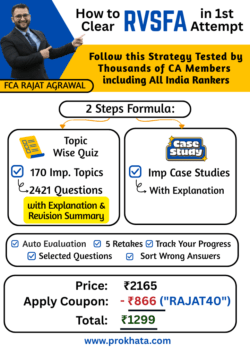

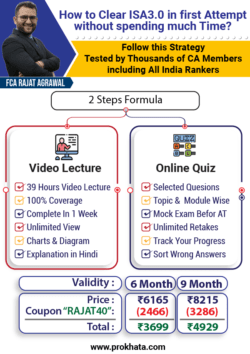

Strategy to clear FAFD Certification in 1st Attempt

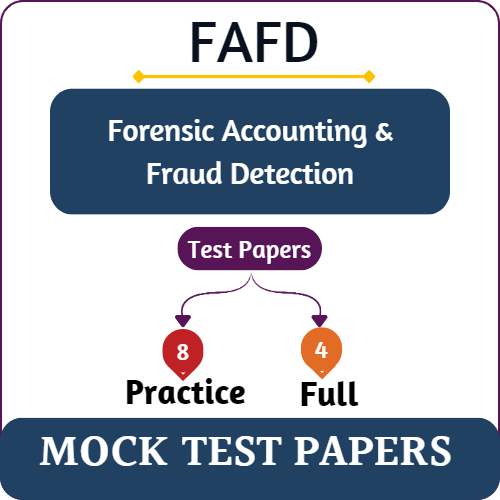

This Product Includes 2 types of Online Question bank

1st

Full Mock Test Papers

with Explanations

2nd

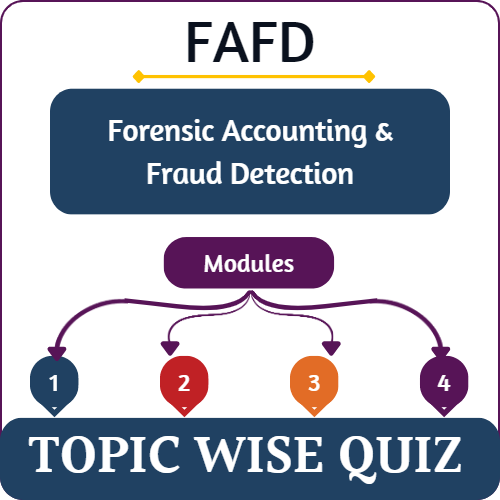

Topic Wise Mock Test Papers

with Explanations

Get Familiar with the course & Join our Community

Introduction of FAFD Course

Join Our Community

Important topics covered in the Topic Wise Quizzes in this course

Important topics covered in the Topic Wise Quizzes in this course

Our topic-wise quizzes cover all the important topics of forensic accounting, fraud, digital forensics, and cybercrime, which are most frequently asked in exams.

Core Forensic Accounting Concepts

Core Forensic Accounting Concepts

Fundamentals: This section introduces the core principles of forensic accounting, including the primacy of truth, due professional care, objectivity, and continuous improvement.

Forensic Accounting, Audit and Auditor: This section defines forensic accounting, forensic audit and the role of a forensic auditor.

Fraud Related Concepts

Fraud Related Concepts

Fraud Triangle: Understanding the elements of the fraud triangle: pressure, opportunity, and rationalisation, and how they contribute to fraudulent activities.

General Fraud: Defining fraud as an intentional act to deceive for personal gain.

Financial Statements Frauds: This module will cover how financial statements can be manipulated for fraudulent purposes and how to detect this.

Specific Frauds: This section will cover various specific types of fraud including:

Cheque Fraud: Methods of manipulating or forging cheques.

Lapping: Understanding the lapping scheme where money is stolen and then credited to another account to conceal the theft.

Social Engineering: Psychological manipulation techniques used to gain unauthorized access to systems or information.

Perpetrator: Understanding the typical profiles and motivations of fraud perpetrators.

Employee: How employees can be involved in fraudulent activities.

Red Flags: Identifying warning signs of potential fraud.

Green Flags: Understanding how seemingly positive indicators might conceal fraud.

Fraud Investigation Techniques

Fraud Investigation Techniques

Investigation: Core investigation techniques and processes.

Chain of Custody: Maintaining the integrity of evidence through proper documentation of seizure, custody, control, transfer, analysis, and disposition.

Criminal: Types of criminal activities and the tools used by computer criminals.

Interview: Conducting effective interviews using different types of questions and strategies.

Data: Understanding how data is collected and used during an investigation.

Excel: Using Excel for data analysis and manipulation in fraud investigations.

Benford: Applying Benford’s Law for fraud detection and data analysis.

Digital Forensics

Digital Forensics

Digital Forensics: Core principles and processes for handling electronic data as evidence.

Computer Forensics: The application of computer investigation and analysis techniques to determine potential legal evidence.

Cyber Attack: Types of cyber attacks, including DoS and DDoS, phishing, SQL injection, and password attacks.

Cyber: General concepts of cybercrime, cyber law, and specific cyber offenses.

Network: Understanding network protocols, devices, and services.

Cryptography: The science of securing communications through encryption techniques.

Steganography: The practice of concealing information within other digital media.

EnCase: Using Encase software for digital investigations.

Encryption: The process of converting information into a coded format.

Information Technology Act: Understanding the legal framework related to cyber offenses and electronic evidence in India.

Financial Information & Documents

Financial Information & Documents

CAAT: Using Computer-Assisted Audit Techniques for data analysis and audit procedures.

CAAT Sampling: Applying statistical sampling techniques in auditing with CAATs.

Act: Understanding relevant legal and regulatory requirements.

Analysis: Core data analysis concepts.

Audit: Fundamental audit concepts and procedures.

Balance Sheet: Understanding the structure and purpose of a balance sheet.

Costs: Understanding the different types of costs relevant to financial investigations.

Idea: Use of IDEA data analysis software in forensic accounting and auditing.

FAIS Standards: The course will cover all of the FAIS standards.

FAIS 000: Core principles of forensic accounting.

FAIS 110: Determining the nature of an engagement.

FAIS 120: Fraud Risk Assessment.

FAIS 130: Legal frameworks in FAI engagements.

FAIS 140: Hypothesis formation and iteration.

FAIS 210: Objectives in forensic accounting engagements.

FAIS 220: Independence and objectivity.

FAIS 230: Engagement of an expert.

FAIS 240: Legal and regulatory compliance.

FAIS 250: Communication expectations and principles.

FAIS 310: Stakeholder engagement.

FAIS 320: Evidence in forensic accounting.

FAIS 330: Forensic accounting and investigation process.

FAIS 340: Interview conduct and environment.

FAIS 350: Supervision in engagements.

FAIS 360: Testimony and witness role.

FAIS 410: Data analysis planning and execution.

FAIS 420: E-discovery process.

FAIS 430: Financial irregularities and misconduct.

FAIS 510: Report components.

FAIS 610: Professional responsibilities and reporting.

This structure allows for a logical progression from foundational concepts to more specialised topics.

Why CA should consider pursuing FAFD certificatio ?

Why FAFD Certification is a Game-Changer for Chartered Accountants

Why FAFD Certification is a Game-Changer for Chartered Accountants

Become an expert in detecting and stopping fraud—a critical skill as global fraud risks climb!

Stand out to top employers for high-demand forensic roles in corporate and government sectors.

Help clients manage risks like a pro, offering specialized forensic and fraud detection expertise.

Become the trusted advisor your clients rely on for insights into fraud risks and prevention.

Charge premium fees as a fraud detection specialist—skills in demand, rewards guaranteed.

Help organizations enhance internal controls and regulatory compliance.

Set yourself apart with this advanced, niche certification.

Ready to elevate your practice? FAFD certification can make you a top choice in forensic auditing and fraud prevention.

Steps for Pursuing FAFD Certificate

1. Register

2. E-Learning

Member need to undergo E-Learning of 17 hours and 30 minutes available at the Digital Learning Hub of ICAI i.e. https://learning.icai.org for free to all the Members.

3. Professional Training

Course duration is for 11 days which is divided into 4 hours of daily Instructor-led Virtual sessions and the last day class duration (i.e. 11th Day) will be of 2 Hours.

Module tests:

There will 2 online Module Tests in the Session (20 Marks each).

Project Report:

Every Participant will have to submit one Research paper (min. 10 pages) with PPT, and two forensic audit reports within two weeks after completion of the Course (60 Marks).

Eligibility Requirement :

40 Marks for two Module Tests + 40 Marks for two Forensic Audit Report + 20 Marks for Research Paper & PPT (TOTAL- 100 Marks).

Candidates have to secure 50% marks in their Module Test and Project Work (i.e. 50 Marks in total out of 100) to get eligible for appearing in the Assessment Test. Hence passing the Module Tests and the Project Work is the precondition for appearing in the FAFD Assessment Test.

4. Assessment Test (AT)

An online final assessment test of 100 Marks will be held on a quarterly basis.

The minimum mark required for passing FAFD Assessment Test is 50% i.e. 50 marks out of 100.

Download FAFD ICAI Books

FAFD Blogs and Project Reports

FAFD Blogs

1. Building the Foundation: Establishing a Forensic Project Plan

2. Exposing Fraud: The Rising Function of Detective Forensic Accounting

3. Constructing an Effective Framework for Assessing Fraud Risk: Best Practices and Insights

4. Navigating an Emerging Landscape: The Role of Fraud Risk Assessment in Forensic Work

5. Start Your Forensic Accounting Practice: Pathways to Excellence

6. FAFD : Forensic Accounting and Fraud Detection Question bank in Prokhata